Xerox 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 Xerox 2009 Annual Report

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

2009 2008

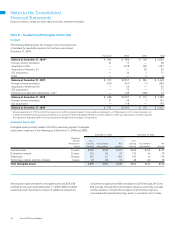

Other Current Liabilities

Income taxes payable $ 27 $ 47

Other taxes payable 161 173

Interest payable 114 141

Restructuring reserves 64 325

Unearned income 201 203

Financial derivative instruments 15 134

Product warranties 19 25

Dividends payable 41 38

Distributor and reseller rebates/commissions 127 131

Other 558 552

Total Other Current Liabilities $ 1,327 $ 1,769

The components of other long-term assets and other long-term liabilities

at December 31, 2009 and 2008 were as follows:

2009 2008

Other Long-term Assets

Prepaid pension costs $ 155 $ 61

Net investment in discontinued operations(1) 240 259

Internal use software, net 354 288

Restricted cash 258 183

Debt issuance costs, net 62 48

Financial derivative instruments 10 53

Other 241 265

Total Other Long-term Assets $ 1,320 $ 1,157

Other Long-term Liabilities

Deferred and other tax liabilities $ 167 $ 182

Financial derivative instruments 9 —

Environmental reserves 23 29

Restructuring reserves 10 27

Other 363 336

Total Other Long-term Liabilities $ 572 $ 574

(1) At December 31, 2009, our net investment in discontinued operations primarily

consists of a $265 performance-based instrument relating to the 1997 sale of

The Resolution Group (“TRG”), net of remaining net liabilities associated with our

discontinued operations of $25. The recovery of the performance-based instrument

is dependent on the sufficiency of TRG’s available cash flows, as guaranteed by

TRG’s ultimate parent, which are expected to be recovered in annual cash

distributions through 2017.

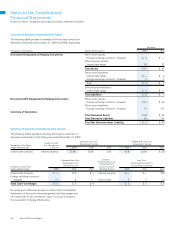

Note 11 – Debt

Short-term borrowings at December 31, 2009 and 2008 were as follows:

2009 2008

Current maturities of long-term debt $ 988 $ 1,549

Notes payable — 7

Italy Credit Facility due 2009 — 54

Total Short-term Debt $ 988 $ 1,610

We classify our debt based on the contractual maturity dates of the

underlying debt instruments or as of the earliest put date available to

the debt holders. We defer costs associated with debt issuance over the

applicable term, or to the first put date in the case of convertible debt or

debt with a put feature. These costs are amortized as interest expense in

our Consolidated Statements of Income.

2010 Plan

We expect to record pre-tax restructuring charges of approximately

$280 in 2010, of which $250 is expected to be recorded in the first

quarter. These actions are expected to impact all geographies and

segments with approximately equal focus on SAG reductions, gross

margin improvements and optimization of RD&E investments. The

restructuring is also expected to involve the rationalization of some

of our facilities.

2009 Activity

Restructuring activity was minimal in 2009 and the related charges

primarily reflected changes in estimates in severance costs from

previously recorded actions.

2008 Activity

During 2008, we recorded $357 of net restructuring charges pre-

dominantly consisting of severance and costs related to the elimination

of approximately 4,900 positions, primarily in both North America and

Europe. Focus areas for the actions include the following:

•Improving efficiency and effectiveness of infrastructure including:

marketing, finance, human resources and training.

•Capturing efficiencies in technical services, managed services, and

supply chain and manufacturing infrastructure.

•Optimizing product development and engineering resources.

In addition, related to these activities, we also recorded lease can-

cellation and other costs of $19 and asset impairment charges of

$53. The lease termination and asset impairment charges primarily

related to: (i) the relocation of certain manufacturing operations

including the closing of our toner plant in Oklahoma City and the

consolidation of our manufacturing operations in Ireland; and (ii) the

exit from certain leased and owned facilities as a result of the actions

noted above.

2007 Activity

Restructuring activity was minimal in 2007 and the related charges

primarily reflected changes in estimates in severance costs from

previously recorded actions.

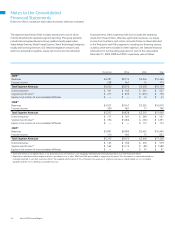

Note 10 – Supplementary Financial Information

The components of other current assets and other current liabilities at

December 31, 2009 and 2008 were as follows:

2009 2008

Other Current Assets

Deferred taxes $ 290 $ 305

Restricted cash 31 20

Prepaid expenses 111 119

Financial derivative instruments 16 39

Advances and deposits 19 26

Income taxes receivable 38 42

Other 203 239

Total Other Current Assets $ 708 $ 790