Xerox 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

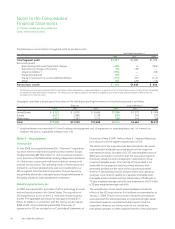

New Accounting Standards and Accounting Changes

Derivative Instruments and Hedging Activities

In March 2008, the FASB issued SFAS No. 161 “Disclosures about

Derivative Instruments and Hedging Activities an amendment of

FASB Statement No. 133”. The new standard requires additional

disclosures regarding a company’s derivative instruments and

hedging activities by requiring disclosure of the fair values of

derivative instruments and their gains and losses in a tabular

format. It also requires disclosure of derivative features that are

credit risk – related as well as cross-referencing within the notes to

the financial statements to enable financial statement users to

locate important information about derivative instruments,

financial performance and cash flows. We adopted this standard

effective as of December 31, 2008. The only impact from this

standard was to require us to expand our disclosures regarding our

derivative instruments. Refer to Note 13 – Financial Instruments

for additional information.

Fair Value Accounting

In 2006, the FASB issued SFAS No. 157, “Fair Value Measurements”

(“FAS 157”). We adopted the provisions of FAS 157 on January 1,

2008. FAS 157 defines fair value, establishes a market-based

framework or hierarchy for measuring fair value and expands

disclosures about fair value measurements. FAS 157 is applicable

whenever another accounting pronouncement requires or permits

assets and liabilities to be measured at fair value. FAS 157 does not

expand or require any new fair value measures; however, the

application of this statement may change current practice. FAS

157 does not apply to fair value measurements for purposes of

lease classification or measurement under SFAS No. 13,

“Accounting for Leases”. In February 2008, the FASB decided that

an entity need not apply this standard to nonfinancial assets and

liabilities that are recognized or disclosed at fair value in the

financial statements on a nonrecurring basis until 2009.

Accordingly, our adoption of this standard in 2008 was limited to

financial assets and liabilities, which primarily affects the valuation

of our derivative contracts. The adoption of FAS 157 did not have a

material effect on our financial condition or results of operations.

We do not believe the full adoption of FAS 157 with respect to our

nonfinancial assets and liabilities will have a material effect on our

financial condition or results of operations. Nonfinancial assets and

liabilities for which we have not applied the provisions of FAS 157

primarily include those measured at fair value in impairment

testing and those initially measured at fair value in a business

combination.

In 2007, the FASB issued SFAS No. 159, “The Fair Value Option for

Financial Assets and Financial Liabilities – Including an

Amendment of FASB Statement No. 115” (“FAS 159”). FAS 159

became effective for us on January 1, 2008. FAS 159 permits

entities to choose to measure many financial instruments and

certain other items at fair value. Entities that elect the fair value

option will report unrealized gains and losses in earnings at each

subsequent reporting date. The fair value option may be elected

on an instrument-by-instrument basis, with few exceptions. FAS

159 also establishes presentation and disclosure requirements to

facilitate comparisons between companies that choose different

measurement attributes for similar assets and liabilities. FAS 159

did not have an effect on our financial condition or results of

operations as we did not elect this fair value option, nor is it

expected to have a material impact on future periods as the

election of this option for our financial instruments is expected to

be at most, limited.

Business Combinations and Noncontrolling Interests

In 2007, the FASB issued SFAS No. 141 (revised 2007), “Business

Combinations” (“FAS 141(R)”). FAS 141(R) requires the acquiring

entity in a business combination to recognize the full fair value of

assets acquired and liabilities assumed in the transaction (whether

a full or partial acquisition); establishes the acquisition-date fair

value as the measurement objective for all assets acquired and

liabilities assumed; requires expensing of most transaction and

restructuring costs; and requires the acquirer to disclose the

information needed to evaluate and understand the nature and

financial effect of the business combination. FAS 141(R) applies

prospectively to business combinations for which the acquisition

date is on or after January 1, 2009. The impact of FAS No. 141(R)

on our consolidated financial statements will depend upon the

nature, terms and size of the acquisitions we consummate after

the effective date.

In 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests

in Consolidated Financial Statements – an amendment of

Accounting Research Bulletin No. 51” (“FAS 160”). FAS 160 requires

reporting entities to present noncontrolling (minority) interests as

equity (as opposed to as a liability) and provides guidance on the

accounting for transactions between an entity and noncontrolling

interests. As of December 31, 2008, we had approximately $120 in

noncontrolling interests classified in other long-term liabilities. FAS

160 applies prospectively as of January 1, 2009, except for the

presentation and disclosure requirements which will be applied

retrospectively for all periods presented.

52 Xerox 2008 Annual Report