Xerox 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

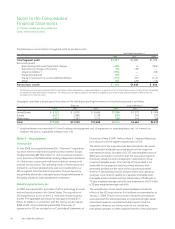

Benefit Plans Accounting

In 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for

Defined Benefit Pension and Other Postretirement Plans, an

amendment of FASB Statements No. 87, 88, 106 and 132(R)”

(“FAS 158”) which requires the recognition of an asset or liability

for the funded status of defined pension and other postretirement

benefit plans in the statement of financial position of the

sponsoring entity. The funded status of a benefit plan is measured

as the difference between plan assets at fair value and the benefit

obligation. The initial incremental recognition of the funded status

under FAS 158 of our defined pension and other post retirement

benefit plans, as well as subsequent changes in our funded status

that are not included in net periodic benefit cost will be reflected in

shareholders’ equity and other comprehensive loss, respectively. As

of December 31, 2006, the net unfunded status of our benefit

plans was $2,842 and recognition of this net unfunded status upon

the adoption of FAS 158 resulted in an after-tax charge to equity

of $1,024. Prior to the adoption of FAS 158, we recorded an

after-tax credit to our minimum pension liability of $131, for a

total equity charge in 2006 related to the funded status of our

benefit plans of $893. Amounts recognized in accumulated other

comprehensive loss are adjusted as they are subsequently

recognized as a component of net periodic benefit cost. The

method of calculating net periodic benefit cost did not change

from existing guidance. Refer to Note 14 – Employee Benefit Plans

for additional information.

The funded status recognition and certain disclosure provisions of

FAS 158 were effective as of our fiscal year ending December 31,

2006. FAS 158 also requires the consistent measurement of plan

assets and benefit obligations as of the date of our fiscal year-end

statement of financial position effective for the year ending

December 31, 2008. Since several of our international plans had a

September 30th measurement date, this standard required us to

change that measurement date to December 31st in 2008. The

adoption of this requirement by our international plans did not

have a material effect on our financial condition or results of

operations. The effect of adoption by our international plans

resulted in a January 1, 2008 opening retained earnings charge of

$16, deferred tax asset increase of $4, pension asset reduction of

$9, a pension liability increase of $6 and a credit to accumulated

other comprehensive loss of $5.

FAS 158 was not effective for our equity investment in Fuji Xerox

(“FX”) until their annual year-end of March 31, 2007. Upon FX’s

adoption of FAS 158, we recorded a $5 charge to equity

representing our share of their after-tax charge to equity for the

unfunded status of their benefit plans. We also recorded a $44

after-tax charge to equity for our portion of a minimum pension

liability adjustment recorded by FX prior to their adoption of FAS

158 for a total equity charge in 2007 related to the funded status

of FX’s benefit plans of $49.

Other Accounting Changes

In December 2008, the FASB issued Staff Position No. FAS 140-4

and FIN 46(R)-8, “Disclosures by Public Entities (Enterprises) about

Transfers of Financial Assets and Interests in Variable Interest

Entities” (“FSP FAS 140-4 and FIN 46(R)-8”). This FSP required

additional disclosures about transfers of financial assets and about

an entity’s involvement with variable interest entities. The FSP is

effective for our fiscal year ended December 31, 2008. Adoption of

this FSP affects disclosures only and therefore has no impact on

the Company’s financial condition, results of operations or cash

flows. Since our transfers of financial assets and involvement with

variable interest entities are not material, we do not expect a

material disclosure requirement from this standard.

In April 2008, the FASB issued Staff Position No. FAS 142-3,

“Determination of Useful Life of Intangible Assets” (“FSP FAS

142-3”). FSP FAS 142-3 amends the factors that should be

considered in developing renewal or extension assumptions used to

determine the useful life of a recognized intangible asset under FAS

142, “Goodwill and Other Intangible Assets.” FSP FAS 142-3 also

requires expanded disclosures related to the determination of

intangible asset useful lives. This standard applies prospectively to

intangible assets acquired and/or recognized on or after January 1,

2009. We do not believe that the adoption of this standard will have

a material effect on our financial condition or results of operations.

In 2007, the FASB’s Emerging Issues Task Force issued EITF Issue

No. 06-10, “Accounting for Deferred Compensation and

Postretirement Benefit Aspects of Collateral Assignment Split-

Dollar Life Insurance Arrangements” (“EITF 06-10”). EITF 06-10

provides that an employer should recognize a liability for the

postretirement benefit related to collateral assignment split-dollar

life insurance arrangements in accordance with either SFAS

No. 106, “Employers’ Accounting for Postretirement Benefits Other

Than Pensions,” or Accounting Principles Board Opinion No. 12,

“Omnibus Opinion.” We recorded a $11 after-tax charge to

retained earnings in 2008 reflecting the cumulative effect upon

adoption of EITF 06-10. The standard is not expected to have a

material impact on results of operations in the future.

In 2006, the FASB ratified the consensus reached on EITF Issue

No. 06-2, “Accounting for Sabbatical Leave and Other Similar

Benefits Pursuant to FASB Statement No. 43” (“EITF 06-2”). EITF

06-2 clarifies recognition guidance on the accrual of employees’

rights to compensated absences under a sabbatical or other similar

benefit arrangement. We recorded a $7 after-tax charge to

Retained earnings in 2007 reflecting our share of the cumulative

effect recorded by Fuji Xerox upon adoption of EITF 06-2. This was

Xerox 2008 Annual Report 53