Xerox 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25Xerox 2009 Annual Report

Management’s Discussion

•$292 million after-tax charge ($426 million pre-tax) for the

second, third and fourth quarter 2008 restructuring and asset

impairment actions.

•$24 million after-tax charge ($39 million pre-tax) for an Office

product line equipment write-off.

•$41 million income tax benefit from the settlement of certain

previously unrecognized tax benefits.

Application of Critical Accounting Policies

In preparing our Consolidated Financial Statements and accounting

for the underlying transactions and balances, we apply various

accounting policies. Senior management has discussed the development

and selection of the critical accounting policies, estimates and related

disclosures included herein with the Audit Committee of the Board

of Directors. We consider the policies discussed below as critical

to understanding our Consolidated Financial Statements, as their

application places the most significant demands on management’s

judgment, since financial reporting results rely on estimates of the

effects of matters that are inherently uncertain. In instances where

different estimates could have reasonably been used, we disclosed

the impact of these different estimates on our operations. In certain

instances, like revenue recognition for leases, the accounting rules are

prescriptive; therefore, it would not have been possible to reasonably

use different estimates. Changes in assumptions and estimates are

reflected in the period in which they occur. The impact of such changes

could be material to our results of operations and financial condition

in any quarterly or annual period.

Specific risks associated with these critical accounting policies are

discussed throughout the MD&A, where such policies affect our

reported and expected financial results. For a detailed discussion of

the application of these and other accounting policies, refer to Note

1 – Summary of Significant Accounting Policies, in the Consolidated

Financial Statements.

RevenueRecognitionforLeases

Our accounting for leases involves specific determinations under

applicable lease accounting standards, which often involve complex

and prescriptive provisions. These provisions affect the timing of

revenue recognition for our equipment. If a lease qualifies as a sales-

type capital lease, equipment revenue is recognized upon delivery or

installation of the equipment as sale revenue as opposed to ratably

over the lease term. The critical elements that we consider with respect

to our lease accounting are the determination of the economic life

and the fair value of equipment, including the residual value. For

purposes of determining the economic life, we consider the most

objective measure to be the original contract term, since most equip-

ment is returned by lessees at or near the end of the contracted term.

The economic life of most of our products is five years, since this

represents the most frequent contractual lease term for our principal

products and only a small percentage of our leases are for original terms

longer than five years. There is no significant after-market for our used

equipment. We believe five years is representative of the period during

which the equipment is expected to be economically usable, with normal

service, for the purpose for which it is intended.

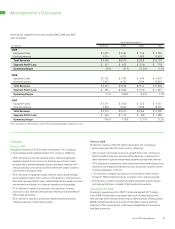

• 2% decrease in equipment sales revenue. There was no impact from

currency on equipment sales revenue. When including GIS in our 2007

results,(5) equipment sales revenue decreased 5%, with a 1-percentage

point benefit from currency. Overall price declines of between

5%–10%, as well as product mix, more than offset overall growth

in install activity.

• 5% growth in color revenue.(2) Color revenue of $6,669 million in

2008 represented 41% of total revenue, excluding GIS,(3) compared

to 39% in 2007, reflecting:

– 10% growth in color post sale revenue to $4,590 million. Color

post sale revenue represented 37% and 35% of post sale revenue

in 2008 and 2007, respectively.(3)

– Color equipment sales revenue declined 4% to $2,079 million.

Color equipment sales represented 50% of total equipment sales

in 2008 and 2007, respectively.(3)

– 24%(4) growth in color pages. Color pages(4) represented 18% and

12% of total pages in 2008 and 2007, respectively.

(1) Post sale revenue is largely a function of the equipment placed at customer

locations, the volume of prints and copies that our customers make on that

equipment, the mix of color pages and associated services.

(2) Color revenues represent a subset of total revenue and excludes the impact

of GIS’s revenues.

(3) As of December 31, 2009 and 2008, total color, color post sale and color

equipment sales revenues comprised 39%, 37% and 46%; and 38%, 36% and

44%, respectively, if calculated on total, total post sale, and total equipment sales

revenues, including GIS. GIS is excluded from the color information presented because

the breakout of the information required to make this computation for all periods

is not available.

(4) Pages include estimates for developing markets, GIS and printers.

(5) The percentage point impacts from GIS reflect the revenue growth year-over-year

after including GIS’s results for 2007 on a pro forma basis. We acquired GIS in

May 2007. See “Non-GAAP Financial Measures” section for an explanation of this

non-GAAP measure.

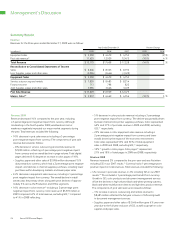

Net Income

Net income and diluted earnings per share for the three years ended

December 31, 2009 were as follows:

(in millions, except per-share amounts) 2009 2008 2007

Net income attributable to Xerox $ 485 $ 230 $ 1,135

Diluted earnings per share $ 0.55 $ 0.26 $ 1.19

NetIncome2009

Net income attributable to Xerox of $485 million, or $0.55 per diluted

share, included the following:

•A $49 million after-tax ($72 million pre-tax) charge, or $0.06 per

diluted share, related to costs associated with the acquisition of ACS.

•A charge of $46 million, or $0.05 per diluted share, for our share of

Fuji Xerox’s after-tax restructuring charge.

NetIncome2008

Net income of $230 million, or $0.26 per diluted share, included

the following:

•$491 million after-tax charges ($774 million pre-tax) associated

with securities-related litigation matters, as well as other probable

litigation-related losses, including $36 million for the Brazilian

labor-related contingencies.