Xerox 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

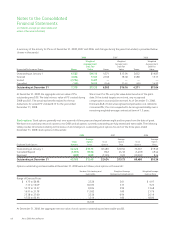

The following table provides information relating to stock option

exercises for the three years ended December 31, 2008:

2008 2007 2006

Total intrinsic value $4 $61 $72

Cash received 665 82

Tax benefit realized for tax deductions 222 25

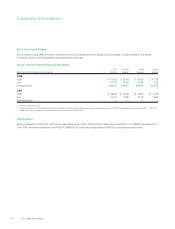

Treasury Stock

The Board of Directors has cumulatively authorized programs for

the repurchase of the Company’s common stock totaling $4.5

billion as of December 31, 2008. The $4.5 billion includes

additional authorizations of $1.0 billion in both January and July of

2008.

Through December 31, 2008, we have repurchased a cumulative

total of 194.1 million shares at a cost of $2,945 (including

associated fees of $4) under these stock repurchase programs.

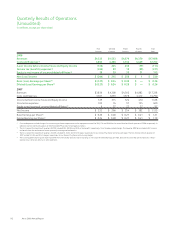

Note 18 – Earnings Per Share

The following table sets forth the computation of basic and diluted earnings per share of common stock for the three years ended

December 31, 2008 (shares in thousands):

2008 2007 2006

Basic Earnings per Share:

Net Income $ 230 $ 1,135 $ 1,210

Accrued dividends on Series C Mandatory Convertible Preferred Stock —— (29)

Adjusted net income available to common shareholders $ 230 $ 1,135 $ 1,181

Weighted Average Common Shares Outstanding 885,471 934,903 943,852

Basic Earnings per Share $ 0.26 $ 1.21 $ 1.25

Diluted Earnings per Share:

Net Income $ 230 $ 1,135 $ 1,210

Interest on Convertible securities, net —11

Adjusted net income available to common shareholders $ 230 $ 1,136 $ 1,211

Weighted Average Common Shares Outstanding 885,471 934,903 943,852

Common shares issuable with respect to:

Stock options 3,885 8,650 9,300

Restricted stock and performance shares 6,186 7,396 3,980

Series C Mandatory Convertible Preferred Stock —— 37,398

Convertible securities —1,992 1,992

Adjusted Weighted Average Shares Outstanding 895,542 952,941 996,522

Diluted Earnings per Share $ 0.26 $ 1.19 $ 1.22

The 2008, 2007 and 2006 computation of diluted earnings per

share did not include the effects of 29 million, 23 million and

27 million stock options, respectively, because their respective

exercise prices were greater than the corresponding market value

per share of our common stock. In addition, the common shares

issuable with respect to convertible securities were not included in

the 2008 computation of diluted EPS because to do so would have

been anti-dilutive.

Xerox 2008 Annual Report 89