Xerox 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 Xerox 2009 Annual Report

Management’s Discussion

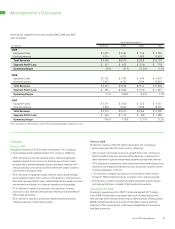

Equity in Net Income of Unconsolidated Affiliates

2009 equity in net income of unconsolidated affiliates of $41 million

is principally related to our 25% share of Fuji Xerox income. The $72

million decrease from 2008 is primarily due to Fuji Xerox’s lower net

income, which has been impacted by the worldwide economic weakness,

and includes $46 million related to our share of Fuji Xerox after-tax

restructuring costs.

2008 equity in net income of unconsolidated affiliates of $113 million

increased by $16 million from 2007, primarily due to a $14 million

reduction in our share of Fuji Xerox restructuring charges.

Subsequent Events

We have operations in Venezuela where the U.S. Dollar is the functional

currency. At December 31, 2009 our Venezuelan operations had

approximately 90 million in net Bolivar-denominated monetary assets

that were re-measured to U.S. Dollars at the official exchange rate of

2.15 Bolivars to the Dollar. In January 2010, Venezuela announced a

devaluation of the Bolivar to an official rate of 4.30 Bolivars to the Dollar

for our products. As a result of this devaluation, we expect to record a

loss of approximately $21 million in the first quarter of 2010 for the

re-measurement of our net Bolivar-denominated monetary assets. Other

than the loss from re-measurement, we do not expect the devaluation to

materially impact our results of operations or financial position in 2010,

since we derive less than 0.5% of our total revenue from Venezuela and

expect to take actions to lessen the effect of the devaluation.

On January 20, 2010 we acquired Irish Business Systems Limited (“IBS”)

for approximately $31 million. This acquisition expands our reach into

the small and mid-size business (SMB) market in Ireland. IBS, with eight

offices located throughout Ireland, is a managed print services provider

and the largest independent supplier of digital imaging and printing

solutions in Ireland.

On February 5, 2010 we completed the acquisition of ACS. Refer to

Note 3 – Acquisitions, Note 11 – Debt and Note 17 – Shareholders’

Equity for further information regarding the acquisition and associated

funding for it.

Recent Accounting Pronouncements

On January 1, 2009 we adopted SFAS No. 160 “Noncontrolling Interests

in Consolidated Financial Statements – an amendment of ARB No. 51”

(Accounting Standards Codification™ Topic 810-10-65). This guidance

requires that minority interests be renamed noncontrolling interests

and be presented as a separate component of equity. In addition, the

Company must report a consolidated net income (loss) measure that

includes the amount attributable to such noncontrolling interests for all

periods presented.

Refer to Note 1 – Summary of Significant Accounting Policies in the

Consolidated Financial Statements for a description of all recent

accounting pronouncements, including the respective dates of adoption

and the effects on results of operations and financial condition.

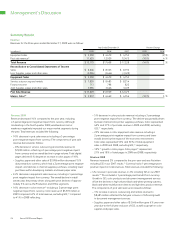

Income Taxes

Year Ended December 31,

(in millions) 2009 2008 2007

Pre-tax income (loss) $ 627 $ (79) $ 1,468

Income tax expense (benefit) 152 (231) 400

Effective tax rate 24.2% 292.4% 27.2%

The 2009 effective tax rate of 24.2% was lower than the U.S. statutory

tax rate, primarily reflecting the benefit to taxes from the geographical

mix of income before taxes and the related effective tax rates in those

jurisdictions, and the settlement of certain previously unrecognized

tax benefits partially offset by a reduction in the utilization of foreign

tax credits.

The 2008 effective tax rate of 292.4% reflected the tax benefits from

certain discrete items including the net provision for litigation matters;

the second, third and fourth quarter restructuring and asset impairment

charges; the product line equipment write-off; and the settlement of

certain previously unrecognized tax benefits. Excluding these items, the

adjusted effective tax rate was 20.9%*. The adjusted 2008 effective tax

rate was lower than the U.S. statutory tax rate, primarily reflecting the

benefit to taxes from the geographical mix of income before taxes and

the related effective tax rates in those jurisdictions, the utilization of

foreign tax credits and tax law changes.

The 2007 effective tax rate of 27.2% was lower than the U.S. statutory

rate, primarily reflecting tax benefits from the geographical mix of

income before taxes and the related effective tax rates in those juris-

dictions and the utilization of foreign tax credits, as well as the resolution

of other tax matters. These benefits were partially offset by changes

in tax law.

Our effective tax rate will change based on nonrecurring events, as well

as recurring factors including the geographical mix of income before

taxes and the related effective tax rates in those jurisdictions and

available foreign tax credits. In addition, our effective tax rate will

change based on discrete or other nonrecurring events (such as audit

settlements) that may not be predictable. Including the results from

ACS, we anticipate that our effective tax rate for 2010 will be approxi-

mately 32%, excluding the effects of any discrete events.

Refer to Note 15 – Income and Other Taxes in the Consolidated

Financial Statements for additional information.

* See the “Non-GAAP Measures” section for additional information.