Xerox 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

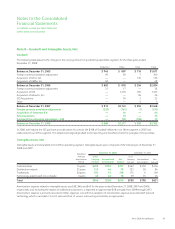

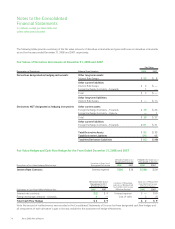

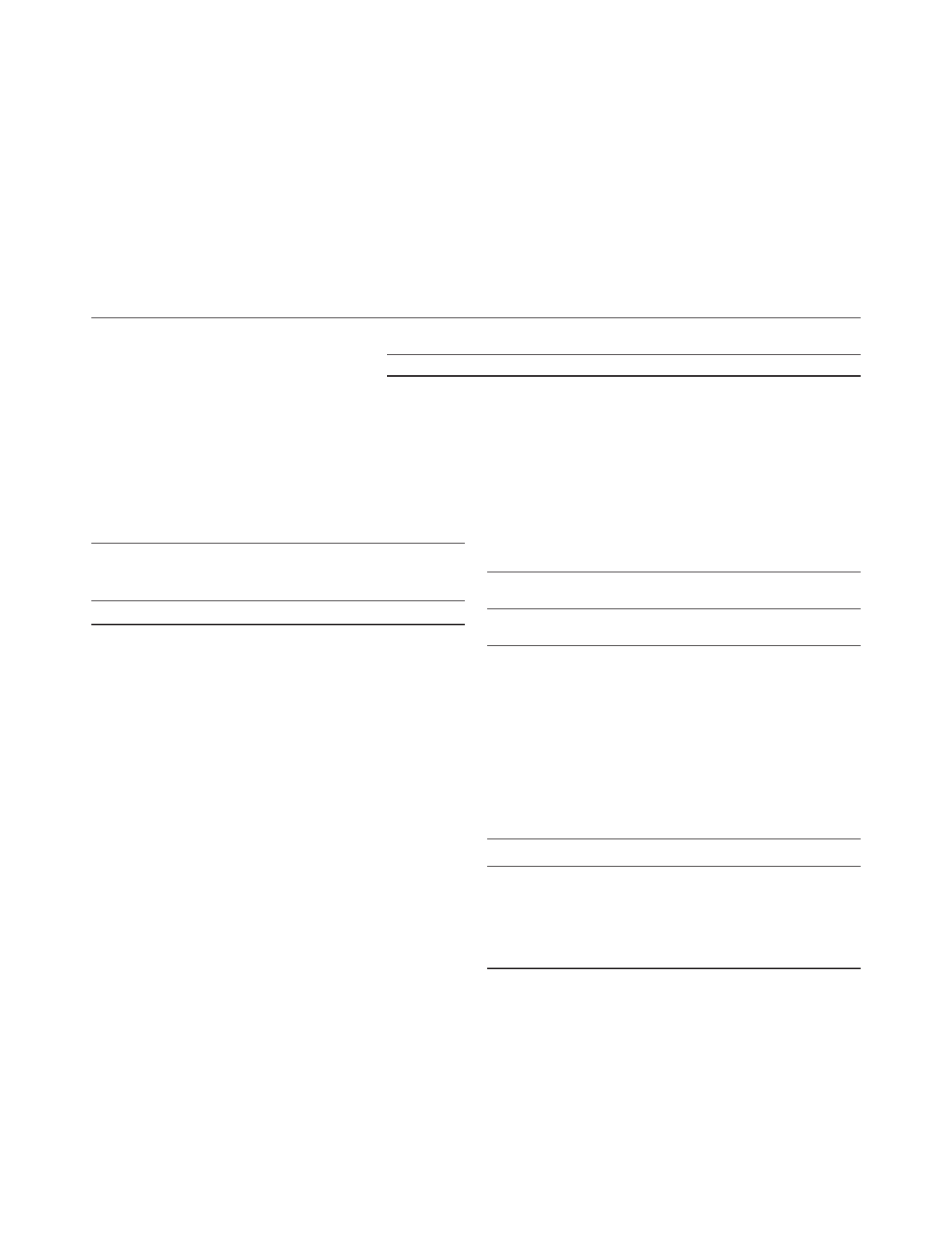

Non Designated Derivatives for the Years Ended December 31, 2008 and 2007

Derivatives Not designated as hedging instruments Location of Derivative Gain (Loss) 2008 2007

Foreign exchange contracts – forwards Other expense $(143) $(10)

Foreign exchange contracts – options Other expense (4) 3

Total Non Designated Derivatives $(147) $ (7)

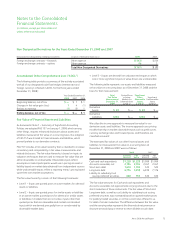

Accumulated Other Comprehensive Loss (“AOCL”)

The following table provides a summary of the activity associated

with all of our designated cash flow hedges (interest rate and

foreign currency) reflected in AOCL for the three years ended

December 31, 2008):

Year Ended December 31,

2008 2007 2006

Beginning balance, net of tax $— $ 1 $1

Changes in fair value gain (loss) 14 (1)

Reclass to earnings (1) (5) 1

Ending balance, net of tax $— $— $1

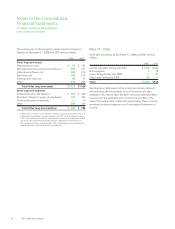

Fair Value of Financial Assets and Liabilities

As discussed in Note 1 – Summary of Significant Accounting

Policies, we adopted FAS 157 on January 1, 2008, which among

other things, requires enhanced disclosures about assets and

liabilities measured at fair value on a recurring basis. Our adoption

of FAS 157 was limited to financial assets and liabilities, which

primarily relate to our derivative contracts.

FAS 157 includes a fair value hierarchy that is intended to increase

consistency and comparability in fair value measurements and

related disclosures. The fair value hierarchy is based on inputs to

valuation techniques that are used to measure fair value that are

either observable or unobservable. Observable inputs reflect

assumptions market participants would use in pricing an asset or

liability based on market data obtained from independent sources

while unobservable inputs reflect a reporting entity’s pricing based

upon their own market assumptions.

The fair value hierarchy consists of the following three levels:

• Level 1 – Inputs are quoted prices in active markets for identical

assets or liabilities.

• Level 2 – Inputs are quoted prices for similar assets or liabilities

in an active market, quoted prices for identical or similar assets

or liabilities in markets that are not active, inputs other than

quoted prices that are observable and market-corroborated

inputs which are derived principally from or corroborated by

observable market data.

• Level 3 – Inputs are derived from valuation techniques in which

one or more significant inputs or value drivers are unobservable.

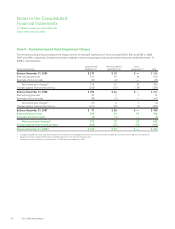

The following table represents our assets and liabilities measured

at fair value on a recurring basis as of December 31, 2008 and the

basis for that measurement:

Total

Fair Value

Measurement

December 31,

2008

Quoted Prices

in Active

Markets for

Identical Asset

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Derivative

Assets $ 92 $— $ 92 $—

Derivative

Liabilities $134 $— $134 $—

We utilize the income approach to measure fair value for our

derivative assets and liabilities. The income approach uses pricing

models that rely on market observable inputs such as yield curves,

currency exchange rates and forward prices, and therefore are

classified as Level 2.

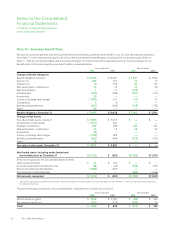

The estimated fair values of our other financial assets and

liabilities not measured at fair value on a recurring basis at

December 31, 2008 and 2007 were as follows:

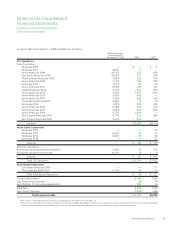

2008 2007

Carrying

Amount Fair

Value Carrying

Amount Fair

Value

Cash and cash equivalents $1,229 $1,229 $1,099 $1,099

Accounts receivable, net 2,184 2,184 2,457 2,457

Short-term debt 1,610 1,593 525 525

Long-term debt 6,774 5,918 6,939 7,176

Liability to subsidiary trust

issuing preferred securities 648 555 632 632

The fair value amounts for Cash and cash equivalents and

Accounts receivable, net approximate carrying amounts due to the

short maturities of these instruments. The fair value of Short and

Long-term debt, as well as our Liability to subsidiary trust issuing

preferred securities, was estimated based on quoted market prices

for publicly traded securities or on the current rates offered to us

for debt of similar maturities. The difference between the fair value

and the carrying value represents the theoretical net premium or

discount we would pay or receive to retire all debt at such date.

Xerox 2008 Annual Report 75