Xerox 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

Research, Development and Engineering Expenses

(“R,D&E”)

We invest in technological development, particularly in color, and

believe our R,D&E spending is sufficient to remain technologically

competitive.

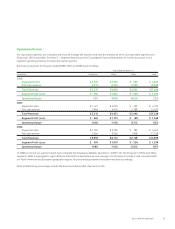

Year Ended December 31, Change

(in millions) 2008 2007 2006 2008 2007

Total R,D&E expenses $884 $912 $922 $28 $10

R,D&E % revenue 5.0% 5.3% 5.8% (0.3)pts (0.5)pts

2008 R,D&E of $884 million decreased $28 million from 2007. We

expect our 2009 R,D&E spending to approximate 4% to 5% of

total revenue.

• R&D of $750 million decreased $14 million from 2007. Our R&D

is strategically coordinated with that of Fuji Xerox, which

invested $788 million and $672 million in R&D in 2008 and

2007, respectively. Much of the reported Fuji Xerox R&D increase

was caused by changes in foreign exchange rates.

• Sustaining engineering costs of $134 million were $14 million

lower than 2007 due primarily to lower spending related to

environmental compliance activities and maturing product

platforms in the Production segment.

• R,D&E as a percentage of revenue declined 0.3-percentage

points reflecting the capture of efficiencies following a

significant number of new product launches over the past two

years as well as leveraging our current R,D&E investments to

support our GIS operations.

2007 R,D&E of $912 million decreased $10 million from 2006.

• R&D of $764 million increased $3 million from 2006. Our R&D is

strategically coordinated with that of Fuji Xerox, which invested

$672 million and $660 million in R&D in 2007 and 2006,

respectively.

• Sustaining engineering costs of $148 million were $13 million

lower than 2006 due primarily to lower spending related to

environmental compliance activities and maturing product

platforms in the Production segment.

• R,D&E as a percentage of revenue declined 0.5-percentage

points as we leveraged our current R,D&E investments to support

GIS operations.

Selling, Administrative and General Expenses (“SAG”)

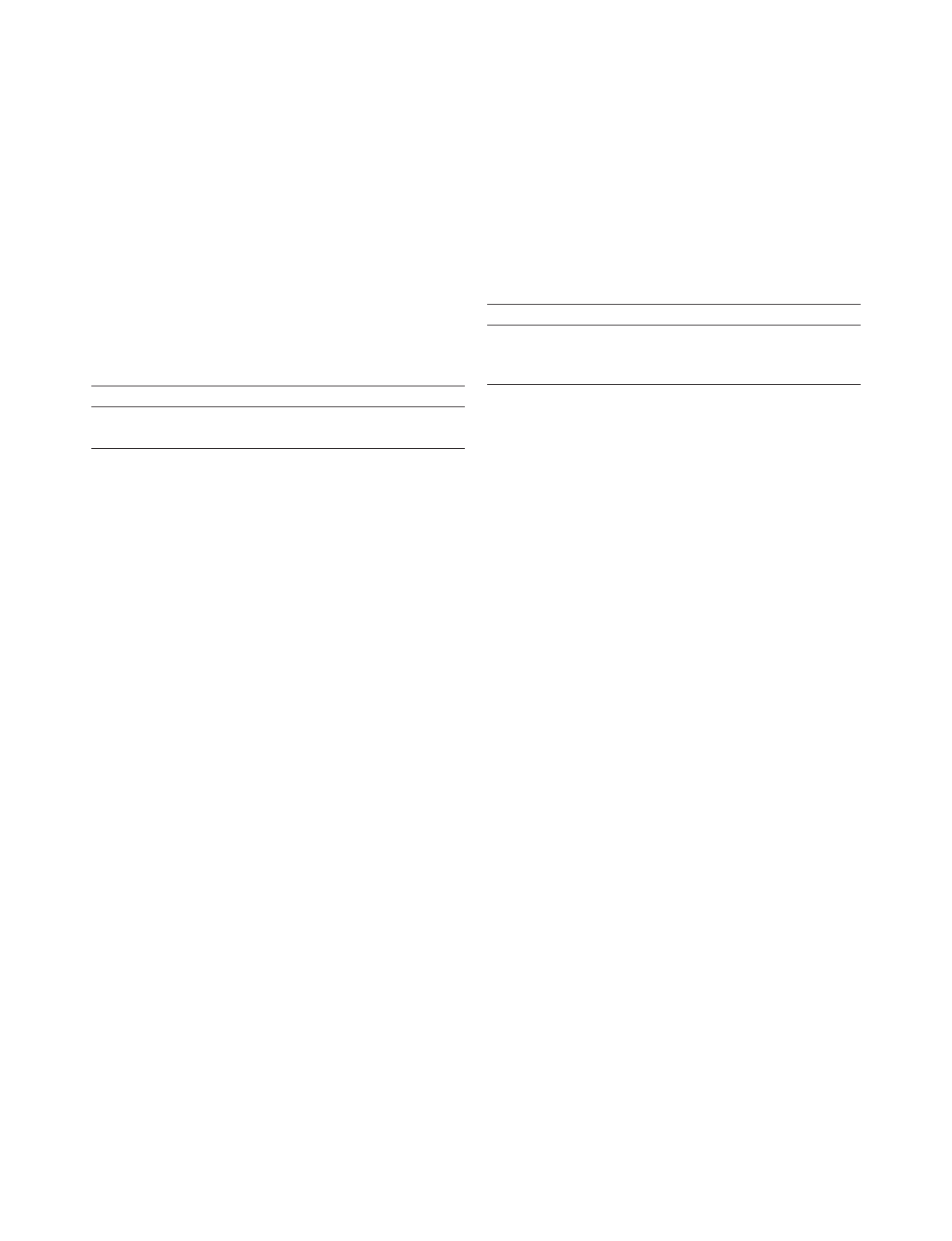

Year Ended December 31, Change

(in millions) 2008 2007 2006 2008 2007

Total SAG

expenses $4,534 $4,312 $4,008 $222 $304

SAG % revenue 25.7% 25.0% 25.2% 0.7pts (0.2)pts

2008 SAG expenses of $4,534 million were $222 million higher

than 2007, including a $12 million unfavorable impact from

currency. The SAG expense increase was the result of the following:

• $94 million increase in selling expenses primarily reflecting the

full year inclusion of GIS, investments in selling resources and

marketing communications and unfavorable currency partially

offset by lower compensation.

• $75 million increase in general and administrative (“G&A”)

expenses primarily from the full year inclusion of GIS and

unfavorable currency.

• $54 million increase in bad debt expense reflecting increased

write-offs, particularly in the fourth quarter 2008, which included

several high value account bankruptcies in the U.S., U.K. and

Germany.

2007 SAG expenses of $4,312 million were $304 million higher

than 2006, including a $141 million negative impact from

currency. The SAG expense increase was the result of the following:

• $93 million increase in selling expenses primarily reflecting the

negative impact from currency and the inclusion of GIS. This

increase was partially offset by lower costs reflecting the

benefits from the 2006 restructuring programs intended to

realign our sales infrastructure.

• $164 million increase in G&A expenses primarily from the

inclusion of GIS, unfavorable currency and information

technology investments.

• $47 million increase in bad debt expense primarily as a result of

an increase in reserves for several customers in Europe as well as

a 2006 reduction in expense due to adjustments to the reserves

to reflect improvement in write-offs and aging.

36 Xerox 2008 Annual Report