Xerox 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73Xerox 2009 Annual Report

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

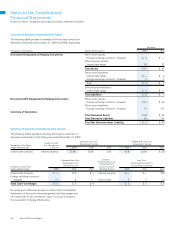

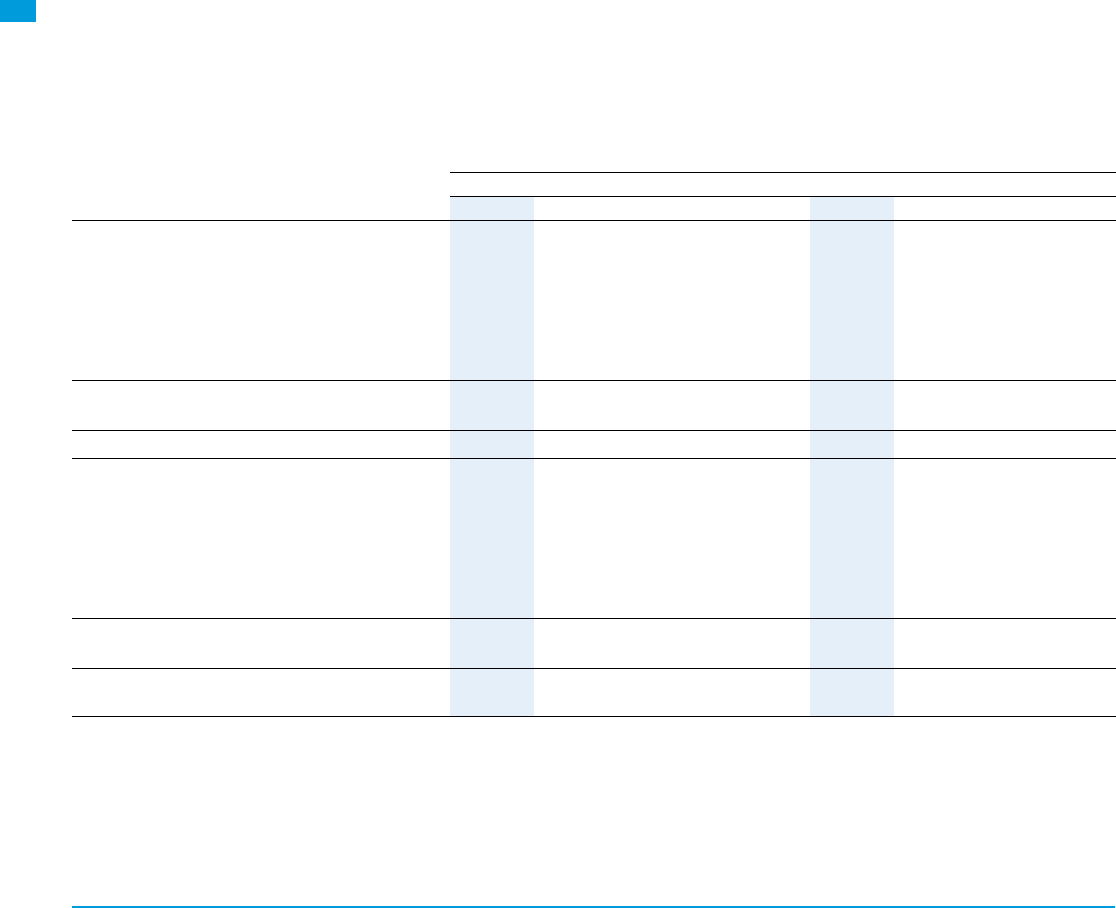

Pension Benefits Retiree Health

Year Ended December 31,

2009 2008 2007 2009 2008 2007

Components of Net Periodic Benefit Cost:

Service cost $ 173 $ 209 $ 237 $ 7 $ 14 $ 17

Interest cost(1) 508 (5) 578 60 84 87

Expected return on plan assets(2) (523) (80) (668) — — —

Recognized net actuarial loss 25 36 75 — — 10

Amortization of prior service credit (21) (20) (20) (41) (21) (12)

Recognized curtailment/settlement loss 70 34 33 — — —

Net periodic defined benefit cost 232 174 235 26 77 102

Defined contribution plans 38 80 80 — — —

Total Net Periodic Benefit Costs $ 270 $ 254 $ 315 $ 26 $ 77 $ 102

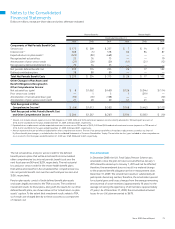

Other Changes in Plan Assets and

Benefit Obligations Recognized in

Other Comprehensive Income:

Net actuarial loss (gain) $ 8 $ 1,062 $ (499) $ 126 $ (244) $ (114)

Prior service cost (credit) — 1 5 1 (219) —

Amortization of net actuarial (loss) gain (95) (70) (108) — — (10)

Amortization of prior service (cost) credit 21 20 20 41 21 12

Total Recognized in Other

Comprehensive Income(3) $ (66) $ 1,013 $ (582) $ 168 $ (442) $ (112)

Total Recognized in Net Periodic Benefit Cost

and Other Comprehensive Income $ 204 $ 1,267 $ (267) $ 194 $ (365) $ (10)

(1) Interest cost includes interest expense on non-TRA obligations of $390, $408 and $374 and interest expense (income) directly allocated to TRA participant accounts of

$118, $(413) and $204 for the years ended December 31, 2009, 2008 and 2007, respectively.

(2) Expected return on plan assets includes expected investment income on non-TRA assets of $405, $493 and $464 and actual investment income (expense) on TRA assets of

$118, $(413) and $204 for the years ended December 31, 2009, 2008 and 2007, respectively.

(3) Amount represents the pre-tax effect included within other comprehensive income. The net of tax amount and effect of translation adjustments, as well as our share of

Fuji Xerox benefit plan changes, is included within the Consolidated Statements of Common Shareholders’ Equity. The net after-tax loss (gain) included in other comprehensive

(loss) income for the three years ended December 31, 2009 was $169, $286 and $(382), respectively.

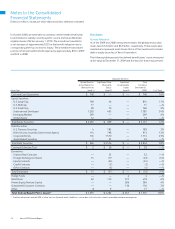

The net actuarial loss and prior service credit for the defined

benefit pension plans that will be amortized from Accumulated

other comprehensive loss into net periodic benefit cost over the

next fiscal year are $64 and $(20), respectively. The net actuarial

loss and prior service credit for the retiree health benefit plans

that will be amortized from Accumulated other comprehensive loss

into net periodic benefit cost over the next fiscal year are zero and

$(26), respectively.

Pension plan assets consist of both defined benefit plan assets

and assets legally restricted to the TRA accounts. The combined

investment results for these plans, along with the results for our other

defined benefit plans, are shown above in the “actual return on plan

assets” caption. To the extent that investment results relate to TRA,

such results are charged directly to these accounts as a component

of interest cost.

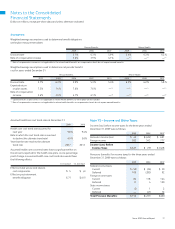

Plan Amendment

In December 2009, the U.K. Final Salary Pension Scheme was

amended to close the plan to future accrual effective January 1,

2014. Benefits earned up to January 1, 2014 will not be affected;

therefore, the amendment does not result in a material change

to the projected benefit obligation at the re-measurement date,

December 31, 2009. The amendment results in substantially all

participants becoming inactive; therefore, the amortization period

for actuarial gains and losses changes from the average remaining

service period of active members (approximately 10 years) to the

average remaining life expectancy of all members (approximately

27 years). As of December 31, 2009, the accumulated actuarial

losses for our U.K. plan amounted to $678.