Xerox 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

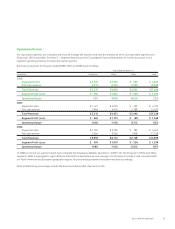

Management’s Discussion

2008 total gross margin of 38.9% was 1.4-percentage points

below the prior year. Pricing, product mix and unfavorable

exchange rates on our Yen based inventory purchases were only

partially offset by cost productivity improvements. Selling,

administrative and general (“SAG”) expenses as a percent of

revenue were 25.7 percent or 0.7-percentage points higher than

the prior year. SAG expenses increased due to the full year inclusion

of GIS, higher bad debt provisions and increased marketing

investments partially offset by restructuring savings. Additionally,

we continued to invest in research and development and to

prioritize our investments in the faster growing areas of the market.

Research, development and engineering (“RD&E”) expenses were

5% of revenue in 2008, which is consistent with the prior year. Our

investments in the growing areas of digital production and office

systems, particularly with respect to color products, contributed to

more than two-thirds of our equipment sales being generated from

products launched in the last two years.

Changes in our revenue mix – both from geographic and product

line perspectives – have reduced our gross profit margins. This,

combined with uncertain economic conditions, required us to take

actions to adjust our cost and expense profile. Accordingly, we

recognized pre-tax restructuring charges of $429 million for 2008

actions in order to reduce our cost base and provide increased

flexibility in our business in this depressed or recessionary

economy. Refer to Note 9 – Restructuring and Asset Impairment

Charges in the Consolidated Financial Statements for further

information.

Our balance sheet strategy focused on optimizing operating cash

flows and returning value to shareholders through acquisitions,

share repurchase and dividends. We continue to maintain debt

levels primarily to support our customer financing operations. Cash

flow from operations was $939 million in 2008 and included $615

million of net securities-related litigation payments as we resolved

two long standing securities litigation cases. Cash used for

investments was $441 million and included capital expenditures of

$335 million and acquisitions of $155 million. Cash used for

financing of $311 million reflected continued net repayments of

secured borrowings of $227 million; $812 million for share

repurchases; and $154 million for dividends, partially offset by net

cash flows from new borrowings of $926 million. New borrowings

included $1.4 billion of Senior Notes in an April 2008 public

offering. We finished the year with cash and cash equivalents of

$1.2 billion.

Our prospective balance sheet strategy includes: optimizing

operating cash flows; maintaining our investment grade credit

ratings; achieving an optimal cost of capital; and effectively

deploying cash to deliver and maximize long-term shareholder

value through acquisitions, share repurchase and dividends.

However, due to the current economic uncertainty, we have no

immediate plans for further share repurchases at this time. Our

strategy also includes appropriately leveraging our financing assets

(finance receivables and equipment on operating leases).

Currency Impacts

To understand the trends in our business, we believe that it is

helpful to analyze the impact of changes in the translation of

foreign currencies into U.S. Dollars on revenues and expenses. We

refer to this analysis as “currency impact” or “the impact from

currency”. Revenues and expenses from our developing markets are

analyzed at actual exchange rates for all periods presented, since

these countries generally have volatile currency and inflationary

environments, and our operations in these countries have

historically implemented pricing actions to recover the impact of

inflation and devaluation. We do not hedge the translation effect

of revenues or expenses denominated in currencies where the local

currency is the functional currency.

Approximately 50% of our consolidated revenues are derived from

operations outside of the United States where the U.S. Dollar is not

the functional currency. When compared with the average of the

major European currencies and Canadian Dollar on a revenue-

weighted basis, the U.S. Dollar was 3% weaker in 2008 and 9%

weaker in 2007, each compared to the prior year. As a result, the

foreign currency translation impact on revenue was a 1% benefit

in 2008 and a 3% benefit in 2007.

Currency exchange rates fluctuated significantly in the fourth

quarter 2008. The U.S. Dollar strengthened significantly in the

fourth quarter 2008 as compared to the currencies of our major

foreign operations – the Euro, Pound Sterling and Canadian Dollar.

The foreign currency translation impact on revenue from this

fluctuation in exchange rates was a 3% point benefit through the

third quarter 2008 as compared to a 5% detriment in the fourth

quarter 2008. If U.S. Dollar exchange rates against these major

currencies remain at their current levels we expect it will have an

estimated 5% to 6% negative impact on total revenue in the first

half of 2009.

26 Xerox 2008 Annual Report

• 4% increase in post sale revenue, or 2% including GIS in our

• 2% decrease in equipment sales revenue. There was no impact

• 5% growth in color revenue.

• 9% increase in post sale revenue, or 6% including GIS in our

• 7% increase in equipment sales revenue, or a decrease of 1%