Xerox 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

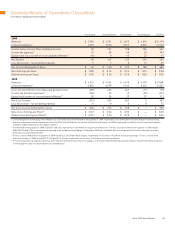

83Xerox 2009 Annual Report

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

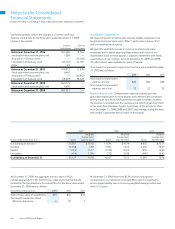

of shares determined by reference to the price paid for our common

stock upon a change in control. In addition, upon the occurrence of

certain fundamental change events, including a future change in control

of Xerox or if Xerox common stock ceases to be listed on a national

securities exchange, the holders of Convertible Preferred Stock will have

the right to require us to redeem any or all of the Convertible Preferred

Stock in cash at a redemption price per share equal to the liquidation

preference and any accrued and unpaid dividends to, but not including,

the redemption date. The Convertible Preferred Stock will be classified as

temporary equity (i.e., apart from permanent equity) as a result of the

contingent redemption feature.

Common Stock

We have 1.75 billion authorized shares of common stock, $1 par value.

At December 31, 2009, 79 million shares were reserved for issuance

under our incentive compensation plans, 48 million shares were reserved

for debt to equity exchanges and two million shares were reserved for

the conversion of convertible debt.

In connection with the acquisition of ACS in February 2010 (see Note

3 – Acquisitions for further information), we issued approximately

489,800 thousand shares of common stock to holders of ACS Class A

and Class B common stock.

Treasury Stock

Our Board of Directors has authorized programs for repurchase of the

Company’s common stock. During the year ended December 31, 2009,

we did not purchase any common stock and we have no immediate

plans for further share repurchases.

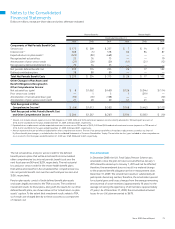

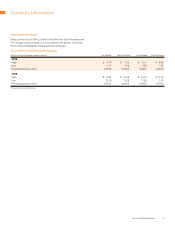

The following provides cumulative information relating to our share

repurchase programs from their inception in October 2005 through

December 31, 2009 (shares in thousands):

Authorized share repurchase $ 4,500

Share repurchases $ 2,941

Share repurchase fees $ 4

Number of shares repurchased 194,093

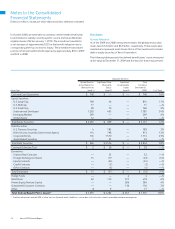

Product Warranty Liabilities

In connection with our normal sales of equipment, including

those under sales-type leases, we generally do not issue product

warranties. Our arrangements typically involve a separate full-service

maintenance agreement with the customer. The agreements generally

extend over a period equivalent to the lease term or the expected

useful life under a cash sale. The service agreements involve the pay-

ment of fees in return for our performance of repairs and maintenance.

As a consequence, we do not have any significant product warranty

obligations, including any obligations under customer satisfaction

programs. In a few circumstances, particularly in certain cash sales,

we may issue a limited product warranty if negotiated by the customer.

We also issue warranties for certain of our lower-end products in the

Office segment, where full-service maintenance agreements are not

available. In these instances, we record warranty obligations at the time

of the sale. Aggregate product warranty liability expenses for the three

years ended December 31, 2009 were $34, $39 and $40, respectively.

Total product warranty liabilities as of December 31, 2009 and 2008

were $20 and $27, respectively.

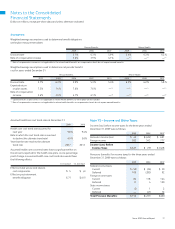

Note 17 – Shareholders’ Equity

Preferred Stock

As of December 31, 2009, we had no preferred stock shares or

preferred stock purchase rights outstanding. We are authorized to

issue approximately 22 million shares of cumulative preferred stock,

$1 par value.

In connection with the acquisition of ACS in February 2010 (see Note

3 – Acquisitions for further information), we issued 300,000 shares of

Convertible Preferred Stock with an aggregate liquidation preference

of $300 to the holders of ACS Class B Common Stock. The Convertible

Preferred Stock will pay quarterly cash dividends at a rate of 8 percent

per year and will have a liquidation preference of $1,000 per share.

Each share of Convertible Preferred Stock will be convertible at any

time, at the option of the holder, into 89.8876 shares of common

stock for a total of 26,966 thousand shares (which reflects an initial

conversion price of approximately $11.125 per share of common

stock, which is a 25% premium over $8.90, which was the average

closing price of Xerox common stock over the seven-trading day period

ended on September 14, 2009, and the number used for calculating

the conversion price in the ACS merger agreement), subject to customary

anti-dilution adjustments. On or after the fifth anniversary of the issue

date, we will have the right to cause, under certain circumstances, any

or all of the Convertible Preferred Stock to be converted into shares of

common stock at the then applicable conversion rate. The holders of

Convertible Preferred Stock will also be able to convert upon a change

in control at the applicable conversion rate plus an additional number