Xerox 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7Xerox 2008 Annual Report

Our distribution and services capacity is also the best and

broadest in our industry. Through our vast and growing

network of direct sales, agents, resellers, Global Imaging

partners and distributors, we do business in over 160 countries.

This is a huge competitive advantage, as customers depend

on us for global account management and increasingly

want to move documents around the world with speed, ease

and security.

Our strategic bets in the marketplace are paying off in

areas like color and document services. Color pages now

represent 18 percent of total pages printed on Xerox

technology, up from 12 percent in 2007. We lead the industry

in the number of color pages printed. In services, we generated

$3.5 billion in annuity revenue last year, a year-over-year

increase of 3 percent.

Our recurring revenue stream represents more than 70

percent of our total revenue. That gives us some cushion

in challenging economic times and helps fuel the $1.7 billion

in cash that we expect to generate this year from core

operations.

Our leadership team is battle-tested and results-driven.

They are an unusual mix of Xerox veterans, new leaders who

have recently emerged from the ranks and people who joined

us from other leading companies. They are all driven by one

goal – the success of Xerox measured by the value we deliver

to our shareholders.

Last but hardly least is the quality and dedication of our

workforce. Together with our technology and our distribution,

they provide the knowledge and the passion to bring value to

our customers. When I visit customers, it’s our people they

want to talk about. Customers sing the praises of Xerox people

and want to talk about their focus on solving problems, their

can-do attitude, and their desire to do whatever it takes to get

the job done. At the end of the day, Xerox people spell the

difference between failure and success.

So we are feeling good about where we are. There is a fair

amount of disruption in our industry – some of it brought on

by the economy but much of it brought on by Xerox. Over the

past few years, we have upped the ante considerably on the

technology we have brought to market. We have both built

and acquired new document services offerings. And we have

expanded our distribution.

We are proud of but not content with the competitive

advantage we have created in our industry. We know it’s a

never-ending battle but it’s one we’re eager to wage. We feel

the same way about corporate responsibility. Even in the worst

of times, we continue to make appropriate investments in

the communities in which we work and live. We continue to

be a leader in diversity in all its forms. We continue to fight

for a sustainable world and a greener planet.

We don’t have our heads in the sand about the challenges

we face, yet we believe we are better positioned than most

to meet the obstacles that 2009 will certainly bring our way.

There are likely to be winners and losers when the dust finally

settles. We feel confident we will be a winner.

Anne M. Mulcahy

Chairman and Chief Executive Officer

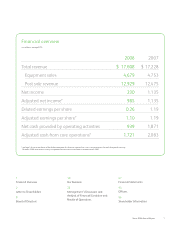

Adjusted Net Income/EPS Full-year 2008

(in millions, except per share amounts) Net Income EPS

Net Income – As Reported $ 230 0.26

Adjustments:

Q4 2008 Restructuring and asset impairment charges 240 0.27

Q4 2008 Equipment write-off 24 0.03

Q1 2008 Provision for litigation matters 491 0.54

Net Income – As Adjusted $ 985 1.10

Adjusted Net Cash from Operating Activities/

Cash from Core Operations

(in millions) Full-year 2008 Full-year 2007

Operating Cash – As Reported $ 939 $ 1,871

Payments for securities litigation 615 —

Operating Cash – As Adjusted $ 1,554 $ 1,871

Increase (decrease) in finance receivables (164) (119)

Increase in equipment on operating leases 331 331

Cash from Core Operations – As Adjusted $ 1,721 $ 2,083

Adjusted Free Cash Flow/Free Cash Flow Per Share

(in millions, except per-share data, shares in thousands) Full-year 2008

Operating Cash Flow – As Reported $ 939

Payments for securities litigation, net 615

Capital expenditures (206)

Internal-use software (129)

Adjusted Free Cash Flow (FCF) $ 1,219

Adjusted Weighted Average Shares Outstanding 895,542

Adjusted Free Cash Flow Per Share $ 1.36

Note: Color results exclude Global Imaging Systems performance.

Non-GAAP Reconciliation