Xerox 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

the life of the portfolio. We consider all available information in our

quarterly assessments of the adequacy of the provision for

doubtful accounts.

The current economic environment has increased the risk of

non-collection of receivables. We have accordingly considered this

increased risk in the evaluation and assessment of our allowance

for doubtful accounts at year-end. Collection risk is somewhat

mitigated by the fact that our receivables are fairly well dispersed

among a diverse customer base both in size and geography. Days

sales outstanding remained fairly flat year-over-year. In addition,

the aging of receivables has not increased significantly. Accounts

receivable balances greater than 60 days outstanding were 17%

of total gross accounts receivables at December 31, 2008 as

compared to 15% at December 31, 2007. However, we continue to

assess our receivable portfolio in light of the current economic

environment and its impact on our estimation of the adequacy of

the allowance for doubtful accounts.

As discussed above, in preparing our Consolidated Financial

Statements for the three year period ended December 31, 2008,

we estimated our provision for doubtful accounts based on

historical experience and customer-specific collection issues. This

methodology has been consistently applied for all periods

presented. During the five year period ended December 31, 2008,

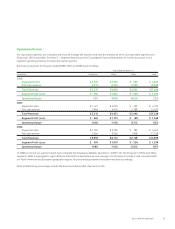

our reserve for doubtful accounts ranged from 3.0% to 4.2% of

gross receivables. Holding all other assumptions constant, a

1-percentage point increase or decrease in the reserve from the

December 31, 2008 rate of 3.4% would change the 2008 provision

by approximately $98 million.

Pension and Post-Retirement Benefit Plan Assumptions

We sponsor defined benefit pension plans in various forms in

several countries covering substantially all employees who meet

eligibility requirements. Post-retirement benefit plans cover

primarily U.S. employees for retirement medical costs. Several

statistical and other factors that attempt to anticipate future

events are used in calculating the expense, liability and asset

values related to our pension and post-retirement benefit plans.

These factors include assumptions we make about the discount

rate, expected return on plan assets, rate of increase in healthcare

costs, the rate of future compensation increases and mortality.

Difference between these assumptions and actual experiences are

reported as net actuarial gains and losses and are subject to

amortization to net periodic pension cost over the average

remaining service lives of the employees participating in the

pension plan.

Cumulative actuarial losses for our pension plans as of

December 31, 2008 were $1.8 billion, as compared to $1 billion at

December 31, 2007. The change from December 31, 2007 relates

primarily to actual losses on plan assets in 2008 as compared to

expected returns partially offset by an increase in the discount

rate. The total actuarial loss will be amortized in the future, subject

to offsetting gains or losses that will change the future

amortization amount.

We have utilized a weighted average expected rate of return on

plan assets of 7.6% for 2008, 7.6% for 2007 and 7.8% for 2006,

on a worldwide basis. In estimating this rate, we considered the

historical returns earned by the plan assets, the rates of return

expected in the future and our investment strategy and asset mix

with respect to the plans’ funds.

During 2008, the actual loss on plan assets was $1.5 billion,

primarily as a result of the significant declines in the equity

markets during the fourth quarter of 2008. In estimating the 2009

expected rate of return we considered this significant decline in the

fair value of our plan assets as well as potential changes in our

investment mix, partly in response to the significant volatility

expected in the equity markets for the foreseeable future. The

weighted average expected rate of return on plan assets we will

utilize for 2009 will be 7.4% as compared to 7.6% in 2008.

For purposes of determining the expected return on plan assets, we

utilize a calculated value approach in determining the value of the

pension plan assets, as opposed to a fair market value approach.

The primary difference between the two methods relates to a

systematic recognition of changes in fair value over time (generally

two years) versus immediate recognition of changes in fair value.

Our expected rate of return on plan assets is then applied to the

calculated asset value to determine the amount of the expected

return on plan assets to be used in the determination of the net

periodic pension cost. The calculated value approach reduces the

volatility in net periodic pension cost that can result from using the

fair market value approach. The difference between the actual

return on plan assets and the expected return on plan assets is

added to, or subtracted from, any cumulative differences that

arose in prior years. This amount is a component of the net

actuarial gain or loss.

Another significant assumption affecting our pension and post-

retirement benefit obligations and the net periodic pension and

other post-retirement benefit cost is the rate that we use to

discount our future anticipated benefit obligations. The discount

rate reflects the current rate at which the pension liabilities could

be effectively settled considering the timing of expected payments

for plan participants. In estimating this rate, we consider rates of

return on high quality fixed-income investments included in various

published bond indices, adjusted to eliminate the effects of call

provisions and differences in the timing and amounts of cash

outflows related to the bonds. In the U.S. and the U.K., which

comprise approximately 80% of our projected benefit obligations,

30 Xerox 2008 Annual Report