Xerox 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 Xerox 2009 Annual Report

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

Note 1 – Summary of Significant Accounting Policies

References herein to “we,” “us,” “our,” the “Company” and Xerox refer

to Xerox Corporation and its consolidated subsidiaries unless the context

specifically requires otherwise.

Description of Business and Basis of Presentation

We are a technology and services enterprise and a leader in the

global document market. We develop, manufacture, market, service

and finance a complete range of document equipment, software,

solutions and services.

Basis of Consolidation

The Consolidated Financial Statements include the accounts of

Xerox Corporation and all of our controlled subsidiary companies.

All significant intercompany accounts and transactions have been

eliminated. Investments in business entities in which we do not have

control, but we have the ability to exercise significant influence over

operating and financial policies (generally 20% to 50% ownership),

are accounted for using the equity method of accounting. Operating

results of acquired businesses are included in the Consolidated

Statements of Income from the date of acquisition.

We consolidate variable interest entities if we are deemed to be the

primary beneficiary of the entity. Operating results for variable interest

entities in which we are determined to be the primary beneficiary are

included in the Consolidated Statements of Income from the date such

determination is made.

For convenience and ease of reference, we refer to the financial

statement caption “Income (Loss) before Income Taxes and Equity

Income” as “Pre-tax Income” or “Pre-tax Loss” throughout the Notes

to the Consolidated Financial Statements.

In 2009, we changed the presentation of our financial statements

for noncontrolling (minority) interests. Refer to “Business Combinations

and Noncontrolling Interests” below for additional information.

Use of Estimates

The preparation of our Consolidated Financial Statements, in

accordance with accounting principles generally accepted in the United

States of America, requires that we make estimates and assumptions

that affect the reported amounts of assets and liabilities, as well as the

disclosure of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses during

the reporting period. Significant estimates and assumptions are used

for, but not limited to: (i) allocation of revenues and fair values in leases

and other multiple-element arrangements; (ii) accounting for residual

values; (iii) economic lives of leased assets; (iv) allowance for doubtful

accounts; (v) inventory valuation; (vi) restructuring and related charges;

(vii) asset impairments; (viii) depreciable lives of assets; (ix) useful lives

of intangible assets; (x) pension and post-retirement benefit plans; (xi)

income tax reserves and valuation allowances; and (xii) contingency and

litigation reserves. Future events and their effects cannot be predicted

with certainty; accordingly, our accounting estimates require the exercise

of judgment. The accounting estimates used in the preparation of our

Consolidated Financial Statements will change as new events occur, as

more experience is acquired, as additional information is obtained and

as our operating environment changes. Actual results could differ from

those estimates.

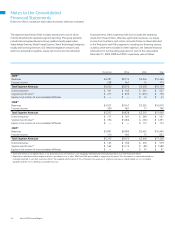

The following table summarizes certain significant charges that require

management estimates:

Year Ended December 31,

2009 2008 2007

Restructuring provisions and

asset impairments $ (8) $ 429 $ (6)

Amortization of acquired

intangible assets(1) 64 58 46

Provisions for receivables 289 199 131

Provisions for obsolete and

excess inventory 52 115 66

Provisions for litigation and

regulatory matters 9 781 (6)

Depreciation and obsolescence

of equipment on operating leases 329 298 269

Depreciation of buildings

and equipment 247 257 262

Amortization of internal use

and product software 58 56 79

Defined pension benefits –

net periodic benefit cost 232 174 235

Other post-retirement benefits –

net periodic benefit cost 26 77 102

Deferred tax asset valuation

allowance provisions (11) 17 14

(1) Note: this includes amortization of $4 for patents which is included in cost of sales.

Changes in Estimates

In the ordinary course of accounting for items discussed above, we

make changes in estimates as appropriate and as we become aware

of circumstances surrounding those estimates. Such changes and

refinements in estimation methodologies are reflected in reported

results of operations in the period in which the changes are made and,

if material, their effects are disclosed in the Notes to the Consolidated

Financial Statements.