Xerox 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 Xerox 2009 Annual Report

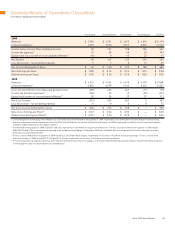

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

Legal Matters

As more fully discussed below, we are involved in a variety of claims,

lawsuits, investigations and proceedings concerning securities law,

intellectual property law, environmental law, employment law and the

Employee Retirement Income Security Act (“ERISA”). We determine

whether an estimated loss from a contingency should be accrued by

assessing whether a loss is deemed probable and can be reasonably

estimated. We assess our potential liability by analyzing our litigation

and regulatory matters using available information. We develop our

views on estimated losses in consultation with outside counsel handling

our defense in these matters, which involves an analysis of potential

results, assuming a combination of litigation and settlement strategies.

Should developments in any of these matters cause a change in our

determination as to an unfavorable outcome and result in the need to

recognize a material accrual, or should any of these matters result in a

final adverse judgment or be settled for significant amounts, they could

have a material adverse effect on our results of operations, cash flows

and financial position in the period or periods in which such change in

determination, judgment or settlement occurs.

The following is a summary of 2009 significant developments in

litigation matters:

•In re Xerox Corp. ERISA Litigation – settlement reached, approved

by district court and paid.

•Arbitration between MPI Technologies, Inc. and MPI Tech S.A.

and Xerox Canada Ltd. and Xerox Corporation – settlement

reached and paid.

Litigation Against the Company

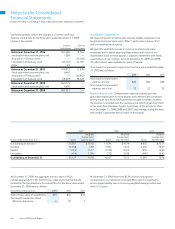

In re Xerox Corporation Securities Litigation: A consolidated securities

law action (consisting of 17 cases) is pending in the United States

District Court for the District of Connecticut. Defendants are the

Company, Barry Romeril, Paul Allaire and G. Richard Thoman. The

consolidated action is a class action on behalf of all persons and entities

who purchased Xerox Corporation common stock during the period

October 22, 1998 through October 7, 1999 inclusive (“Class Period”)

and who suffered a loss as a result of misrepresentations or omissions

by Defendants as alleged by Plaintiffs (the “Class”). The Class alleges

that in violation of Section 10(b) and/or 20(a) of the Securities

Exchange Act of 1934, as amended (“1934 Act”), and SEC Rule 10b-5

thereunder, each of the defendants is liable as a participant in a

fraudulent scheme and course of business that operated as a fraud or

deceit on purchasers of the Company’s common stock during the Class

Period by disseminating materially false and misleading statements

and/or concealing material facts relating to the defendants’ alleged

failure to disclose the material negative impact that the April 1998

restructuring had on the Company’s operations and revenues. The

complaint further alleges that the alleged scheme: (i) deceived the

investing public regarding the economic capabilities, sales proficiencies,

growth, operations and the intrinsic value of the Company’s common

stock; (ii) allowed several corporate insiders, such as the named

Note 16 – Contingencies

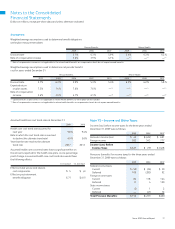

Brazil Tax and Labor Contingencies

Our Brazilian operations are involved in various litigation matters

and have received or been the subject of numerous governmental

assessments related to indirect and other taxes, as well as disputes

associated with former employees and contract labor. The tax matters,

which comprise a significant portion of the total contingencies,

principally relate to claims for taxes on the internal transfer of inventory,

municipal service taxes on rentals and gross revenue taxes. We are

disputing these tax matters and intend to vigorously defend our

position. Based on the opinion of legal counsel and current reserves

for those matters deemed probable of loss, we do not believe that the

ultimate resolution of these matters will materially impact our results of

operations, financial position or cash flows. The labor matters principally

relate to claims made by former employees and contract labor for the

equivalent payment of all social security and other related labor benefits,

as well as consequential tax claims, as if they were regular employees.

As of December 31, 2009, the total amounts related to the unreserved

portion of the tax and labor contingencies, inclusive of any related

interest, amounted to approximately $1,225, with the increase from

December 31, 2008 balance of approximately $839 primarily related

to currency and current-year interest indexation. In connection with

the above proceedings, customary local regulations may require us to

make escrow cash deposits or post other security of up to half of the

total amount in dispute. As of December 31, 2009 we had $240 of

escrow cash deposits for matters we are disputing, and there are liens

on certain Brazilian assets with a net book value of $19 and additional

letters of credit of approximately $137. Generally, any escrowed

amounts would be refundable and any liens would be removed to the

extent the matters are resolved in our favor. We routinely assess all these

matters as to probability of ultimately incurring a liability against our

Brazilian operations and record our best estimate of the ultimate loss in

situations where we assess the likelihood of an ultimate loss as probable.