Xerox 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 Xerox 2009 Annual Report

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

The Credit Facility also contains various events of default, the occur-

rence of which could result in a termination by the lenders and the

acceleration of all our obligations under the Credit Facility. These events

of default include, without limitation: (i) payment defaults, (ii) breaches

of covenants under the Credit Facility (certain of which breaches do

not have any grace period), (iii) cross-defaults and acceleration to certain

of our other obligations and (iv) a change of control of Xerox.

Senior Notes Offerings

In December 2009, we issued a total of $2.0 billion of Senior Notes.

Debt issuance costs of approximately $15 were deferred. The Senior Notes

rank equally with our other existing senior unsecured indebtedness. The

net proceeds from these Senior Notes were used to repay ACS’s senior

credit facility upon completion of the acquisition and to fund a portion

of the cash consideration and certain fees and expenses relating to the

acquisition of ACS (Refer to Note 3 – Acquisitions for further information).

Prior to the closing of the acquisition, the net proceeds from the Senior

Notes were invested in cash and cash equivalents.

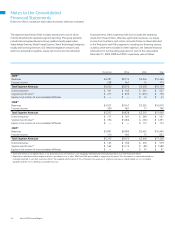

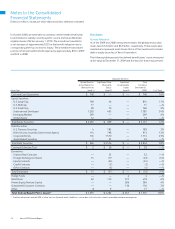

The following is a summary of our December 2009 Senior Note offerings:

Bridge Loan Facility Commitment

In connection with the agreement to acquire ACS, we entered into a

syndicated $3.0 billion Bridge Loan Facility commitment with several

banks that was to be used for funding of the acquisition in the event the

transaction closed prior to obtaining permanent financing in the capital

markets. Debt issuance costs for the Bridge Loan Facility commitment

were $58. As a result of the successful December Senior Note offering,

we reduced the size of the commitment to $500 in December 2009

and, as a result of sufficient cash balances as of December 31, 2009,

we elected to terminate the remainder of the commitment in January

2010. The Debt issuance costs of $58 were written off to earnings and

are included in Acquisition-related costs.

The Credit Facility contains various conditions to borrowing and

affirmative, negative and financial maintenance covenants. Certain of

the more significant covenants are summarized below:

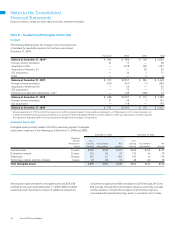

(a) Maximum leverage ratio (a quarterly test that is calculated as

principal debt divided by consolidated EBITDA, as defined) of

4.25x through September 30, 2010, 4.00x thereafter through

December 31, 2010 and 3.75x thereafter to maturity of the facility.

(b) Minimum interest coverage ratio (a quarterly test that is calculated

as consolidated EBITDA divided by consolidated interest expense)

may not be less than 3.00x.

(c) Limitations on (i) liens of Xerox and certain of our subsidiaries

securing debt, (ii) certain fundamental changes to corporate

structure, (iii) changes in nature of business and (iv) limitations

on debt incurred by certain subsidiaries.

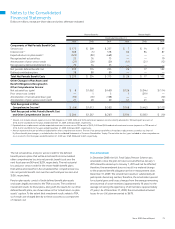

In May 2009, we issued $750 of 8.25% Senior Notes due 2014 (the

“2014 Senior Notes”) at 99.982 percent of par, resulting in net proceeds

of approximately $745. The 2014 Senior Notes accrue interest at the

rate of 8.25% per annum, payable semi annually and, as a result of

the discount, have a weighted average effective interest rate of 8.25%.

Debt issuance costs of approximately $5 were deferred. The 2014

Senior Notes rank equally with our other existing senior unsecured

indebtedness. Proceeds from the offering were used to repay borrowings

under the Credit Facility and for general corporate purposes.

Weighted

Average

Net Effective

Rates % of Par Principal Proceeds Interest Rate

Senior Notes due 2015 4.250% 99.808% $ 1,000 $ 991 4.25%

Senior Notes due 2019 5.625% 99.725% 650 643 5.63%

Senior Notes due 2039 6.750% 99.588% 350 346 6.75%

Total $ 2,000 $ 1,980