Xerox 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23Xerox 2009 Annual Report

Management’s Discussion

We continue to maintain debt levels primarily to support our

customer financing operations and, at the end of 2009, to fund the

ACS acquisition. Total Debt at December 31, 2009 of $9,264 million

increased $880 million from the prior year as net debt repayments

of approximately $1.8 billion were more than offset by the issuance

of $2,750 million in Senior Notes. Our 2009 public offerings included

$750 million of Senior Notes issued in May and $2.0 billion of Senior

Notes issued in December. The net proceeds from the December Senior

Notes offering were used in connection with the acquisition of ACS.

We finished the year with cash and cash equivalents of $3,799 billion,

which included funds subsequently used for the acquisition of ACS.

Our 2010 priorities include:

•Effective ACS transition, including synergies capture;

•Grow revenue and maintain leadership in innovation;

•Continue to aggressively manage spending and resize our cost

base to align to current revenues; and

•Drive operating cash flow and achieve debt reduction goals.

Our 2010 balance sheet and cash flow strategy includes: sustaining

our working capital improvements; maintaining our investment-grade

credit ratings; achieving an optimal cost of capital; and effectively

deploying cash to deliver and maximize shareholder value through

acquisitions and dividends. Our strategy also includes appropriately

leveraging our financing assets (finance receivables and equipment

on operating leases).

Currency Impacts

To understand the trends in our business, we believe that it is helpful

to analyze the impact of changes in the translation of foreign currencies

into U.S. Dollars on revenues and expenses. We refer to this analysis as

“currency impact” or “the impact from currency.” Revenues and expenses

from our developing markets are analyzed at actual exchange rates

for all periods presented, since these countries generally have volatile

currency and inflationary environments, and our operations in these

countries have historically implemented pricing actions to recover the

impact of inflation and devaluation. We do not hedge the translation

effect of revenues or expenses denominated in currencies where the

local currency is the functional currency.

Approximately 50% of our consolidated revenues are derived from

operations outside of the United States where the U.S. Dollar is not

the functional currency. When compared with the average of the

major European currencies and Canadian Dollar on a revenue-weighted

basis, the U.S. Dollar was 7% stronger in 2009 and 3% weaker in

2008, each compared to the prior year. As a result, the foreign currency

translation impact on revenue was a 3% detriment in 2009 and a

1% benefit in 2008.

The overall slowdown in business activity reduced print volumes,

especially in heavily document-driven processes, and our customers,

in an effort to manage costs, are delaying spending on technology

upgrades until there are stronger signs of economic improvement.

The weak economies in developing markets, like Russia and Eurasia,

where access to credit is still quite limited, also impacted our revenues.

We reacted to these challenges by prioritizing cash generation and

taking actions on cost and expense to help mitigate the effects of

lower revenue.

The following is a summary of key 2009 highlights:

• Delivered strong operating cash flow and reduced spending;

• Operational performance continues to improve sequentially;

• Competitive position strengthened through innovative technology

and industry-leading Managed Print Services offering; and

• ACS acquisition opens new market opportunities and strengthens

financial position.

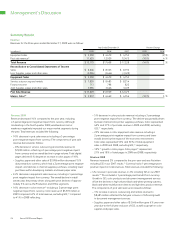

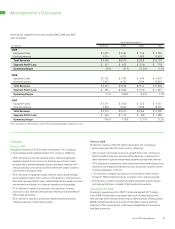

Total revenue of $15,179 million for 2009 declined 14% from the prior

year, including a 3-percentage point negative impact from currency.

Equipment sales of $3,550 million for 2009 decreased 24% from the

prior year, primarily reflecting the continued industry-wide slowdown

in technology spending. Post sale revenue of $11,629 million for 2009

was down 10% from the prior year, primarily reflecting lower supplies

revenue as distributors maintained lower inventory levels and businesses

implemented their own cost-cutting measures.

The benefits from restructuring and operational cost improvements

helped to relieve the pressure from revenue declines. Gross margins of

39.7% for 2009 increased 0.8-percentage points from the prior year

despite the continued effect of higher product costs due to the strength

of the Japanese Yen. Selling, administrative and general expenses

(“SAG”) for 2009 declined $385 million, reflecting favorable currency, the

benefits from restructuring and operational cost improvements, partially

offset by increased bad debt expense.

Cash flows from operations of $2,208 million in 2009 were primarily

driven by working capital improvements. Cash used in investing activities

of $343 million reflected well-controlled capital expenditures of $193

million, as well as $145 million for GIS’s acquisition of ComDoc in the

first quarter of 2009.