Xerox 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

quarter 2008 as a result of the significant and rapid weakening of

the U.S. Dollar and Euro versus the Yen.

The 2006 currency losses primarily reflected the mark-to-market of

derivative contracts which are economically hedging anticipated

foreign currency denominated payments. The mark-to-market

losses were primarily due to the strengthening of the Euro against

other currencies, in particular the Canadian Dollar, U.S. Dollar and

the Yen, as compared to the weakening Euro in 2005.

Amortization of intangible assets: 2008 amortization of

intangible assets expense of $54 million reflects amortization

expense of $33 million for intangible assets acquired as part of our

recent acquisitions.

2007 amortization of intangible assets expense of $42 million

reflects amortization expense of $16 million associated with

intangible assets acquired as part of our acquisition of GIS,

partially offset by reduced amortization from prior years due to the

full amortization of certain intangible assets from previous

acquisitions.

Legal matters: In 2008 legal matters consisted of the following:

• $721 million reflecting provisions for the $670 million court

approved settlement of Carlson v. Xerox Corporation (“Carlson”)

and other pending securities-related cases, net of expected

insurance recoveries. On January 14, 2009, the United States

Court for the District of Connecticut entered a Final Order and

Judgment approving the settlement in the Carlson litigation.

• $36 million for probable losses on Brazilian labor-related

contingencies. Following an assessment of the most recent trend

in the outcomes of these matters, we reassessed the probable

estimated loss and, as a result, recorded an additional reserve of

$36 million in the fourth quarter of 2008.

• $24 million associated with probable losses from various other

legal matters.

In 2006 legal matters consisted of the following:

• $68 million for probable losses on Brazilian labor-related

contingencies.

• $33 million associated with probable losses from various legal

matters partially offset by $12 million of proceeds from the

Palm litigation matter.

Refer to Note 16 – Contingencies in the Consolidated Financial

Statements for additional information regarding litigation against

the Company.

Income Taxes

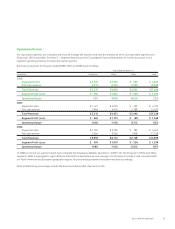

Year Ended December 31,

(in millions) 2008 2007 2006

Pre-tax (loss) income $(114) $1,438 $ 808

Income tax (benefits) expenses (231) 400 (288)

Effective tax rate 202.6% 27.8% (35.6)%

The 2008 effective tax rate of 202.6% reflected the tax benefits

from certain discrete items including the net provision for litigation

matters; the second, third and fourth quarter restructuring and

asset impairment charges; the product line equipment write-off;

and the settlement of certain previously unrecognized tax benefits.

Excluding these items, the adjusted effective tax rate was 21.5%*.

The adjusted 2008 effective tax rate was lower than the U.S.

statutory tax rate primarily reflecting the benefit to taxes from the

geographical mix of income before taxes and the related effective

tax rates in those jurisdictions, the utilization of foreign tax credits

and tax law changes.

The 2007 effective tax rate of 27.8% was lower than the U.S.

statutory rate primarily reflecting tax benefits from the

geographical mix of income before taxes and the related effective

tax rates in those jurisdictions and the utilization of foreign tax

credits as well as the resolution of other tax matters. These

benefits were partially offset by changes in tax law.

The 2006 effective tax rate of (35.6%) was lower than the U.S.

statutory rate primarily due to the tax benefits of $518 million

from the resolution of tax issues associated with the 1999-2003

IRS audits and other domestic and foreign tax audits; tax benefits

of $19 million as a result of tax law changes and tax treaty

changes; and $11 million from the reversal of a valuation

allowance on deferred tax assets associated with foreign net

operating loss carryforwards, as well as the geographical mix of

income before taxes and related effective tax rates in those

jurisdictions. These benefits were partially offset by losses in

certain jurisdictions where we are not providing tax benefits and

continue to maintain deferred tax valuation allowances.

Our effective tax rate will change based on nonrecurring events as

well as recurring factors including the geographical mix of income

before taxes and the related effective tax rates in those

jurisdictions and available foreign tax credits. In addition, our

effective tax rate will change based on discrete or other

nonrecurring events (such as audit settlements) that may not be

predictable. We anticipate that our effective tax rate for 2009 will

approximate 28%, excluding the effect of any discrete items.

* See the “Non-GAAP Measures” section for additional information.

38 Xerox 2008 Annual Report

• $330 million decrease in pre-tax income before litigation and

• $615 million decrease due to net payments for the settlement

• $90 million decrease due to higher net income tax payments,

• $74 million decrease primarily due to lower benefit and

• $71 million decrease due to higher inventory levels as a result of

• $136 million increase from accounts receivable due to strong

• $107 million increase from derivatives, primarily due to the

• $348 million increase in pre-tax income before restructuring,

• $108 million increase in other liabilities primarily reflecting the

• $57 million increase reflecting lower pension contributions to our

• $30 million increase as a result of lower restructuring payments

• $114 million decrease due to year-over-year inventory growth of

• $73 million decrease due to a lower net run-off of finance

• $49 million decrease primarily due to higher accounts receivable