Xerox 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81Xerox 2009 Annual Report

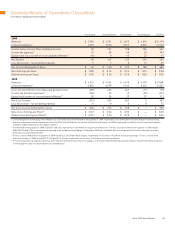

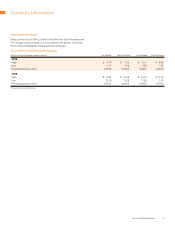

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

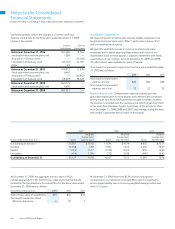

which subsequently were consolidated into one action. Seven actions

were filed in state courts in Texas, which subsequently were consolidated

into one action in the Dallas County Court at Law No. 3. The operative

complaints in the Delaware and Texas actions name as defendants

ACS and/or the members of ACS’s board of directors (the “Individual

Defendants”) and Xerox Corporation and/or Boulder Acquisition Corp.,

a wholly-owned subsidiary of Xerox (the “Xerox Defendants”). On

October 22, 2009, a class of ACS shareholders was certified in the

Delaware action. Pursuant to a stipulation entered into by all parties

in the Delaware and Texas actions on November 20, 2009, the Texas

plaintiffs agreed to stay prosecution of the Texas action until agreed

otherwise by the defendants and ordered by the Texas court, and all

plaintiffs agreed that any further prosecution of the Delaware and Texas

actions, or any claims that could have been brought in those actions,

would proceed in the Delaware action. The Texas court has calendared

a trial date of November 29, 2010, for administrative purposes in the

event that all issues are not resolved in the Delaware proceedings.

On December 11, 2009, plaintiffs in the Delaware action filed an

amended complaint alleging, among other things, that (i) the Individual

Defendants breached their fiduciary duties to ACS and its shareholders

by authorizing the sale of ACS to Xerox for what plaintiffs deem

inadequate consideration and pursuant to inadequate process, and the

Xerox Defendants aided and abetted these alleged breaches; (ii) the

Individual Defendants breached their fiduciary duties to ACS and its

shareholders by agreeing to the provisions of the merger agreement

relating to the consideration to be paid to the holders of Class B shares

which the Delaware plaintiffs allege violates the ACS certificate of

incorporation and is, therefore, void, and the Xerox Defendants aided

and abetted these alleged breaches; and (iii) the Individual Defendants

breached their fiduciary duties by failing to disclose material facts in

the October 23, 2009 Form S-4 filed with the SEC in connection with the

merger. The amended complaint seeks, among other things, to enjoin

the defendants from consummating the merger on the agreed-upon

terms, and unspecified compensatory damages, together with the costs

and disbursements of the action.

On December 16, 2009, the Delaware court so ordered a stipulation

between Xerox, ACS and certain Individual Defendants and the

plaintiffs in the Delaware action providing, among other things, that

in exchange for modifying certain provisions of the merger agreement

and other consideration, the plaintiffs would not seek to enjoin any

shareholder vote on the closing of the merger, nor take any action for

the purpose of preventing or delaying the closing of the merger. On

January 20, 2010, the Delaware court so ordered a stipulation by all

parties in the Delaware action providing, among other things, for a trial

to take place May 10–14, 2010 on the claims for damages asserted

in the action. On January 29, 2010, defendants moved to dismiss the

amended complaint and on February 8, 2010, plaintiffs moved for

partial summary judgment.

The merger between ACS and Xerox closed on February 5, 2010.

We deny any wrongdoing and are vigorously defending the actions.

individual defendants, to sell shares of privately held common stock

of the Company while in possession of materially adverse, non-

public information; and (iii) caused the individual plaintiffs and the

other members of the purported class to purchase common stock

of the Company at inflated prices. The complaint seeks unspecified

compensatory damages in favor of the plaintiffs and the other members

of the purported class against all defendants, jointly and severally,

for all damages sustained as a result of defendants’ alleged wrongdoing,

including interest thereon, together with reasonable costs and expenses

incurred in the action, including counsel fees and expert fees. In 2001,

the Court denied the defendants’ motion for dismissal of the complaint.

The plaintiffs’ motion for class certification was denied by the Court

in 2006, without prejudice to refiling. In February 2007, the Court

granted the motion of the International Brotherhood of Electrical

Workers Welfare Fund of Local Union No. 164, Robert W. Roten, Robert

Agius (“Agius”) and Georgia Stanley to appoint them as additional lead

plaintiffs. In July 2007, the Court denied plaintiffs’ renewed motion

for class certification, without prejudice to renewal after the Court holds

a pre-filing conference to identify factual disputes the Court will be

required to resolve in ruling on the motion. After that conference and

Agius’s withdrawal as lead plaintiff and proposed class representative,

in February 2008 plaintiffs filed a second renewed motion for class

certification. In April 2008, defendants filed their response and motion

to disqualify Milberg LLP as a lead counsel. On September 30, 2008, the

Court entered an order certifying the class and denying the appointment

of Milberg LLP as class counsel. Subsequently, on April 9, 2009, the

Court denied defendants’ motion to disqualify Milberg LLP. The parties

have filed motions to exclude certain expert testimony. On November

6, 2008, the defendants filed a motion for summary judgment. Briefing

with respect to each of these motions is complete. On April 22, 2009,

the Court denied plaintiffs’ motions to exclude the testimony of two of

defendants’ experts. The Court has not yet rendered decisions regarding

the other pending motions. The individual defendants and we deny any

wrongdoing and are vigorously defending the action. In the course of

litigation, we periodically engage in discussions with plaintiffs’ counsel

for possible resolution of this matter. Should developments cause a

change in our determination as to an unfavorable outcome, or result

in a final adverse judgment or a settlement for a significant amount,

there could be a material adverse effect on our results of operations,

cash flows and financial position in the period in which such change in

determination, judgment or settlement occurs.

Merger Agreement Between Xerox and Affiliated Computer Services,

Inc.: In late September and early October 2009, nine purported class

action complaints were filed by Affiliated Computer Services, Inc. (“ACS”)

shareholders challenging ACS’s proposed merger with Xerox. (See Note 3

– Acquisitions.) Two actions were filed in the Delaware Court of Chancery