Xerox 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 2% increase in post sale revenue as growth from color,

continuous feed and light production products offset declines in

revenue from black-and-white high-volume printing systems and

light lens devices.

• 10% decrease in equipment sales revenue, primarily reflecting

pricing declines in both black-and-white and color production

systems, driven in part by weakness in the U.S.

• 1% increase in installs of production color products driven in

activity as well as color

continuous feed.

• 6% decline in installs of production black-and-white systems

driven primarily by declines in installs of light production

systems.

• 8% increase in post sale and other revenue, including a

4-percentage point benefit from currency, as growth from digital

products more than offset declines in revenue from older light

lens technology.

• 1% decrease in equipment sales revenue, including a

3-percentage point benefit from currency, reflecting growth in

production color systems offset by declines in black-and-white

production printing systems and light production and an

increased proportion of equipment installed under operating

lease contracts where revenue is recognized over-time in post

sale.

• 6% growth in installs of production color products driven by

242/252/260 family, DocuColor 5000 and iGen3

activity.

• 8% decline in installs of production black-and-white systems

reflecting declines in installs of both high-volume and light

production systems.

2008 Operating profit of $394 million decreased $168 million from

2007. The decrease is primarily the result of lower revenue and

lower gross margins due to pricing and product mix as well as

increased SAG expenses.

2007 Operating profit of $562 million increased $58 million from

2006. The increase is primarily the result of higher gross profit and

lower R,D&E, partially offset by an increase in bad debt expense.

1-percentage point benefit from currency, as well as the benefits

from our expansion in the SMB market through GIS and Veenman.

Revenue for 2008 reflects:

• 4% increase in post sale revenue, reflecting the full year

inclusion of GIS as well as growth from color multifunction

black-and-white digital devices. Office post sale revenue was

negatively impacted in the fourth quarter of 2008 by declines in

channel supply purchases, including lower purchases within

developing markets.

• 2% increase in equipment sales revenue, reflecting the full year

inclusion of GIS as well as growth from color digital products

which more than offset declines from black-and-white devices

primarily due to price declines and product mix.

• 24% color multifunction device install growth led by strong

and Phaser products.

• 8% increase in installs of black-and-white copiers and

multifunction devices, including 8% growth in Segment 1&2

products (11-30 ppm) and 8% growth in Segment 3-5 products

(31-90 ppm). Segment 3-5 installs include the Xerox 4595, a 95

ppm device with an embedded controller.

• 12% increase in color printer installs.

• 9% increase in post sale revenue, reflecting the inclusion of GIS

since May 2007 as well as growth from color multifunction

devices and color printers.

• 9% increase in equipment sales revenue, reflecting the inclusion

of GIS since May 2007 as well as color multifunction products

install growth.

• 65% color multifunction device install growth led by strong

demand for Xerox WorkCentre products.

• 5% increase in installs of black-and-white copiers and

multifunction devices, including 4% growth in Segment 1&2

products (11-30 ppm) and 7% growth in Segment 3-5 products

(31-90 ppm) that includes the 95 ppm device with an embedded

controller.

• 10% decline in color printer installs due to lower OEM sales.

34 Xerox 2008 Annual Report

Operating Profit

2008 Operating profit of $1,062 million decreased $53 million

from 2007. The decrease was primarily due to lower gross profits

reflecting lower margins as well as higher SAG expenses partially

offset by the full year inclusion of GIS.

2007 Operating profit of $1,115 million increased $105 million

from 2006. The increase was primarily due to the inclusion of GIS

since May 2007 and higher gross profits partially offset by higher

SAG expenses.

Other

Revenue

2008 Other revenue of $2,543 million increased 4% primarily

reflecting the full year inclusion of GIS and increased paper

revenue partially offset by lower revenue from wide format

systems. There was no impact from currency. Paper comprised

approximately 50% of Other segment revenue.

2007 Other revenue of $2,440 million increased 15%, including a

3-percentage point benefit from currency, primarily reflecting the

inclusion of GIS since May 2007 as well as increased paper and

value-added services revenues. Paper comprised approximately

50% of Other segment revenue.

Operating Loss

2008 Operating loss of $165 million increased $76 million from

2007 reflecting lower wide format revenue, higher foreign

exchange losses and lower interest income partially offset by gains

on sales of assets.

2007 Operating loss of $89 million decreased $35 million from

2006 reflecting higher revenue as well as lower currency exchange

losses and litigation charges, partially offset by higher interest

expense and lower gains on the sales of businesses and assets.

Costs, Expenses and Other Income

Gross Margin

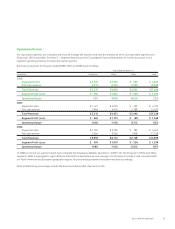

Gross margins by revenue classification were as follows:

Year Ended December 31,

2008 2007 2006

Sales 33.7% 35.9% 35.7%

Service, outsourcing and rentals 41.9% 42.7% 43.0%

Finance income 61.8% 61.6% 63.7%

Total Gross margin 38.9% 40.3% 40.6%

2008 Total gross margin decreased 1.4-percentage points

compared to 2007 as price declines and mix of approximately

2.0-percentage points were only partially offset by cost

productivity improvements. Cost improvements were limited by an

unfavorable impact on product costs of approximately

0.5-percentage points from the significant strengthening of the

Yen versus the U.S. Dollar and Euro. The negative impact of

0.3-percentage points from an Office product line equipment

write-off was offset by positive adjustments related to the

capitalized costs for equipment on operating leases and European

product disposal costs.

• Sales gross margin decreased 2.2-percentage points primarily

due to the approximately 2.5-percentage point impact of price

declines as well as channel and product mix. Cost improvements,

which historically tend to offset price declines, were limited in

2008 by the adverse impact of the strengthening Yen on our

inventory purchases.

• Service, outsourcing and rentals margin decreased

0.8-percentage points primarily due to mix as price declines of

1.3-percentage points were offset by cost improvements. Mix

reflects margin pressure from document management services.

• Financing income margin of approximately 62% remained

comparable to 2007.

Since a large portion of our inventory procurement is from Japan,

the strengthening of the Yen versus the U.S. Dollar and Euro in

2008 significantly impacted our product cost. The Yen

strengthened approximately 14% against the U.S. Dollar and 6%

against the Euro in 2008 as compared to 2007. A significant

portion of that strengthening occurred in the fourth quarter 2008

when the Yen strengthened 17% against the U.S. Dollar and 29%

against the Euro as compared to prior year. We expect product

costs and gross margins to continue to be negatively impacted in

2009 if Yen exchange rates remain at current levels.

2007 Total Gross margin was down slightly as compared to 2006

as cost improvements were offset by price and product mix.

• Sales gross margin increased 0.2-percentage points primarily as

cost improvements and other variances more than offset the

2.0-percentage point impact of price declines.

• Service, outsourcing and rentals margin decreased

0.3-percentage points as cost improvements and other variances

did not fully offset price declines and unfavorable product mix of

approximately 2.0-percentage points.

• Financing income margin declined 2.1-percentage points

reflecting additional interest expense due to higher interest

rates.

Xerox 2008 Annual Report 35