Xerox 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

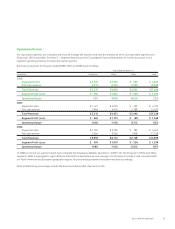

• R&D of $750 million decreased $14 million from 2007. Our R&D

• Sustaining engineering costs of $134 million were $14 million

• R,D&E as a percentage of revenue declined 0.3-percentage

support our GIS operations.

• R&D of $764 million increased $3 million from 2006. Our R&D is

• Sustaining engineering costs of $148 million were $13 million

• R,D&E as a percentage of revenue declined 0.5-percentage

GIS operations.

Total SAG

SAG % revenue

2008 SAG expenses of $4,534 million were $222 million higher

currency. The SAG expense increase was the result of the following:

• $94 million increase in selling expenses primarily reflecting the

full year inclusion of GIS, investments in selling resources and

• $75 million increase in general and administrative (“G&A”)

expenses primarily from the full year inclusion of GIS and

• $54 million increase in bad debt expense reflecting increased

write-offs, particularly in the fourth quarter 2008, which included

several high value account bankruptcies in the U.S., U.K. and

2007 SAG expenses of $4,312 million were $304 million higher

currency. The SAG expense increase was the result of the following:

• $93 million increase in selling expenses primarily reflecting the

negative impact from currency and the inclusion of GIS. This

• $164 million increase in G&A expenses primarily from the

inclusion of GIS, unfavorable currency and information

• $47 million increase in bad debt expense primarily as a result of

to reflect improvement in write-offs and aging.

36 Xerox 2008 Annual Report

Bad debt expense included in SAG was $188 million, $134 million

and $87 million in 2008, 2007 and 2006, respectively. Bad debt

expense as a percent of total revenue increased in the fourth

quarter 2008 but was 1.1% in 2008 as compared to 0.8% and

0.5% for 2007 and 2006, respectively. Despite the fourth quarter

2008 increase in the provision and write-offs, days sales

outstanding at December 31, 2008 remained fairly flat year-over-

year and the aging of receivables as compared to historical levels

has not increased significantly. However, due to the current

economic conditions, there is an increased risk for our provision for

bad debts to trend higher in 2009 as compared to 2008. At

December 31, 2008, bad debt reserves, as a percentage of

receivables, were comparable to year end 2007.

Restructuring and Asset Impairment Charges

For the years ended December 31, 2008, 2007 and 2006 we

recorded net restructuring and asset impairment charges (credits)

of $429 million, $(6) million and $385 million, respectively. The

2008 net charge included $357 million related to headcount

reductions of approximately 4,900 employees primarily in North

America and Europe and lease termination and asset impairment

charges of $72 million primarily reflecting the exit from certain

leased and owned facilities resulting from a rationalization of our

worldwide operating locations. These actions applied equally to

both North America and Europe with approximately half focused

on SAG expense reductions, approximately a third on gross margin

improvements and the remainder focused on the optimization of

R,D&E investments. We expect to realize savings in 2009 of

approximately $250 million as a result of the 2008 restructuring

actions. Restructuring activity was minimal in 2007 and the related

credit of $6 million primarily reflected changes in estimates for

prior years’ severance costs. The 2006 net charge included $318

million related to headcount reductions of approximately 3,400

employees in North America and Europe, and lease termination

and asset impairment charges of $67 million primarily reflecting

the relocation of certain manufacturing operations and the exit

from certain leased and owned facilities. The restructuring reserve

balance as of December 31, 2008, for all programs was $352

million of which approximately $325 million is expected to be

spent over the next twelve months. Refer to Note 9 – Restructuring

and Asset Impairment Charges in the Consolidated Financial

Statements for further information regarding our restructuring

programs.

Worldwide Employment

Worldwide employment of 57,100 as of December 31, 2008

decreased approximately 300 from December 31, 2007, primarily

reflecting the reductions from restructuring partially offset by

additions as a result of 2008 acquisition activity. Worldwide

employment was approximately 57,400 and 53,700 at

December 31, 2007 and 2006, respectively.

Other Expenses, Net

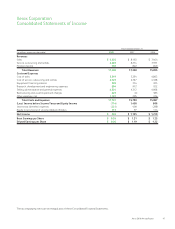

Other expenses, net for each of the three years ended

December 31, 2008, 2007 and 2006 consisted of the following:

Year Ended December 31,

(in millions) 2008 2007 2006

Non-financing interest expense $ 262 $263 $239

Interest income (35) (55) (69)

Gain on sales of businesses and assets (21) (7) (44)

Currency losses, net 34 8 39

Amortization of intangible assets 54 42 41

Legal matters 781 (6) 89

All other expenses, net 47 50 41

Total Other expenses, net $1,122 $295 $336

Non-financing interest expense: 2008 non-financing interest

expense was flat compared to 2007, as the benefit of lower

interest rates was offset by higher average non-financing debt

balances. In 2007 non-financing interest expense increased

primarily due to higher average non-financing debt balances as

well as higher interest rates.

Interest income: Interest income is derived primarily from our

invested cash and cash equivalent balances. The decline in interest

income in 2008 was primarily due to lower average cash balances

and rates of return. The decline in 2007 was primarily due to lower

average cash balances partially offset by higher rates of return.

Gain on sales of businesses and assets: 2008 gain on sales of

business and assets primarily consisted of the sale of certain

surplus facilities in Latin America.

The 2006 gain on sales of businesses and assets primarily

consisted of $15 million on the sale of our Corporate headquarters,

$11 million on the sale of a manufacturing facility and $10 million

receipt from escrow of additional proceeds related to our 2005 sale

of Integic.

Currency losses net: Currency losses primarily result from the

re-measurement of foreign currency-denominated assets and

liabilities, the cost of hedging foreign currency-denominated assets

and liabilities, the mark-to-market of foreign exchange contracts

utilized to hedge those foreign currency-denominated assets and

liabilities and the mark-to-market impact of hedges of anticipated

transactions, primarily future inventory purchases, for those that

we do not apply cash flow hedge accounting treatment.

The 2008 currency losses were primarily due to net

re-measurement losses associated with our Yen-denominated

payables, foreign currency denominated assets and liabilities in our

developing markets and the cost of hedging. The currency losses

on Yen-denominated payables were largely limited to the first

Xerox 2008 Annual Report 37