Xerox 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61Xerox 2009 Annual Report

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

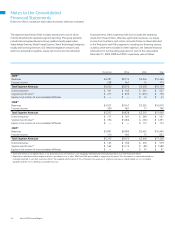

The following table summarizes the total amount of costs incurred in

connection with these restructuring programs by segment for the three

years ended December 31, 2009:

2009 2008 2007

Production $ (4) $ 190 $ (6)

Office (3) 200 3

Other (1) 39 (3)

Total Net Restructuring Charges $ (8) $ 429 $ (6)

Over the past several years, we have engaged in a series of restructuring

programs related to downsizing our employee base, exiting certain

activities, outsourcing certain internal functions and engaging in other

actions designed to reduce our cost structure and improve productivity.

These initiatives primarily include severance actions and impact all major

geographies and segments. Management continues to evaluate our

business and, therefore, there may be additional provisions for new plan

initiatives, as well as changes in estimates to amounts previously recorded,

as payments are made or actions are completed. Asset impairment

charges were also incurred in connection with these restructuring actions

for those assets made obsolete as a result of these programs.

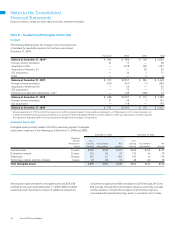

Lease

Severance and Cancellation and Asset

Restructuring Activity Related Costs Other Costs Impairments(1) Total

Balance December 31, 2006 $ 293 $ 44 $ — $ 337

Restructuring provision 27 7 1 35

Reversals of prior accruals (38) (3) — (41)

Net current-year charges(2) (11) 4 1 (6)

Charges against reserve and currency (211) (10) (1) (222)

Balance December 31, 2007 $ 71 $ 38 $ — $ 109

Restructuring provision 363 20 53 436

Reversals of prior accruals (6) (1) — (7)

Net current-year charges(2) 357 19 53 429

Charges against reserve and currency (108) (25) (53) (186)

Balance December 31, 2008 $ 320 $ 32 $ — $ 352

Restructuring provision 28 9 — 37

Reversals of prior accruals (39) (6) — (45)

Net current-year charges(2) (11) 3 — (8)

Charges against reserve and currency (255) (15) — (270)

Balance December 31, 2009(3) $ 54 $ 20 $ — $ 74

(1) Charges associated with asset impairments represent the write-down of the related assets to their new cost basis and are recorded concurrently with the recognition of the provision.

(2) Represents amount recognized within the Consolidated Statements of Income for the years shown.

(3) We expect to utilize the majority of the remaining December 31, 2009 restructuring balance in 2010.

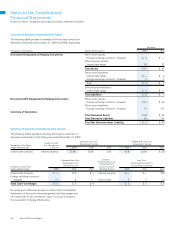

The following table summarizes the reconciliation to the Consolidated

Statements of Cash Flows:

Year Ended December 31,

2009 2008 2007

Charges to reserve $ (270) $ (186) $ (222)

Asset impairments — 53 1

Effects of foreign currency and

other non-cash items — 2 (14)

Cash Payments for

Restructurings $ (270) $ (131) $ (235)

Note 9 – Restructuring and Asset Impairment Charges

The net restructuring and asset impairment (credits) charges in the

Consolidated Statements of Income totaled $(8), $429 and $(6) in

2009, 2008 and 2007, respectively. Detailed information related to

restructuring program activity during the three years ended December

31, 2009 is outlined below: