Xerox 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 Xerox 2009 Annual Report

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

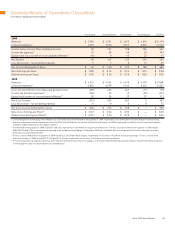

Stock-Based Compensation

We have a long-term incentive plan whereby eligible employees may

be granted restricted stock units (“RSUs”), performance shares (“PSs”)

and non-qualified stock options.

We grant PSs and RSUs in order to continue to attract and retain

employees and to better align employee interest with those of our

shareholders. Each of these awards is subject to settlement with newly

issued shares of our common stock. At December 31, 2009 and 2008,

15 million shares were available for grant of awards.

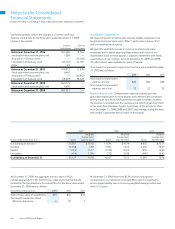

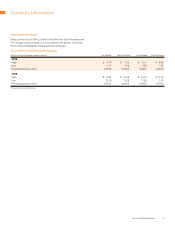

Stock-based compensation expense for the three years ended December

31, 2009 was as follows:

2009 2008 2007

Stock-based compensation

expense, pre-tax $85 $85 $89

Stock-based compensation

expense, net of tax 52 52 55

Restricted stock units: Compensation expense is based upon the

grant date market price for most awards and a Monte Carlo simulation

pricing model for a fiscal 2009 grant that included a market condition;

the expense is recorded over the vesting period, which ranges from three

to five years from the date of grant. A summary of the activity for RSUs

as of December 31, 2009, 2008 and 2007, and changes during the years

then ended, is presented below (shares in thousands):

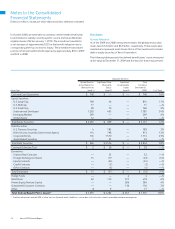

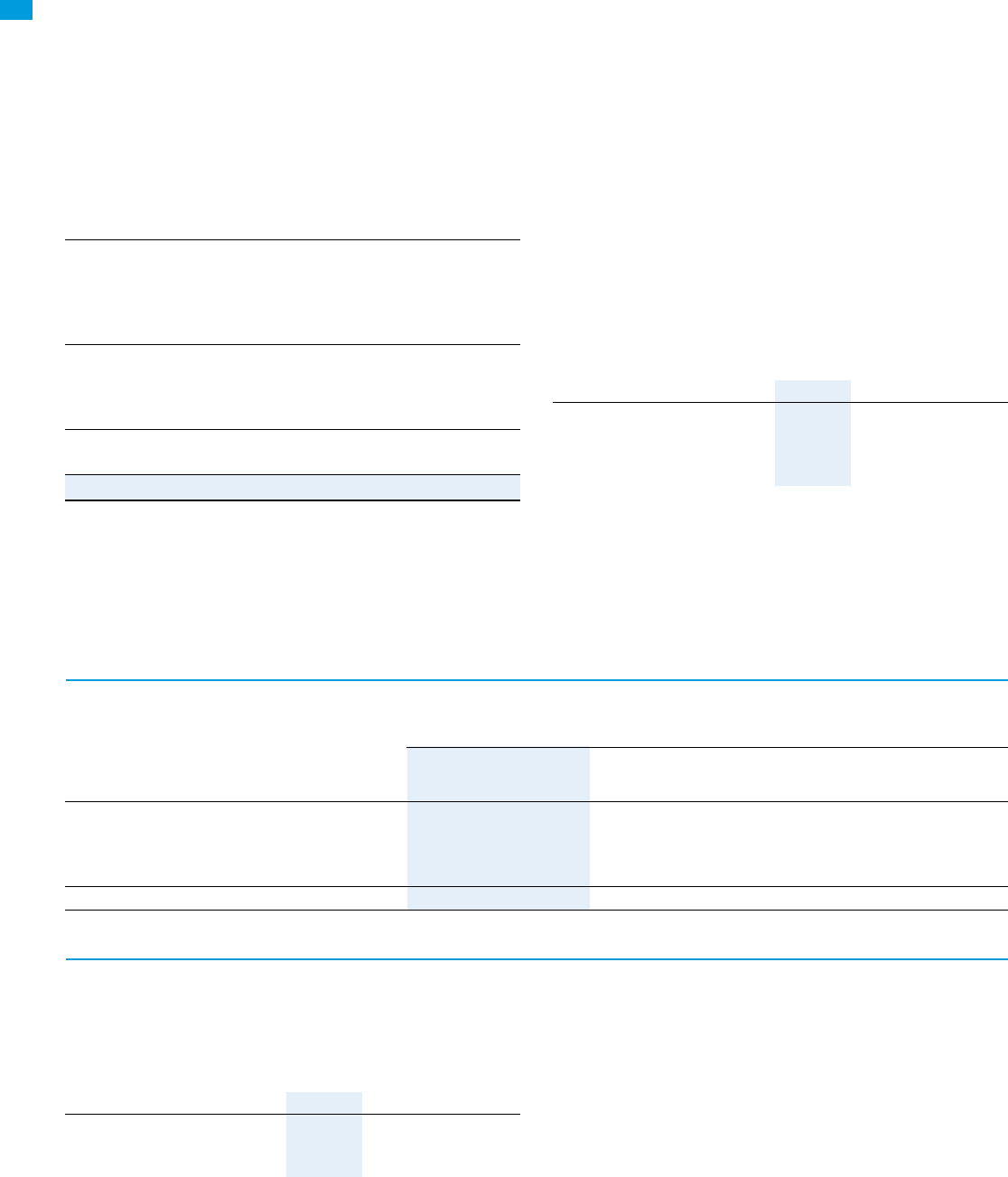

The following table reflects the changes in Common stock and

Treasury stock shares for the three years ended December 31, 2009

(shares in thousands):

Common Treasury

Stock Shares Stock Shares

Balance at December 31, 2006 954,568 (8,363)

Stock option and incentive plans, net 7,588 —

Acquisition of Treasury stock — (36,638)

Cancellation of Treasury stock (43,165) 43,165

Other 22 —

Balance at December 31, 2007 919,013 (1,836)

Stock option and incentive plans, net 4,442 —

Acquisition of Treasury stock — (56,842)

Cancellation of Treasury stock (58,678) 58,678

Balance at December 31, 2008 864,777 —

Stock option and incentive plans, net 4,604 —

Balance at December 31, 2009 869,381 —

At December 31, 2009, there was $129 of total unrecognized

compensation cost related to nonvested RSUs, which is expected to

be recognized ratably over a remaining weighted-average contractual

term of 1.9 years.

At December 31, 2009, the aggregate intrinsic value of RSUs

outstanding was $213. The total intrinsic value and actual tax benefit

realized for the tax deductions for vested RSUs for the three years ended

December 31, 2009 were as follows:

Vested Restricted Stock Units 2009 2008 2007

Total intrinsic value of vested RSUs $19 $54 $16

Tax benefit realized for vested

RSUs tax deductions 6 18 3

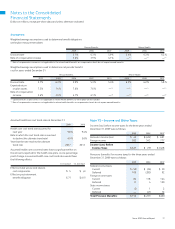

2009 2008 2007

Weighted Weighted Weighted

Average Grant Average Grant Average Grant

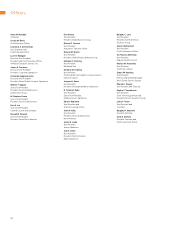

Nonvested Restricted Stock Units Shares Date Fair Value Shares Date Fair Value Shares Date Fair Value

Outstanding at January 1 14,037 $ 15.43 11,696 $ 16.78 8,635 $ 15.71

Granted 15,268 6.69 5,923 13.63 4,444 18.17

Vested (3,764) 15.17 (3,350) 16.92 (935) 13.65

Cancelled (414) 13.94 (232) 15.98 (448) 16.42

Outstanding at December 31 25,127 10.18 14,037 15.43 11,696 16.78