Xerox 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

and can be reasonably estimated. We assess our potential liability

by analyzing our litigation and regulatory matters using available

information. We develop our views on estimated losses in

consultation with outside counsel handling our defense in these

matters, which involves an analysis of potential results, assuming a

combination of litigation and settlement strategies. Should

developments in any of these matters cause a change in our

determination as to an unfavorable outcome and result in the

need to recognize a material accrual, or should any of these

matters result in a final adverse judgment or be settled for

significant amounts, they could have a material adverse effect on

our results of operations, cash flows and financial position in the

period or periods in which such change in determination, judgment

or settlement occurs.

Business Combinations and Goodwill

The application of the purchase method of accounting for business

combinations requires the use of significant estimates and

assumptions in the determination of the fair value of assets

acquired and liabilities assumed in order to properly allocate

purchase price consideration between assets that are depreciated

and amortized from goodwill. Our estimates of the fair values of

assets and liabilities acquired are based upon assumptions believed

to be reasonable, and when appropriate, include assistance from

independent third-party appraisal firms.

As a result of our acquisition of GIS, as well as other prior year

acquisitions, we have a significant amount of goodwill. Goodwill is

tested for impairment annually or more frequently if an event or

circumstance indicates that an impairment loss may have been

incurred. Application of the goodwill impairment test requires

judgment, including the identification of reporting units,

assignment of assets and liabilities to reporting units, assignment

of goodwill to reporting units and determination of the fair value

of each reporting unit. We estimate the fair value of each reporting

unit using a discounted cash flow methodology. This requires us to

use significant judgment including estimation of future cash flows,

which is dependent on internal forecasts, estimation of the long-

term rate of growth for our business, the useful life over which cash

flows will occur, determination of our weighted average cost of

capital for purposes of establishing a discount rate and relevant

market data.

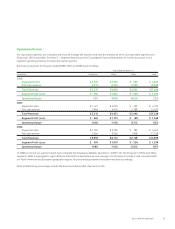

Our annual impairment test of goodwill is performed in the fourth

quarter. The estimated fair values of the Company’s reporting

units were based on discounted cash flow models derived from

internal earnings forecasts and assumptions. The assumptions and

estimates used in those valuations incorporated the expected

impact of the challenging economic environment that has

persisted over the past year. In performing our 2008 impairment

test, the following were the overall composite long-term

assumptions regarding revenue and expense growth, which were

the basis for estimating future cash flows used in the discounted

cash flow model: 1) revenue growth 3%; 2) gross margin 39-40%;

3) RD&E 4-5%; 4) SAG 24-25%; and 5) return on sales 8-9%. We

believe these estimated assumptions are appropriate for our

circumstances, in-line with historical results and consistent with our

forecasted long-term business model. These assumptions also have

considered the current economic environment.

Based on those valuations, we determined that the fair values of

our reporting units exceeded their carrying values and no goodwill

impairment charge was required during the fourth quarter. In light

of the continued difficult economic conditions and the fact that

the Company’s stock has been generally trading below net book

value per share over the past quarter, we reassessed our

assumptions as of December 31, 2008. We do not believe the

recent general downturn in the U.S. equity markets is

representative of any fundamental change in our business. Based

on current results and expectations, we determined that the fair

values of our reporting units continue to exceed their carrying

values and determined that no goodwill impairment charge was

required as of December 31, 2008.

Refer to Note 1 – Summary of Significant Accounting Policies –

“Goodwill and Intangible Assets” for further information regarding

our goodwill impairment testing, as well as Note 8 – Goodwill and

Intangible Assets, Net in the Consolidated Financial Statements for

further information regarding goodwill by operating segment.

32 Xerox 2008 Annual Report