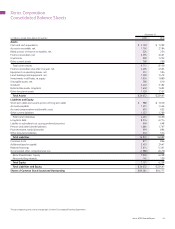

Xerox 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33Xerox 2009 Annual Report

Management’s Discussion

Currencylosses,net:Currency losses primarily result from the

re-measurement of foreign currency-denominated assets and liabilities,

the cost of hedging foreign currency-denominated assets and liabilities,

the mark-to-market of foreign exchange contracts utilized to hedge

those foreign currency-denominated assets and liabilities and the

mark-to-market impact of hedges of anticipated transactions, primarily

future inventory purchases, for those that we do not apply cash flow

hedge accounting treatment.

The 2009 currency losses were primarily due to the significant

movement in exchange rates among the U.S. Dollar, Euro and Yen

in the first quarter of 2009, as well as the increased cost of hedging,

particularly in developing markets.

The 2008 currency losses were primarily due to net re-measurement

losses associated with our Yen-denominated payables, foreign currency-

denominated assets and liabilities in our developing markets and the

cost of hedging. The currency losses on Yen-denominated payables were

largely limited to the first quarter 2008 as a result of the significant and

rapid weakening of the U.S. Dollar and Euro versus the Yen.

Amortizationofintangibleassets: The increase in 2009 and 2008

amortization as compared to prior years primarily reflects the full-year

amortization of the assets acquired as part of our recent acquisitions.

Litigationmatters: In 2008 legal matters consisted of the following:

•$721 million reflecting provisions for the $670 million court approved

settlement of Carlson v. Xerox Corporation (“Carlson”) and other

pending securities-related cases, net of expected insurance recoveries.

On January 14, 2009, the United States Court for the District of

Connecticut entered a Final Order and Judgment approving the

settlement of the Carlson litigation.

•$36 million for probable losses on Brazilian labor-related contin-

gencies. Following an assessment of the most recent trend in the

outcomes of these matters, we reassessed the probable estimated

loss and, as a result, recorded an additional reserve of $36 million in

the fourth quarter of 2008.

•$24 million associated with probable losses from various other legal

matters.

Refer to Note 16 – Contingencies in the Consolidated Financial

Statements for additional information regarding litigation against

the Company.

Allotherexpenses,net: All Other expenses in 2009 were $19 million

higher than the prior year, primarily due to fees associated with the

sale of receivables, as well as an increase in interest expense related to

Brazil tax and labor contingencies.

Acquisition-Related Costs

Acquisition-related costs of $72 million were incurred and expensed

during 2009 in connection with our acquisition of ACS. $58 million

of the costs relate to the write-off of fees associated with the Bridge

Loan Facility commitment which was terminated as a result of securing

permanent financing to fund the acquisition. The remainder of the costs

represents transaction costs such as banking, legal and accounting fees,

as well as some pre-integration costs such as external consulting services.

Consistent with the new accounting guidance with respect to business

combinations, adopted in 2009, all acquisition-related costs must be

expensed as incurred.

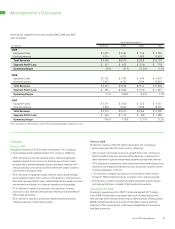

Worldwide Employment

Worldwide employment of 53,600 as of December 31, 2009 decreased

approximately 3,500 from December 31, 2008, primarily reflecting

restructuring reductions, partially offset by additional headcount

related to GIS acquisitions. Worldwide employment was approximately

57,100 and 57,400 at December 31, 2008 and 2007, respectively.

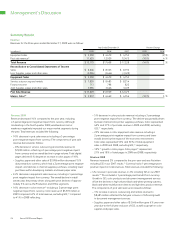

Other Expenses, Net

Other expenses, net for the years ended December 31, 2009, 2008

and 2007 consisted of the following:

Year Ended December 31,

(in millions) 2009 2008 2007

Non-financing interest expense $ 256 $ 262 $ 263

Interest income (21) (35) (55)

Gain on sales of businesses

and assets (16) (21) (7)

Currency losses, net 26 34 8

Amortization of intangible assets 60 54 42

Litigation matters 9 781 (6)

All Other expenses, net 31 12 20

Total Other Expenses, Net $ 345 $ 1,087 $ 265

Non-financinginterestexpense:2009 non-financing interest expense

decreased compared to 2008, as interest expense associated with our

$2.0 billion Senior Note offering for the funding of the ACS acquisition

was more than offset by lower interest rates on the remaining debt.

In 2008, non-financing interest expense was flat compared to 2007,

as the benefit of lower interest rates was offset by higher average

non-financing debt balances.

Interestincome: Interest income is derived primarily from our invested

cash and cash equivalent balances. The decline in interest income in

2009 and 2008 was primarily due to lower average cash balances and

rates of return.

Gainonsalesofbusinessesandassets: 2009 and 2008 gain on

sales of business and assets primarily consisted of the sales of certain

surplus facilities in Latin America.