Xerox 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

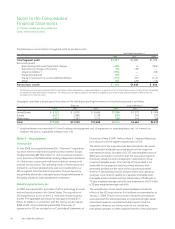

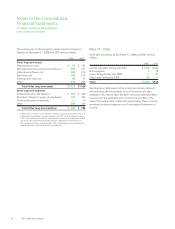

The following is a reconciliation of segment profit to pre-tax income:

Year Ended December 31,

2008 2007 2006

Total Segment profit $1,291 $1,588 $1,390

Reconciling items:

Restructuring and asset impairment charges (429) 6 (385)

Restructuring charges of Fuji Xerox (16) (30) —

Litigation matters(1) (774) — (68)

Equipment write-off (39) ——

Equity in net income of unconsolidated affiliates (113) (97) (114)

Other (34) (29) (15)

Pre-tax (loss) income $ (114) $1,438 $ 808

(1) The 2008 provision for litigation represents $670 for the Carlson v. Xerox Corporation court approved settlement, as well as provisions for other litigation matters including $36 for the probable

loss related to the Brazil labor related contingencies. The 2006 provision for litigation represents $68 related to probable losses on Brazilian labor-related contingencies. Refer to Note 16 –

Contingencies for further discussion.

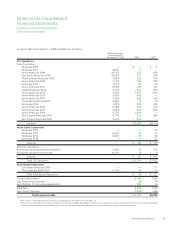

Geographic area data is based upon the location of the subsidiary reporting the revenue or long-lived assets and is as follows:

Revenues Long-Lived Assets(1)

2008 2007 2006 2008 2007 2006

United States $ 9,122 $ 9,078 $ 8,406 $1,386 $1,375 $1,309

Europe 6,011 5,888 5,378 680 746 572

Other Areas 2,475 2,262 2,111 248 341 356

Total $17,608 $17,228 $15,895 $2,314 $2,462 $2,237

(1) Long-lived assets are comprised of (i) land, buildings and equipment, net, (ii) equipment on operating leases, net, (iii) internal use

software, net and (iv) capitalized software costs, net.

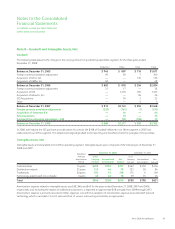

Note 3 – Acquisitions

Veenman B.V.

In June 2008, we acquired Veenman B.V. (“Veenman”), expanding

our reach into the small and mid-sized business market in Europe,

for approximately $69 (€44 million) in cash, including transaction

costs. Veenman is the Netherlands’ leading independent distributor

of office printers, copiers and multifunction devices serving small

and mid-size businesses. The operating results of Veenman are not

material to our financial statements, and are included within our

Office segment from the date of acquisition. The purchase price

was primarily allocated to intangible assets and goodwill based on

third-party valuations and management’s estimates.

Global Imaging Systems, Inc.

In 2007, we acquired GIS, a provider of office technology for small

and mid-size businesses in the United States. The acquisition of

GIS expanded our access to the U.S. small and mid-size business

market. The aggregate purchase price was approximately $1.5

billion. In addition, in connection with the closing, we also repaid

$200 of GIS’s then outstanding bank debt. The results of

operations for GIS are included in our Consolidated Statements of

Income as of May 9, 2007. Refer to Note 2 – Segment Reporting

for a discussion of the segment classification of GIS.

The total cost of the acquisition has been allocated to the assets

acquired and the liabilities assumed based on their respective

estimated fair values. Goodwill of $1,335 and intangible assets of

$363 were recorded in connection with the acquisition based on

third-party valuations and management’s estimates for those

acquired intangible assets. The majority of the goodwill is not

deductible for tax purposes and the primary elements that

generated goodwill are the value of the acquired assembled

workforce, specialized processes and procedures and operating

synergies, none of which qualify as a separate intangible asset.

Intangible assets included customer relationships of $189 with a

12 year weighted average useful life and tradenames of $174 with

a 20 year weighted average useful life.

The unaudited pro forma results presented below include the

effects of the GIS acquisition as if it had been consummated as of

January 1, 2006. The pro forma results include the amortization

associated with the estimated value of acquired intangible assets

and interest expense associated with debt used to fund the

acquisition. However, pro forma results do not include any

anticipated synergies or other expected benefits of the acquisition.

60 Xerox 2008 Annual Report