Xerox 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39Xerox 2009 Annual Report

Management’s Discussion

status of our U.S. qualified pension plans and the availability of a credit

balance that had resulted from funding in prior periods in excess of

minimum requirements. In 2008 we made additional contributions

above what was disclosed in the 2007 Annual Report of $165 million

to our U.S. qualified pension plans.

Our retiree health benefit plans are non-funded and are almost entirely

related to domestic operations. Cash contributions are made each

year to cover medical claims costs incurred in that year. The amounts

reported in the above table as retiree health payments represent our

estimated future benefit payments.

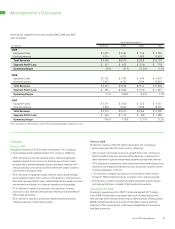

Contractual Cash Obligations and Other Commercial

Commitments and Contingencies

At December 31, 2009 we had the following contractual cash

obligations and other commercial commitments and contingencies

(in millions):

2010 2011 2012 2013 2014 Thereafter

Long-term debt, including capital

lease obligations(1) $ 988 $ 802 $ 1,101 $ 961 $ 819 $ 4,451

Minimum operating lease commitments(2) 224 181 128 99 70 80

Liability to subsidiary trust issuing

preferred securities(3) — — — — — 649

Retiree health payments 103 101 100 100 98 457

Purchase commitments

Flextronics(4) 503 — — — — —

Fuji Xerox(5) 1,256 — — — — —

EDS contracts(6) 113 77 77 77 19 —

Other IM service contracts(7) 80 77 61 56 44 18

Total Contractual Cash Obligations $ 3,267 $ 1,238 $ 1,467 $ 1,293 $ 1,050 $ 5,655

(1) Refer to Note 11 – Debt in our Consolidated Financial Statements for additional information and interest payments related to long-term debt (amounts above include principal

portion only).

(2) Refer to Note 6 – Land, Buildings and Equipment, Net in our Consolidated Financial Statements for additional information related to minimum operating lease commitments.

(3) Refer to Note 12 – Liability to Subsidiary Trust Issuing Preferred Securities in our Consolidated Financial Statements for additional information and interest payments (amounts

above include principal portion only).

(4) Flextronics: We outsource certain manufacturing activities to Flextronics and are currently in the third year of the Master Supply Agreement. The term of this agreement is three

years, with two additional one-year extension periods at our option. The amount included in the table reflects our estimate of purchases over the next year and is not a contractual

commitment.

(5) Fuji Xerox: The amount included in the table reflects our estimate of purchases over the next year and is not a contractual commitment.

(6) EDS contract: We have an information management contract with Electronic Data Systems Corp. (“EDS”) through March 2014. Services to be provided under this contract include

support for European and Brazilian mainframe system processing and application maintenance through June 2010, as well as workplace and service desk and voice and data network

management through March 2014. There are no minimum payments required under this contract. The amounts disclosed in the table reflect our estimate of probable minimum

payments for the periods shown. We can terminate the contract for convenience with six months prior notice, as defined in the contract, with no termination fee and with payment to

EDS for costs incurred as of the termination date. Should we terminate the contract for convenience, we have an option to purchase the assets placed in service under the EDS contract.

(7) IM (Information Management) services: During 2009 we terminated several agreements with EDS for information management services and entered into new agreements for similar

services with several providers. Services to be provided under these contracts include support for data network transport; mainframe application processing, development and support;

and mid-range applications processing and support. These contracts have various terms through 2015. Some of the contracts require minimum payments and include termination

penalties. The amounts disclosed in this table reflect our estimate of probable minimum payments.

PensionandOtherPost-retirementBenefitPlans

We sponsor pension and other post-retirement benefit plans that may

require periodic cash contributions. Our 2009 contributions for these

plans were $122 million for pensions and $107 million for our retiree

health plans. We expect to make contributions of approximately $260

million to our worldwide defined benefit pension plans and $103 million

to our retiree health benefit plans in 2010. Once the January 1, 2010

actuarial valuations are finalized for our U.S. qualified pension plans, we

will reassess the need for additional contributions for these plans. No

additional contributions were made in 2009, due to the ERISA funded