Xerox 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37Xerox 2009 Annual Report

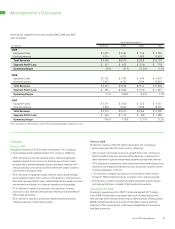

Management’s Discussion

FinancialInstruments

Refer to Note 13 – Financial Instruments in the Consolidated

Financial Statements for additional information regarding our

derivative financial instruments.

ShareRepurchasePrograms

Refer to Note 17 – Shareholders’ Equity – “Treasury Stock” in the

Consolidated Financial Statements for further information regarding

our share repurchase programs.

Dividends

The Board of Directors declared a 4.25 cent per-share dividend on

common stock in each quarter of 2009 and 2008.

CreditFacility

In October 2009, in connection with our anticipated acquisition of

ACS, we amended our $2.0 billion Credit Facility and entered into a

Bridge Loan Facility commitment as noted below. The Credit Facility

amendment extended the maximum permitted leverage ratio of

4.25x through September 30, 2010, which will change to 4.00x through

December 31, 2010 and to 3.75x thereafter. The amendment also

included the following changes:

•The definition of principal debt was changed such that principal

debt was calculated as of December 31, 2009 net of cash proceeds

from the Senior Notes issued in connection with the pre-funding of

the ACS acquisition.

•A portion of the Credit Facility that had a maturity date of April 30,

2012 was extended to a maturity date of April 30, 2013, consistent

with the majority of the facility. Accordingly, after this amendment,

approximately $1.6 billion, or approximately 80% of the Credit

Facility, has a maturity date of April 30, 2013.

CapitalMarketsOfferings

In 2009 we raised net proceeds of $745 million and $1,980 million

through the issuance of Senior Notes of $750 million in May and

$2.0 billion in December, respectively. The net proceeds from the

Senior Notes issued in December 2009 were used to fund the acquisition

of ACS.

Refer to Note 3 – Acquisitions in the Consolidated Financial Statements

for further information regarding the ACS acquisition, as well as Note

11 – Debt in the Consolidated Financial Statements for additional

information regarding the Debt activity.

The following represents Total finance assets associated with our

lease and finance operations as of December 31, 2009 and 2008:

(in millions) 2009 2008

Total finance receivables, net(1) $ 7,027 $ 7,278

Equipment on operating leases, net 551 594

Total Finance Assets, Net $ 7,578 $ 7,872

(1) Includes (i) billed portion of finance receivables, net, (ii) finance receivables, net

and (iii) finance receivables due after one year, net as included in the Consolidated

Balance Sheets as of December 31, 2009 and 2008.

The decrease of $294 million in Total finance assets, net includes

favorable currency of $224 million.

We maintain a certain level of debt, referred to as financing debt, in

order to support our investment in our lease contracts. We maintain an

assumed 7:1 leverage ratio of debt to equity as compared to our finance

assets for this financing aspect of our business. Based on this leverage,

the following represents the breakdown of Total debt between financing

debt and core debt as of December 31, 2009 and 2008:

(in millions) 2009 2008

Financing debt(1) $ 6,631 $ 6,888

Core debt(2) 2,633 1,496

Total Debt $ 9,264 $ 8,384

(1) Financing debt includes $6,149 million and $6,368 million as of December 2009

and 2008, respectively, of debt associated with Total finance receivables, net and

is the basis for our calculation of “equipment financing interest” expense. The

remainder of the financing debt is associated with Equipment on operating leases.

(2) Core debt at December 31, 2009 includes the $2.0 billion Senior Notes issuance

which was used to fund the acquisition of ACS.

The following summarizes our debt as of December 31, 2009 and 2008:

(in millions) 2009 2008

Principal debt balance(3) $ 9,122 $ 8,201

Net unamortized discount (11) (6)

Fair value adjustments 153 189

Total Debt(3) 9,264 8,384

Less: Current maturities and short-term debt (988) (1,610)

Total Long-term Debt(3) $ 8,276 $ 6,774

(3) Total debt at December 31, 2009 includes the $2.0 billion Senior Notes issuance

which was used to fund the acquisition of ACS.

Principal debt balance at December 31, 2008 includes short-term debt

of $61 million. Refer to Note 11 – Debt in the Consolidated Financial

Statements for additional information regarding the above balances.