Xerox 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 Xerox 2009 Annual Report

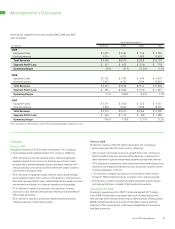

Management’s Discussion

•Over the past three years we have consistently delivered strong

cash flow from operations, driven by the strength of our annuity-

based revenue model. Cash flows from operations were $2,208

million, $939 million and $1,871 million for the years ended

December 31, 2009, 2008 and 2007, respectively. Cash flows

from operations in 2008 included $615 million in net payments

for our securities litigation.

•Our principal debt maturities are in line with historical and

projected cash flows and are spread over the next 10 years as

follows (in millions):

Year Amount

2010 $ 988

2011 802

2012 1,101

2013 961

2014 819

2015 1,000

2016 950

2017 500

2018 1,001

2019 and thereafter 1,000

Total $ 9,122

In February 2010, in connection with the closing of our acquisition of

ACS, we borrowed $649 million under our Credit Facility.

LoanCovenantsandCompliance

At December 31, 2009 we were in full compliance with the covenants

and other provisions of the Credit Facility, our Senior Notes and our

Bridge Loan Facility commitment (which was terminated on January

8, 2010). We have the right to prepay any outstanding loans or to

terminate the Credit Facility without penalty. Failure to be in compliance

with any material provision or covenant of these agreements could have

a material adverse effect on our liquidity and operations and our ability

to continue to fund our customers’ purchase of Xerox equipment.

Refer to Note 11 – Debt for further information regarding debt

arrangements.

CreditRatings: We are currently rated investment grade by all major

rating agencies. As of February 8, 2010 the ratings were as follows:

Senior

Unsecured Debt Outlook

Moody’s Baa2 Stable

Standard & Poors BBB- Stable

Fitch BBB Negative

BridgeLoanFacilityCommitment

In connection with the agreement to acquire ACS, in September

2009 we entered into a commitment for a syndicated $3.0 billion

Bridge Loan Facility with several banks that was to be used for funding

the acquisition in the event the transaction closed prior to obtaining

permanent financing in the capital markets. Debt issuance costs for

the Bridge Loan Facility commitment were $58 million. On December

4, 2009, the debt commitment was reduced to $500 million following

our issuance of $2.0 billion of Senior Notes. On January 8, 2010, we

terminated the remaining commitment because we concluded we

had sufficient liquidity to complete the ACS acquisition without having

to borrow under the Bridge Loan Facility.

Liquidity and Financial Flexibility

We manage our worldwide liquidity using internal cash management

practices, which are subject to (1) the statutes, regulations and

practices of each of the local jurisdictions in which we operate,

(2) the legal requirements of the agreements to which we are a

party and (3) the policies and cooperation of the financial institutions

we utilize to maintain and provide cash management services.

Our liquidity is a function of our ability to successfully generate cash

flows from a combination of efficient operations and access to capital

markets. Our ability to maintain positive liquidity going forward depends

on our ability to continue to generate cash from operations and access

to financial markets, both of which are subject to general economic,

financial, competitive, legislative, regulatory and other market factors

that are beyond our control.

The following is a discussion of our liquidity position as of December

31, 2009:

•As of December 31, 2009, total cash and cash equivalents was

$3.8 billion and our borrowing capacity under our Credit Facility was

$2.0 billion, reflecting no outstanding borrowings or letters of credit.

Cash and cash equivalents at December 31, 2009 included the net

proceeds from the $2.0 billion Senior Notes issued in December

2009, which were used to fund the acquisition of ACS.