Xerox 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

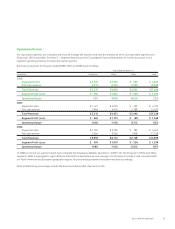

Management’s Discussion

• $45 million decrease due to lower benefit accruals, partially

offset by higher accounts payable due to the timing of

payments to vendors and suppliers.

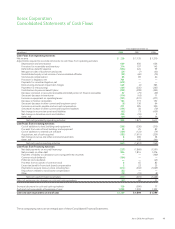

Cash Flows from Investing Activities

Net cash used in investing activities was $441 million for the year

ended December 31, 2008. The $1,171 million increase in cash was

primarily due to the following:

• $1,460 million increase due to less cash used for acquisitions.

2008 acquisitions included $138 million for Veenman B.V. and

Saxon Business Systems as compared to $1,568 million for GIS

and its additional acquisitions in the prior year.

• $192 million decrease due to lower funds from escrow and other

restricted investments in 2008. The prior year reflected funds

received from the run-off of our secured borrowing programs.

• $134 million decrease in other investing cash flows due to the

absence of proceeds from liquidations of short-term

investments.

Net cash used in investing activities was $1,612 million for the year

ended December 31, 2007. The $1,469 million decrease in cash

was primarily due to the following:

• $1,386 million decrease due to $1,615 million in 2007

acquisitions primarily comprised of $1,568 for GIS and its

additional acquisitions and $30 million for Advectis, Inc., as

compared to $229 million in acquisitions in 2006 comprised of

Amici, LLC and XMPie, Inc.

• $123 million decrease in other investing cash flows reflecting the

absence of the 2006 $122 million distribution related to the sale

of investments held by Ridge Re.

• $65 million decrease due to higher capital and internal use

software investments in 2007.

• $57 million decrease due to higher 2006 proceeds from sales of

land, buildings and equipment, which included the sale of our

corporate headquarters and a parcel of vacant land.

• $162 million increase due to a reduction in escrow and other

restricted investments in 2007, as we continue to run-off our

secured borrowing programs.

Cash Flows from Financing Activities

Net cash used in financing activities was $311 million for the year

ended December 31, 2008. The $308 million increase in cash was

primarily due to the following:

• $1,642 million increase from lower net repayments on secured

debt. 2007 reflects termination of our secured financing

programs with GE in the United Kingdom and Canada of $634

million and Merrill Lynch in France for $469 million as well as the

repayment of secured borrowings to DLL of $153 million. The

remainder reflects lower payments associated with our GE U.S.

secured borrowings.

• $888 million decrease from lower net cash proceeds from

unsecured debt. 2008 reflects the issuance of $1.4 billion in

Senior Notes, $250 million from a private placement borrowing

and net payments of $354 million on the Credit Facility and

$370 million on other debt. 2007 reflects the issuance of $1.1

billion Senior Notes, $400 million from private placement

borrowings and net proceeds of $600 million on the Credit

Facility, offset by net payments of $286 million on other debt.

• $180 million decrease due to additional purchases under our

share repurchase program.

• $154 million decrease due to common stock dividend payments.

• $79 million decrease due to lower proceeds from the issuance of

common stock, reflecting a decrease in stock option exercises as

well as lower related tax benefits.

• $33 million decrease due to share repurchases related to

employee withholding taxes on stock-based compensation

vesting.

Net cash used in financing activities was $619 million in year

ended December 31, 2007. The $809 million increase in cash was

primarily due to the following:

• $538 million increase due to higher net cash proceeds from

unsecured debt. This reflects the May 2007 issuance of the $1.1

billion Senior Notes, the issuances of two zero coupon bonds in

2007 resulting in net proceeds of approximately $400 million,

and the net drawdown of $600 million under the 2007 Credit

Facility. These higher net proceeds were partially offset by the

March 2006 issuance of the $700 million Senior Notes and the

August 2006 issuance of an additional $650 million of Senior

Notes, as well as, higher repayments on other unsecured debt in

2007 as compared to 2006.

• $437 million increase due to lower purchases under our share

repurchase program as cash was invested in acquisitions.

• $100 million increase relating to the 2006 payment of our

liability to Xerox Capital LLC in connection with their redemption

of Canadian deferred preferred shares.

• $278 million decrease due to higher net repayments of secured

financing. Refer to Note 4-Receivables, net in the consolidated

financial statements for further information.

40 Xerox 2008 Annual Report

• As of December 31, 2008, total cash and cash equivalents was

• We have consistently delivered strong cash flow from operations