Xerox 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

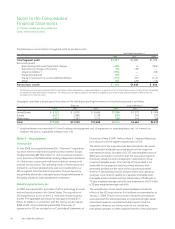

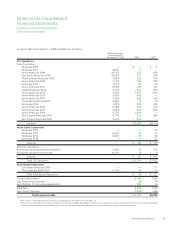

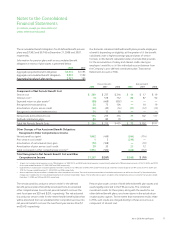

Long-term debt at December 31, 2008 and 2007 was as follows:

Weighted Average

Interest Rates at

December 31, 2008 2008 2007

U.S. Operations

Xerox Corporation

Notes due 2008 — $— $2

Notes due 2011 2.83% 1—

Senior Notes due 2009 10.75% 583 600

Euro Senior Notes due 2009 10.62% 317 330

Floating Senior Notes due 2009 2.60% 150 150

Senior Notes due 2010 7.13% 700 700

Notes due 2011 7.01% 50 50

Senior Notes due 2011 6.59% 750 750

Credit Facility due 2012 2.21% 246 600

Senior Notes due 2012 5.59% 1,100 1,100

Senior Notes due 2013 5.65% 400 —

Senior Notes due 2013 7.63% 550 550

Convertible Notes due 2014 9.00% 19 19

Notes due 2016 7.20% 250 250

Senior Notes due 2016 6.48% 700 700

Senior Notes due 2017 6.83% 500 500

Senior Notes due 2018 6.37% 1,000 —

Zero Coupon Notes due 2022 5.77% 433 409

Zero Coupon Notes due 2023 5.41% 253 —

Subtotal $ 8,002 $ 6,710

Xerox Credit Corporation

Notes due 2012 — —25

Notes due 2013 6.42% 10 60

Notes due 2014 6.06% 50 50

Notes due 2018 — —25

Subtotal $ 60 $ 160

Other U.S. Operations

Borrowings secured by finance receivables(1) 5.59% 56 275

Borrowings secured by other assets 10.34% 68

Subtotal $ 62 $ 283

Total U.S. Operations $ 8,124 $ 7,153

International Operations

Euro Bank Facility due 2008 — —177

Other debt due 2009-2010 4.12% 16 36

Total International Operations $ 16 $ 213

Principal debt balance 8,140 7,366

Less: Unamortized discount (6) (13)

Add: SFAS No. 133 fair value adjustments(2) 189 12

Total Debt 8,323 7,365

Less current maturities (1,549) (426)

Total Long-term debt $ 6,774 $6,939

(1) Refer to Note 4 – Receivables, Net for further discussion of borrowings secured by finance receivables, net.

(2) SFAS No. 133 fair value adjustments represent changes in the fair value of hedged debt obligations attributable to movements in benchmark interest rates. SFAS No. 133 requires hedged debt

instruments to be reported at an amount equal to the sum of their carrying value (principal value plus/minus premiums/discounts) and any fair value adjustment.

Xerox 2008 Annual Report 69