Xerox 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

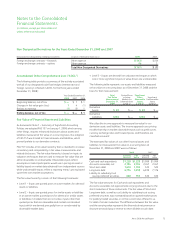

Audit Resolution

In 2006, we recognized an income tax benefits of $472 from the

favorable resolution of certain tax issues associated with the

finalization of our 1999-2003 Internal Revenue Service (“IRS”)

audit as well as an income tax benefits of $46 related to the

favorable resolution of certain tax matters associated with the

finalization of foreign tax audits. The recorded benefits did not

result in a significant cash refund, but it did increase tax credit

carryforwards and reduced taxes otherwise potentially due.

Deferred Income Taxes

In substantially all instances, deferred income taxes have not been

provided on the undistributed earnings of foreign subsidiaries and

other foreign investments carried at equity. The amount of such

earnings included in consolidated retained earnings at

December 31, 2008 was approximately $7.5 billion. These earnings

have been indefinitely reinvested and we currently do not plan to

initiate any action that would precipitate the payment of income

taxes thereon. It is not practicable to estimate the amount of

additional tax that might be payable on the foreign earnings. Our

2001 sale of half of our ownership interest in Fuji Xerox resulted in

our investment no longer qualifying as a foreign corporate joint

venture. Accordingly, deferred taxes are required to be provided on

the undistributed earnings of Fuji Xerox, arising subsequent to such

date, as we no longer have the ability to ensure indefinite

reinvestment.

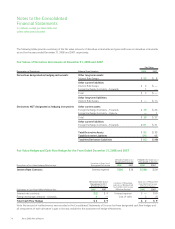

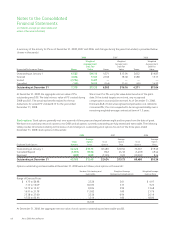

The tax effects of temporary differences that give rise to

significant portions of the deferred taxes at December 31, 2008

and 2007 were as follows:

2008 2007

Tax effect of future tax deductions

Research and development $ 930 $ 895

Post-retirement medical benefits 392 577

Depreciation 249 292

Net operating losses 486 576

Other operating reserves 249 216

Tax credit carryforwards 552 434

Deferred compensation 248 249

Allowance for doubtful accounts 84 100

Restructuring reserves 88 15

Pension 373 58

Other 182 181

3,833 3,593

Valuation allowance (628) (747)

Total $ 3,205 $ 2,846

Tax effect of future taxable income

Unearned income and installment

sales $(1,119) $(1,283)

Intangibles and goodwill (160) (142)

Other (53) (40)

Total (1,332) (1,465)

Total deferred taxes, net $ 1,873 $ 1,381

The above amounts are classified as current or long-term in the

Consolidated Balance Sheets in accordance with the asset or

liability to which they relate or, when applicable, based on the

expected timing of the reversal. Current deferred tax assets at

December 31, 2008 and 2007 amounted to $305 and $200,

respectively.

The deferred tax assets for the respective periods were assessed for

recoverability and, where applicable, a valuation allowance was

recorded to reduce the total deferred tax asset to an amount that

will, more-likely-than-not, be realized in the future. The net change

in the total valuation allowance for the years ended December 31,

2008 and 2007 was a decrease of $119 and an increase of $100,

respectively. The valuation allowance relates primarily to certain

net operating loss carryforwards, tax credit carryforwards and

deductible temporary differences for which we have concluded it is

more-likely-than-not that these items will not be realized in the

ordinary course of operations.

Xerox 2008 Annual Report 81