Xerox 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 Xerox 2009 Annual Report

Notes to the Consolidated

Financial Statements

Dollars in millions, except per share data and unless otherwise indicated.

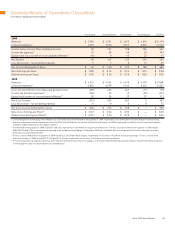

The 2009, 2008 and 2007 computation of diluted earnings per share

did not include the effects of 39 million, 29 million and 23 million stock

options, respectively, because their respective exercise prices were

greater than the corresponding market value per share of our common

stock. In addition, the common shares issuable with respect

to convertible securities were not included in the 2008 computation

of diluted EPS because to do so would have been anti-dilutive.

Note 19 – Subsequent Events

On January 20, 2010, we acquired Irish Business Systems (“IBS”) for

approximately $31. This acquisition expands our reach into the small

and mid-size business market in Ireland. IBS has eight offices located

throughout Ireland and is a managed print services provider and the

largest independent supplier of digital imaging and printing solutions

in Ireland.

On February 5, 2010, we completed the acquisition of ACS. Refer to

Note 3 – Acquisitions, Note 11 – Debt and Note 17 – Shareholders’

Equity for further information regarding the acquisition and funding

associated with it.

On February 25, 2010, we provided notice of termination for

convenience of the Amended and Restated Program Agreement dated

as of October 27, 2005 (as amended to date, the “Program Agreement”)

by and among General Electric Capital Corporation (“GECC”), Xerox,

Xerox Lease Funding LLC and Xerox Lease Equipment LLC. The Program

Agreement will terminate effective no later than August 25, 2010.

Termination of the Program Agreement will result in the termination

of other agreements relating to our vendor finance relationship with

GECC, including the Amended and Restated Loan Agreement dated

as of October 21, 2002 (as amended to date, the “Loan Agreement”)

between Xerox Lease Funding LLC and GECC. As of December 31, 2009,

approximately $2 was outstanding under the Loan Agreement and as

of February 16, 2010 all amounts outstanding under the Loan

Agreement had been repaid.

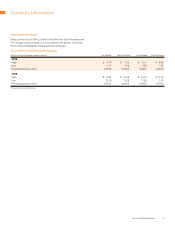

All outstanding stock options at December 31, 2009 were exercisable,

with an aggregate intrinsic value of $13, a weighted-average remaining

contractual life of 2.17 years and a weighted-average exercise price

of $10.13.

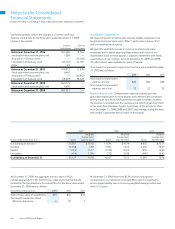

The following table provides information relating to stock option

exercises for the three years ended December 31, 2009:

2009 2008 2007

Total intrinsic value of

stock options $ — $4 $61

Cash received 1 6 65

Tax benefit realized for stock

option tax deductions — 2 22

In connection with the acquisition of ACS in February 2010 (see

Note 3 – Acquisitions for further information), we issued approximately

96,700 thousand options in exchange for ACS options.

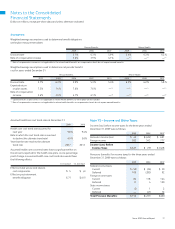

Note 18 – Earnings per Share

The following table sets forth the computation of basic and diluted

earnings per share of common stock for the three years ended

December 31, 2009 (shares in thousands):

2009 2008 2007

Basic Earnings per Share:

Net income attributable

to Xerox $ 485 $ 230 $ 1,135

Weighted-average common

shares outstanding 869,979 885,471 934,903

Basic Earnings per Share $ 0.56 $ 0.26 $ 1.21

Diluted Earnings per Share:

Net income attributable

to Xerox $ 485 $ 230 $ 1,135

Interest on Convertible

securities, net 1 — 1

Adjusted Net Income

Available to

Common Shareholders $ 486 $ 230 $ 1,136

Weighted-average common

shares outstanding 869,979 885,471 934,903

Common shares issuable

with respect to:

Stock options 462 3,885 8,650

Restricted stock and

performance shares 7,087 6,186 7,396

Convertible securities 1,992 — 1,992

Adjusted Weighted-Average

Shares Outstanding 879,520 895,542 952,941

Diluted Earnings per Share $ 0.55 $ 0.26 $ 1.19

Dividends declared per

common share $ 0.17 $ 0.17 $ 0.0425