Xerox 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 Xerox 2009 Annual Report

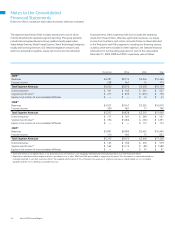

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

Benefit Plans Accounting

In 2008, the FASB issued Staff Position No. FAS 132(R)-1, “Employers’

Disclosures about Post-retirement Benefit Plan Assets” (ASC Topic

715-20-65). This guidance expands disclosure by requiring the following

new disclosures: 1) how investment allocation decisions are made by

management; 2) major categories of plan assets; 3) a roll-forward of

assets valued with non-observable market inputs; and 4) significant

concentrations of risk. Additionally, ASC 715-20-65 requires an

employer to disclose information about the valuation of plan assets

similar to that required in ASC Topic 820 Fair Value Measurements

and Disclosures. This guidance was effective for our fiscal year ending

December 31, 2009. The only impact from this standard was to require

us to expand disclosures regarding our benefit plan assets. Refer to

Note 14 – Employee Benefit Plans for expanded disclosures.

Other Accounting Changes

In January 2010, the FASB issued the following Codification updates:

•ASU 2010-01 which amends Equity (ASC Topic 505): Accounting for

Distributions to Shareholders with Components of Stock and Cash –

a consensus of the FASB Emerging Issues Task Force. This update

clarifies that the stock portion of a distribution to shareholders that

allows them to elect to receive cash or stock with a potential limitation

on the total amount of cash that all shareholders can elect to receive

in the aggregate is considered a share issuance that is reflected in

EPS prospectively and is not a stock dividend for purposes of applying

ASC Topics 505 and 260 (Equity and Earnings Per Share). This update

was effective October 1, 2009 (our fourth quarter) and did not have

a material effect on our financial condition or results of operations.

•ASU 2010-02 which amends Consolidation (ASC Topic 810): Accoun-

ting and Reporting for Decreases in Ownership of a Subsidiary – a

Scope Clarification. This update provides amendments to ASC Topic

810 to clarify the scope of the decrease in ownership provisions of

the topic and related guidance. This update was effective October 1,

2009 (our fourth quarter) and did not have a material effect on our

financial condition or results of operations.

In 2009, the FASB issued the following codification updates:

•ASU 2009-16 which amends Transfers and Servicing (ASC Topic 860):

Accounting for Transfers of Financial Assets. This update removed

the concept of a qualifying special-purpose entity and removed the

exception from applying consolidation guidance to these entities. This

update also clarified the requirements for isolation and limitations on

portions of financial assets that are eligible for sale accounting. We

adopted this update effective for our fiscal year beginning January 1,

2010. We have certain accounts receivable sale arrangements that will

require modification in order to qualify for sale accounting under this

updated guidance. Assuming those arrangements are modified, we do

not believe adoption of this update will have a material effect on our

financial condition or results of operations.

In 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in

Consolidated Financial Statements – an amendment of Accounting

Research Bulletin No. 51” (ASC Topic 810-10-65). This guidance requires

companies to present noncontrolling (minority) interests as equity (as

opposed to a liability) and provides guidance on the accounting for

transactions between an entity and noncontrolling interests. In addition,

it requires companies to report a consolidated net income (loss)

measure that includes the amount attributable to such noncontrolling

interests. We adopted this guidance effective January 1, 2009, and have

applied it to noncontrolling interests prospectively from that date. The

presentation and disclosure requirements were applied retrospectively

for all periods presented. As a result of this adoption, we reclassified

noncontrolling interests in the amount of $120 from Other long-term

liabilities to equity in the December 31, 2008 balance sheet.

Revenue Recognition

In 2009, the FASB issued the following ASUs:

•ASU No. 2009-13, Revenue Recognition (ASC Topic 605) – Multiple-

Deliverable Revenue Arrangements, a consensus of the FASB

Emerging Issues Task Force. This guidance modifies the fair value

requirements of ASC subtopic 605-25 Revenue Recognition-Multiple

Element Arrangements by allowing the use of the “best estimate

of selling price” in addition to VSOE and VOE (now referred to as

TPE, standing for third-party evidence) for determining the selling

price of a deliverable. A vendor is now required to use its best

estimate of the selling price when VSOE or TPE of the selling

price cannot be determined. In addition, the residual method of

allocating arrangement consideration is no longer permitted.

•ASU No. 2009-14, Software (ASC Topic 985) – Certain Revenue

Arrange ments That Include Software Elements, a consensus of

the FASB Emerging Issues Task Force. This guidance modifies the

scope of ASC subtopic 985-605 Software-Revenue Recognition

to exclude from its requirements (a) non-software components

of tangible products and (b) software components of tangible

products that are sold, licensed or leased with tangible products

when the software components and non-software components

of the tangible product function together to deliver the tangible

product’s essential functionality.

These updates require expanded qualitative and quantitative

disclosures and are effective for fiscal years beginning on or after

June 15, 2010. We have elected to adopt these updates effective

for our fiscal year beginning January 1, 2010 and we will apply

them prospectively from that date for new or materially modified

arrangements. We do not believe adoption of these updates will have

a material effect on our financial condition or results of operations.