Xerox 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 14% growth in color revenue. Color revenue of $6,356 million

in 2007 comprised 39% of total revenue, compared to 35% in

2006 reflecting:

– 18% growth in color post sale revenue to $4,180 million.

Color post sale revenue represented 35% and 31% of post

sale revenue, in 2007 and 2006, respectively.(4)

– 7% growth in color equipment sales revenue to $2,176

million. Color equipment sales represented 49% and 45% of

total equipment sales, in 2007 and 2006, respectively.(4)

– 31% growth in color pages. Color pages represented 12%

and 9% of total pages in 2007 and 2006, respectively.(4)

(1) Post sale revenue is largely a function of the equipment placed at customer locations, the

volume of prints and copies that our customers make on that equipment, the mix of color

pages and associated services.

The percentage point impacts from GIS reflect the revenue growth year-over-year after

including GIS’s results for 2007 and 2006 on a proforma basis. See “Non-GAAP Financial

Measures” section for an explanation of this non-GAAP measure.

Color revenues represent a subset of total revenues and excludes the impact of GIS’s

revenues.

(4) As of December 31, 2008, total color, color post sale and color equipment sales revenues

comprised 41%, 37% and 50%, respectively, if calculated on total, total post sale, and

total equipment sales revenues, including GIS. GIS is excluded from the color information

presented, because the breakout of the information required to make this computation for

all periods is not available.

(5) Pages include estimates for developing markets, GIS and printers.

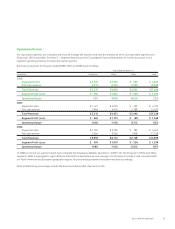

Net income and diluted earnings per share for the three years

ended December 31, 2008 were as follows:

(in millions, except per share amounts) 2007 2006

Net income $1,135 $1,210

Diluted earnings per share $ 1.19 $ 1.22

2008 Net income of $230 million, or $0.26 per diluted share,

included the following:

• $491 million after-tax charges ($774 million pre-tax) associated

with securities-related litigation matters as well as other

probable litigation-related losses including $36 million for the

Brazilian labor-related contingencies.

• $292 million after-tax charge ($426 million pre-tax) for second,

third and fourth quarter 2008 restructuring and asset

impairment actions.

• $24 million after-tax charge ($39 million pre-tax) for an Office

product line equipment write-off.

• $41 million income tax benefit from the settlement of certain

previously unrecognized tax benefits.

2007 Net income of $1,135 million, or $1.19 per diluted share,

included $30 million after-tax charge for our share of Fuji Xerox

(“FX”) restructuring charges.

2006 Net income of $1,210 million, or $1.22 per diluted share,

included the following:

• $472 million income tax benefit related to the favorable

resolution of certain tax matters from the 1999-2003 IRS audit.

• $68 million (pre-tax and after-tax) for probable losses on

Brazilian labor-related contingencies.

• $46 million tax benefit resulting from the resolution of certain

tax matters associated with foreign tax audits.

• $9 million after-tax ($13 million pre-tax) charge from the

write-off of the remaining unamortized deferred debt issuance

costs as a result of the termination of our 2003 Credit Facility.

• $257 million after-tax ($385 million pre-tax) restructuring and

asset impairment charges.

In preparing our Consolidated Financial Statements and

accounting for the underlying transactions and balances, we apply

various accounting policies. Senior management has discussed the

development and selection of the critical accounting policies,

estimates and related disclosures, included herein, with the Audit

Committee of the Board of Directors. We consider the policies

discussed below as critical to understanding our Consolidated

Financial Statements, as their application places the most

significant demands on management’s judgment, since financial

reporting results rely on estimates of the effects of matters that

are inherently uncertain. In instances where different estimates

could have reasonably been used, we disclosed the impact of these

different estimates on our operations. In certain instances, like

revenue recognition for leases, the accounting rules are

prescriptive; therefore, it would not have been possible to

reasonably use different estimates. Changes in assumptions and

estimates are reflected in the period in which they occur. The

impact of such changes could be material to our results of

operations and financial condition in any quarterly or annual

period.

28 Xerox 2008 Annual Report

Specific risks associated with these critical accounting policies are

discussed throughout the MD&A, where such policies affect our

reported and expected financial results. For a detailed discussion of

the application of these and other accounting policies, refer to

Note 1 – Summary of Significant Accounting Policies, in the

Consolidated Financial Statements.

Revenue Recognition for Leases

Our accounting for leases involves specific determinations under

applicable lease accounting standards, which often involve

complex and prescriptive provisions. These provisions affect the

timing of revenue recognition for our equipment. If a lease

qualifies as a sales-type capital lease, equipment revenue is

recognized upon delivery or installation of the equipment as sale

revenue as opposed to ratably over the lease term. The critical

elements that we consider with respect to our lease accounting are

the determination of the economic life and the fair value of

equipment, including the residual value. For purposes of

determining the economic life, we consider the most objective

measure to be the original contract term, since most equipment is

returned by lessees at or near the end of the contracted term. The

economic life of most of our products is five years since this

represents the most frequent contractual lease term for our

principal products and only a small percentage of our leases are for

original terms longer than five years. There is no significant after-

market for our used equipment. We believe five years is

representative of the period during which the equipment is

expected to be economically usable, with normal service, for the

purpose for which it is intended.

Revenue Recognition Under Bundled Arrangements

We sell the majority of our products and services under bundled

lease arrangements, which typically include equipment, service,

supplies and financing components for which the customer pays a

single negotiated monthly fixed price for all elements over the

contractual lease term. Typically these arrangements include an

incremental, variable component for page volumes in excess of

contractual page volume minimums, which are often expressed in

terms of price per page. Revenues under these arrangements are

allocated, considering the relative fair values of the lease and

non-lease deliverables included in the bundled arrangement, based

upon the estimated relative fair values of each element. Lease

deliverables include maintenance and executory costs, equipment

and financing, while non-lease deliverables generally consist of

supplies and non-maintenance services. Our revenue allocation for

lease deliverables begins by allocating revenues to the

maintenance and executory costs plus profit thereon. The

remaining amounts are allocated to the equipment and financing

elements. We perform extensive analyses of available verifiable

objective evidence of equipment fair value based on cash selling

prices during the applicable period. The cash selling prices are

compared to the range of values included in our lease accounting

systems. The range of cash selling prices must be reasonably

consistent with the lease selling prices, taking into account residual

values, in order for us to determine that such lease prices are

indicative of fair value.

Our pricing interest rates, which are used in determining customer

payments, are developed based upon a variety of factors including

local prevailing rates in the marketplace and the customer’s credit

history, industry and credit class. We reassess our pricing interest

rates quarterly based on changes in the local prevailing rates in the

marketplace. These interest rates have been historically adjusted if

the rates vary by twenty-five basis points or more, cumulatively,

from the last rate in effect. The pricing interest rates generally

equal the implicit rates within the leases, as corroborated by our

comparisons of cash to lease selling prices. In light of worldwide

economic conditions prevailing at the end of 2008, we expect to

continually review this methodology in 2009 to ensure that our

pricing interest rates are reflective of changes in the local

prevailing rates in the marketplace.

Allowance for Doubtful Accounts and Credit Losses

We perform ongoing credit evaluations of our customers and

adjust credit limits based upon customer payment history and

current creditworthiness. We continuously monitor collections and

payments from our customers and maintain a provision for

estimated credit losses based upon our historical experience and

any specific customer collection issues that have been identified.

While such credit losses have historically been within our

expectations and the provisions established, we cannot guarantee

that we will continue to experience credit loss rates similar to those

we have experienced in the past. Measurement of such losses

requires consideration of historical loss experience, including the

need to adjust for current conditions, and judgments about the

probable effects of relevant observable data, including present

economic conditions such as delinquency rates and financial

health of specific customers. We recorded bad debt provisions of

$188 million, $134 million and $87 million in SAG expenses in our

Consolidated Statements of Income for the years ended

December 31, 2008, 2007 and 2006, respectively.

Historically, the majority of the bad debt provision relates to our

finance receivables portfolio. This provision is inherently more

difficult to estimate than the provision for trade accounts

receivable because the underlying lease portfolio has an average

maturity, at any time, of approximately two to three years and

contains past due billed amounts, as well as unbilled amounts. The

estimated credit quality of any given customer and class of

customer or geographic location can significantly change during

Xerox 2008 Annual Report 29