Xerox 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63Xerox 2009 Annual Report

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

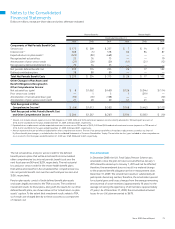

(1) As of December 31, 2009 and 2008, the associated net encumbered finance

receivables were $17 and $104, respectively. This secured loan agreement will

terminate in 2010. Refer to Note 19 – Subsequent Events for additional information.

(2) Fair value adjustments represent changes in the fair value of hedged debt obligations

attributable to movements in benchmark interest rates. Hedge accounting requires

hedged debt instruments to be reported at an amount equal to the sum of their

carrying value (principal value plus/minus premiums/discounts) and any fair value

adjustment.

(3) Represents weighted average effective interest rate which includes the effect of

discounts and premiums on issued debt.

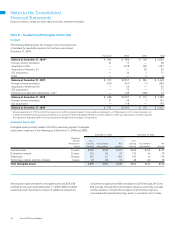

Scheduled payments due on our principal long-term debt for the next

five years and thereafter are as follows:

2010 2011 2012 2013 2014 Thereafter Total

$988(1) $802 $1,101 $961 $819 $4,451 $9,122

(1) Quarterly total debt maturities for 2010 are $17, $702, $268 and $1 for the first,

second, third and fourth quarters, respectively.

The zero coupon note of $267 due 2023 is included in the above

maturity schedule based on the year of its first potential put date

of 2010.

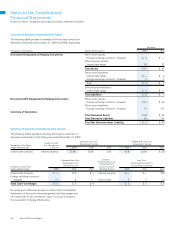

Credit Facility

The Credit Facility is a $2.0 billion unsecured revolving credit facility

including a $300 letter of credit subfacility. At December 31, 2009

we had no outstanding borrowings or letters of credit.

The Credit Facility is available, without sublimit, to certain of our quali-

fying subsidiaries and includes provisions that would allow us to increase

the overall size of the Credit Facility up to an aggregate amount of

$2.5 billion. Our obligations under the Credit Facility are unsecured and

are not currently guaranteed by any of our subsidiaries. Any domestic

subsidiary that guarantees more than $100 of Xerox Corporation debt

must also guaranty our obligations under the Credit Facility as well. In

the event that any of our subsidiaries borrows under the Credit Facility,

its borrowings thereunder would be guaranteed by us.

In October 2009, in connection with the acquisition of ACS, we amended

the Credit Facility as follows:

•The definition of “principal debt” was changed such that prior to the

closing of the ACS acquisition, it was calculated net of cash proceeds

from the Senior Notes issued in connection with the pre-funding of

the ACS acquisition.

•A portion of the Credit Facility that had a maturity date of April

30, 2012 was extended to a maturity date of April 30, 2013,

consistent with the majority of the Credit Facility. Accordingly,

after the amendment, approximately $1.6 billion, or approximately

80% of the Credit Facility, has a maturity date of April 30, 2013.

The remaining portion of the Credit Facility continues to have a

maturity date of April 30, 2012.

•Extended the permitted leverage ratios to current levels noted below.

Borrowings under the Credit Facility bear interest at LIBOR plus an

all-in spread that varies between 2.5% and 4.5%, depending on our

credit rating at the time of borrowing. Based on our credit rating as of

December 31, 2009, the applicable all-in spread for the Credit Facility

would be 3.50%.

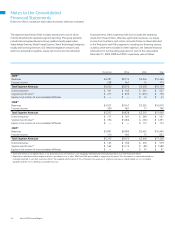

Long-term debt at December 31, 2009 and 2008 was as follows:

Weighted Average

Interest Rates at

December 31, 2009(3) 2009 2008

U.S. Operations

Xerox Corporation

Euro Senior Notes due 2009 —% $ — $ 317

Senior Notes due 2009 —% — 583

Floating Senior Notes due 2009 —% — 150

Senior Notes due 2010 7.13% 700 700

Notes due 2011 0.08% 1 1

Notes due 2011 7.01% 50 50

Senior Notes due 2011 6.59% 750 750

Credit Facility due 2012 —% — 246

Senior Notes due 2012 5.59% 1,100 1,100

Senior Notes due 2013 5.65% 400 400

Senior Notes due 2013 7.63% 550 550

Convertible Notes due 2014 9.00% 19 19

Senior Notes due 2014 8.25% 750 —

Senior Notes due 2015 4.25% 1,000 —

Notes due 2016 7.20% 250 250

Senior Notes due 2016 6.48% 700 700

Senior Notes due 2017 6.83% 500 500

Senior Notes due 2018 6.37% 1,000 1,000

Senior Notes due 2019 5.63% 650 —

Zero Coupon Notes due 2022 —% — 433

Zero Coupon Notes due 2023 5.41% 267 253

Senior Notes due 2039 6.75% 350 —

Subtotal $ 9,037 $ 8,002

Xerox Credit Corporation

Notes due 2013 6.42% 10 10

Notes due 2014 6.06% 50 50

Subtotal $ 60 $ 60

Other U.S. Operations

Borrowings secured by

finance receivables(1) 5.87% 2 56

Borrowings secured by other assets 11.35% 5 6

Subtotal $ 7 $ 62

Total U.S. Operations $ 9,104 $ 8,124

International Operations

Other debt due 2009–2010 2.89% $ 18 $ 16

Total International Operations $ 18 $ 16

Principal Debt Balance 9,122 8,140

Unamortized discount (11) (6)

Fair value adjustments(2) 153 189

Total Debt $ 9,264 $ 8,323

Less: current maturities (988) (1,549)

Total Long-term Debt $ 8,276 $ 6,774