Xerox 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31Xerox 2009 Annual Report

Management’s Discussion

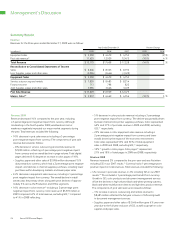

•Sales gross margin decreased 2.2-percentage points primarily due to

the approximately 2.5-percentage point impact of price declines, as

well as channel and product mix. Cost improvements, which historically

tend to offset price declines, were limited in 2008 by the adverse

impact of the strengthening Yen on our inventory purchases.

•Service, outsourcing and rentals margin decreased 0.8-percentage

points, primarily due to mix, as price declines of 1.3-percentage points

were offset by cost improvements. Mix reflects margin pressure from

document management services.

•Financing income margin of approximately 62% remained

comparable to 2007.

•Since a large portion of our inventory procurement is from Japan,

the strengthening of the Yen versus the U.S. Dollar and Euro in

2008 significantly impacted our product cost. The Yen strengthened

approximately 14% against the U.S. Dollar and 6% against the

Euro in 2008 as compared to 2007. A significant portion of that

strengthening occurred in the fourth quarter 2008 when the Yen

strengthened 17% against the U.S. Dollar and 29% against the

Euro as compared to prior year.

Research, Development and Engineering Expenses (“RD&E”)

We invest in technological development, particularly in color, and believe

our RD&E spending is sufficient to remain technologically competitive.

Our R&D is strategically coordinated with that of Fuji Xerox.

RD&E2008

The decrease in R&D spending for 2008 reflects the capture of

efficiencies following a significant number of new product launches

over the previous two years, as well as leveraging our current RD&E

investments to support our GIS operations. Sustaining engineering

costs declined in 2008 due primarily to lower spending related to

environmental compliance activities and maturing product platforms

in the Production segment.

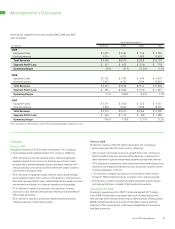

•Sales gross margin increased 0.2-percentage points, primarily

due to the cost improvements and the positive mix of revenues

partially offset by the adverse impact of transaction currency on

our inventory purchases of 1.0-percentage point and price declines

of 1.2-percentage points.

•Service, outsourcing and rentals margin increased 0.7-percentage

points, primarily due to the positive impact from the reduction in

costs driven by our restructuring and cost actions of 1.5-percentage

points. These cost improvements more than offset the approximate

0.9-percentage points impact of pricing.

•Financing income margin of 62% remained comparable to 2008.

GrossMargin2008

2008 Total gross margin decreased 1.4-percentage points compared

to 2007, as price declines and mix of approximately 2.0-percentage

points were only partially offset by cost productivity improvements. Cost

improvements were limited by an unfavorable impact on product costs of

approximately 0.5-percentage points from the significant strengthening

of the Yen versus the U.S. Dollar and Euro. The negative impact of

0.3-percentage points from an Office product line equipment write-off

was offset by positive adjustments related to the capitalized costs for

equipment on operating leases and European product disposal costs.

RD&E2009

The decrease in RD&E spending for 2009 reflects our restructuring

and cost actions which consolidated the Production and Office

development and engineering infrastructures.

Year Ended December 31, Change

(in millions) 2009 2008 2007 2009 2008

RD&E % Revenue 5.5% 5.0% 5.3% 0.5 pts (0.3) pts

R&D $ 713 $ 750 $ 764 $ (37) $ (14)

Sustaining engineering 127 134 148 (7) (14)

Total RD&E Expenses $ 840 $ 884 $ 912 $ (44) $ (28)

R&D Investment by Fuji Xerox(1) $ 796 $ 788 $ 672 $ 8 $ 116

(1) Increase in Fuji Xerox R&D was primarily due to changes in foreign exchange rates.