Xerox 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 Xerox 2009 Annual Report

Management’s Discussion

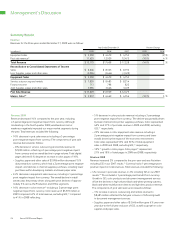

Restructuring and Asset Impairment Charges

For the years ended December 31, 2009, 2008 and 2007, we

recorded net restructuring and asset impairment (credits)/charges

of $(8) million, $429 million and $(6) million, respectively.

•Restructuring activity was minimal in 2009, and the credit of

$8 million primarily reflected changes in estimates for prior

years’ initiatives.

•The 2008 net charge included $357 million related to head count

reductions of approximately 4,900 employees, primarily in North

America and Europe, and lease termination and asset impairment

charges of $72 million, primarily reflecting the exit from certain

leased and owned facilities resulting from a rationalization of our

worldwide operating locations. These actions applied equally to

both North America and Europe, with approximately half focused

on SAG reductions, approximately a third on gross margin

improvements and the remainder focused on the optimization

of RD&E investments. Estimated savings from these initiatives

were approximately $250 million in 2009.

•Restructuring activity was minimal in 2007 and the related credit

of $6 million primarily reflected changes in estimates for prior

year’s severance costs.

The restructuring reserve balance as of December 31, 2009 for all

programs was $74 million, of which approximately $64 million is expected

to be spent over the next 12 months. Refer to Note 9 – Restructuring

and Asset Impairment Charges in the Consolidated Financial Statements

for further information regarding our restructuring programs.

2010ExpectedActions

In connection with our continued objective to align our cost base to

current revenues, we expect to record pre-tax restructuring charges of

approximately $280 million in 2010, of which $250 million is expected

to be recorded in the first quarter. These actions are expected to

impact all geographies and segments, with approximately equal focus

on SAG reductions, gross margin improvements and optimization of

RD&E investments. The restructuring is also expected to involve the

rationalization of some of our facilities.

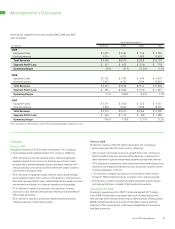

Selling, Administrative and General Expenses (“SAG”)

Year Ended December 31, Change

(in millions) 2009 2008 2007 2009 2008

Total SAG $ 4,149 $ 4,534 $ 4,312 $ (385) $ 222

SAG as a % of Revenue 27.3% 25.7% 25.0% 1.6 pts 0.7 pts

Bad Debt Expense $ 291 $ 188 $ 134 $ 103 $ 54

Bad Debt as a % of Revenue 1.9% 1.1% 0.8% 0.8 pts 0.3 pts

SAG2009

SAG of $4,149 million was $385 million lower than 2008, including

a $126 million benefit from currency. The SAG decrease was the result

of the following:

•$311 million decrease in selling expenses reflecting favorable currency,

benefits from restructuring, an overall reduction in marketing spend

and lower commissions.

•$177 million decrease in general and administrative (“G&A”) expenses

reflecting favorable currency and benefits from restructuring and cost

actions partially offset by higher compensation accruals.

•$103 million increase in bad debt expense reflecting increased

write-offs in North America and Europe.

SAG2008

SAG of $4,534 million was $222 million higher than 2007, including

a $12 million unfavorable impact from currency. The SAG increase

was the result of the following:

•$94 million increase in selling expenses, primarily reflecting the

full-year inclusion of GIS, investments in selling resources and

marketing communications, and unfavorable currency partially

offset by lower compensation.

•$75 million increase in G&A expenses, primarily from the full-year

inclusion of GIS and unfavorable currency.

•$54 million increase in bad debt expense, reflecting increased write-

offs, particularly in the fourth quarter 2008, which included several

high-value account bankruptcies in the U.S., U.K. and Germany.

Bad debt expense, which is included in SAG, increased $103 million

in 2009 and reserves as a percentage of trade and finance receivables

increased to 4.1% at December 31, 2009 as compared to 3.4% at

December 31, 2008. These increases reflect the weak worldwide

eco nomic conditions and the increased level of customer bankruptcies

in certain industry groups during the year. Bad debts provision and

write-offs in the fourth quarter 2009 were flat as compared to the

prior year.