Xerox 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3Xerox 2008 Annual Report

Given our cash flow, healthy cash balance – $1.2 billion at the

end of 2008 – and a $2 billion credit facility, we remain quite

confident in our financial position and have no need to access

the capital markets in the foreseeable future. It’s certainly an

advantaged position in this economy.

Although we are keenly aware that there is much we cannot

control, the wonderful people I am privileged to lead at Xerox

are focused with passion and grit on those things we can

control. This attitude and focus helped us turn in credible

performance in a very difficult year:

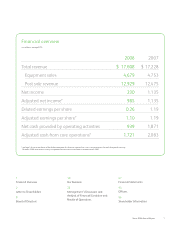

• Total revenue for 2008 was $17.6 billion – that’s an increase

of $380 million, or 2 percent, over 2007.

• Full-year net income was $230 million including a litigation

charge. Excluding this and certain other charges, adjusted

net income was $985 million.*

• We generated $939 million of operating cash flow. Adjusted

cash from core operations for the year was $1.7 billion.*

• Through the 5 percent of our revenue invested in innovation,

we continued to expand our portfolio of document

management technology and services – already the

broadest in the industry and in our history.

• And we continued to expand distribution, bringing the Xerox

brand to more businesses of any size all around the world.

The proof points are everywhere. The highly respected Gartner

organization lists us as a “Magic Quadrant” market leader in

managed print services, as well as for printers and multi function

systems that print, copy, fax and scan all in one device. Our new

offerings last year garnered some 230 awards from industry

groups and media around the world. I could go on, but you get

the point. Third parties are validating our progress and our

leadership in virtually every aspect of our business.

That’s all looking in the rear-view mirror. I don’t have to be

a psychic to know that you have little patience for that –

especially in these turbulent times. Neither do I. I’ve met with

many investors in recent months and I keep hearing three

questions asked over and over:

• What are you doing to confront the recession right now?

• What are you doing to make sure you come out of this crisis

with a full head of steam?

• Why should I continue to invest in Xerox?

Fair enough. Let me answer each of those questions as

candidly and succinctly as I can.

“ The highly respected Gartner

organization lists us as a “Magic

Quadrant” market leader in managed

print services, as well as for printers

and multi function systems.”

Actions to Minimize Impact of the Recession

We are doing everything possible to reduce cost – everything

that doesn’t mortgage our future. We took a $349 million

restructuring charge in the fourth quarter of 2008 that has

resulted in the elimination of about 3,400 jobs. We expect that

the restructuring will deliver $200 million in savings this year.