Xerox 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•

•

•

•

•

•

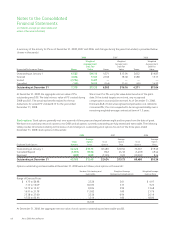

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

Litigation Against the Company

In re Xerox Corporation Securities Litigation: A consolidated

securities law action (consisting of 17 cases) is pending in the

United States District Court for the District of Connecticut.

Defendants are the Company, Barry Romeril, Paul Allaire and G.

Richard Thoman. The consolidated action is a class action on

behalf of all persons and entities who purchased Xerox Corporation

common stock during the period October 22, 1998 through

October 7, 1999 inclusive (“Class Period”) and who suffered a loss

as a result of misrepresentations or omissions by Defendants as

alleged by Plaintiffs (the “Class”). The Class alleges that in violation

of Section 10(b) and/or 20(a) of the Securities Exchange Act of

1934, as amended (“1934 Act”), and SEC Rule 10b-5 thereunder,

each of the defendants is liable as a participant in a fraudulent

scheme and course of business that operated as a fraud or deceit

on purchasers of the Company’s common stock during the Class

Period by disseminating materially false and misleading

statements and/or concealing material facts relating to the

defendants’ alleged failure to disclose the material negative

impact that the April 1998 restructuring had on the Company’s

operations and revenues. The complaint further alleges that the

alleged scheme: (i) deceived the investing public regarding the

economic capabilities, sales proficiencies, growth, operations and

the intrinsic value of the Company’s common stock; (ii) allowed

several corporate insiders, such as the named individual

defendants, to sell shares of privately held common stock of the

Company while in possession of materially adverse, non-public

information; and (iii) caused the individual plaintiffs and the other

members of the purported class to purchase common stock of the

Company at inflated prices. The complaint seeks unspecified

compensatory damages in favor of the plaintiffs and the other

members of the purported class against all defendants, jointly and

severally, for all damages sustained as a result of defendants’

alleged wrongdoing, including interest thereon, together with

reasonable costs and expenses incurred in the action, including

counsel fees and expert fees. In 2001, the Court denied the

defendants’ motion for dismissal of the complaint. The plaintiffs’

motion for class certification was denied by the Court in 2006,

without prejudice to refiling. In February 2007, the Court granted

the motion of the International Brotherhood of Electrical Workers

Welfare Fund of Local Union No. 164, Robert W. Roten, Robert

Agius (“Agius”) and Georgia Stanley to appoint them as additional

lead plaintiffs. In July 2007, the Court denied plaintiffs’ renewed

motion for class certification, without prejudice to renewal after

the Court holds a pre-filing conference to identify factual disputes

the Court will be required to resolve in ruling on the motion. After

that conference and Agius’s withdrawal as lead plaintiff and

proposed class representative, in February 2008 plaintiffs filed a

second renewed motion for class certification. In April 2008,

Defendants filed their response and motion to disqualify Milberg

LLP as a lead counsel. On September 30, 2008, the Court entered

an order certifying the class and denying the appointment of

Milberg LLP as a lead counsel. The parties have filed motions to

exclude certain expert testimony. Briefing with respect to those

motions is complete. The Court has not yet rendered a decision. On

November 6, 2008, the defendants filed a motion for summary

judgment, which has not yet been fully briefed. The individual

defendants and we deny any wrongdoing and are vigorously

defending the action. In the course of litigation, we periodically

engage in discussions with plaintiffs’ counsel for possible

resolution of this matter. Should developments cause a change in

our determination as to an unfavorable outcome, or result in a final

adverse judgment or a settlement for a significant amount, there

could be a material adverse effect on our results of operations,

cash flows and financial position in the period in which such

change in determination, judgment or settlement occurs.

Carlson v. Xerox Corporation, et al.: A consolidated securities law

action (consisting of 21 cases) was pending in the United States

District Court for the District of Connecticut against the Company,

KPMG and Paul A. Allaire, G. Richard Thoman, Anne M. Mulcahy,

Barry D. Romeril, Gregory Tayler and Philip Fishbach. Plaintiffs

purported to bring this case as a class action on behalf of a class

consisting of all persons and/or entities who purchased Xerox

common stock and/or bonds during the period between

February 17, 1998 through June 28, 2002 and who were

purportedly damaged thereby (“Class”). Two claims were asserted:

one alleging that each of the Company, KPMG, and the individual

defendants violated Section 10(b) of the 1934 Act and SEC Rule

10b-5 thereunder; and the other alleging that the individual

defendants are also liable as “controlling persons” of the Company

pursuant to Section 20(a) of the 1934 Act. Plaintiffs claimed that

the defendants participated in a fraudulent scheme that operated

as a fraud and deceit on purchasers of the Company’s common

stock and bonds by disseminating materially false and misleading

statements and/or concealing material adverse facts relating to

various of the Company’s accounting and reporting practices and

financial condition. The plaintiffs further alleged that this scheme

deceived the investing public regarding the true state of the

Company’s financial condition and caused the plaintiffs and other

members of the purported Class to purchase the Company’s

common stock and bonds at artificially inflated prices. On

March 27, 2008, the Court granted preliminary approval of an

agreement to settle this case, pursuant to which the Company

agreed to make cash payments totaling $670 and KPMG agreed to

make cash payments totaling $80. The individual defendants and

the Company did not admit any wrongdoing as a part of the

settlement. On January 15, 2009, the Court entered an order and

final judgment approving the settlement, awarding attorneys’ fees

and expenses, and dismissing the action with prejudice. The

Company’s portion of the settlement amount has been paid. On

Xerox 2008 Annual Report 83