Xerox 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

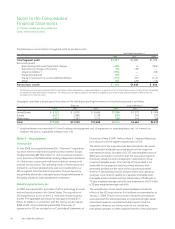

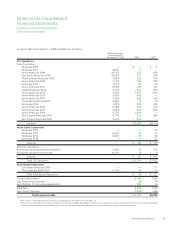

Note 8 – Goodwill and Intangible Assets, Net

Goodwill

The following table presents the changes in the carrying amount of goodwill, by reportable segment, for the three years ended

December 31, 2008:

Production Office Other Total

Balance at December 31, 2005 $ 745 $ 807 $ 119 $1,671

Foreign currency translation adjustment 99 69 1 169

Acquisition of Amici LLC — — 136 136

Acquisition of XMPie, Inc. 48 — — 48

Balance at December 31, 2006 $ 892 $ 876 $ 256 $2,024

Foreign currency translation adjustment 21 17 — 38

Acquisition of GIS — 1,218 105 1,323

Acquisition of Advectis, Inc. — — 26 26

GIS Acquisitions — 30 3 33

Other — —4 4

Balance at December 31, 2007 $ 913 $2,141 $ 394 $3,448

Foreign currency translation adjustment (233) (161) (1) (395)

Acquisition of Veenman B.V. — 44 — 44

GIS acquisitions — 73 — 73

Purchase Price allocation adjustment – GIS — 120 (108) 12

Balance at December 31, 2008 $ 680 $2,217 $ 285 $3,182

In 2008, we finalized the GIS purchase price allocation. As a result, the $108 of Goodwill reflected in our Other segment in 2007 was

reallocated to our Office segment. This adjustment aligned goodwill to the reporting unit benefiting from the synergies of the purchase.

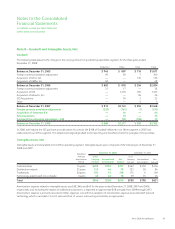

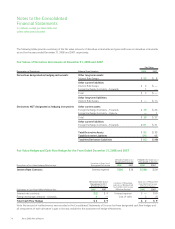

Intangible Assets, Net

Intangible assets primarily relate to the Office operating segment. Intangible assets were comprised of the following as of December 31,

2008 and 2007:

Weighted

Average

Amortization

Period

December 31, 2008 December 31, 2007

Gross

Carrying

Amount

Accumulated

Amortization

Net

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Amount

Customer base 14 years $492 $155 $337 $462 $118 $344

Distribution network 25 years 123 44 79 123 39 84

Trademarks 20 years 191 15 176 175 6 169

Technology, patents and non-compete 6 years 40 22 18 39 15 24

Total $846 $236 $610 $799 $178 $621

Amortization expense related to intangible assets was $58, $46, and $45 for the years ended December 31, 2008, 2007 and 2006,

respectively, and, excluding the impact of additional acquisitions, is expected to approximate $58 annually from 2009 through 2013.

Amortization expense is primarily recorded in Other expenses, net, with the exception of amortization expense associated with licensed

technology, which is recorded in Cost of sales and Cost of service, outsourcing and rentals, as appropriate.

Xerox 2008 Annual Report 65