Xerox 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

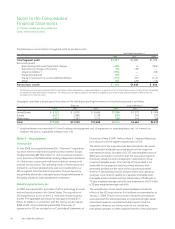

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

adjusted by a $2 credit in 2008. With the exception of this charge,

the adoption of EITF 06-2 did not impact the Company as we do

not have a similar benefit arrangement.

Summary of Accounting Policies

Revenue Recognition

We generate revenue through the sale and rental of equipment,

service and supplies and income associated with the financing of

our equipment sales. Revenue is recognized when earned. More

specifically, revenue related to sales of our products and services is

recognized as follows:

Equipment: Revenues from the sale of equipment, including those

from sales-type leases, are recognized at the time of sale or at the

inception of the lease, as appropriate. For equipment sales that

require us to install the product at the customer location, revenue is

recognized when the equipment has been delivered to and

installed at the customer location. Sales of customer installable

products are recognized upon shipment or receipt by the customer

according to the customer’s shipping terms. Revenues from

equipment under other leases and similar arrangements are

accounted for by the operating lease method and are recognized

as earned over the lease term, which is generally on a straight-line

basis.

Service: Service revenues are derived primarily from maintenance

contracts on our equipment sold to customers and are recognized

over the term of the contracts. A substantial portion of our

products are sold with full service maintenance agreements for

which the customer typically pays a base service fee plus a variable

amount based on usage. As a consequence, other than the product

warranty obligations associated with certain of our low end

products in the Office segment, we do not have any significant

product warranty obligations, including any obligations under

customer satisfaction programs.

Revenues associated with outsourcing services as well as

professional and value-added services are generally recognized as

such services are performed. In those service arrangements where

final acceptance of a system or solution by the customer is

required, revenue is deferred until all acceptance criteria have been

met. Costs associated with service arrangements are generally

recognized as incurred. Initial direct costs of an arrangement are

capitalized and amortized over the contractual service period.

Long-lived assets used in the fulfillment of the arrangements are

capitalized and depreciated over the shorter of their useful life or

the term of the contract. Losses on service arrangements are

recognized in the period that the contractual loss becomes

probable and estimable.

Sales to distributors and resellers: We utilize distributors and

resellers to sell certain of our products to end-users. We refer to our

distributor and reseller network as our two-tier distribution model.

Sales to distributors and resellers are generally recognized as

revenue when products are sold to such distributors and resellers.

Distributors and resellers participate in various cooperative

marketing and other programs, and we record provisions for these

programs as a reduction to revenue when the sales occur. We also

similarly account for our estimates of sales returns and other

allowances when the sales occur based on our historical experience.

Supplies: Supplies revenue generally is recognized upon shipment

or utilization by customers in accordance with the sales terms.

Software: Software included within our equipment and services is

generally considered incidental and is therefore accounted for as

part of the equipment sales or services revenues. Software

accessories sold in connection with our equipment sales as well as

free-standing software revenues are accounted for in accordance

with AICPA Statement of Position No. 97-2, “Software Revenue

Recognition” (“SOP 97-2”). In most cases, these software products

are sold as part of multiple element arrangements and include

software maintenance agreements for the delivery of technical

service as well as unspecified upgrades or enhancements on a

when-and-if-available basis. In those software accessory and free-

standing software arrangements that include more than one

element, we allocate the revenue among the elements based on

vendor-specific objective evidence (“VSOE”) of fair value. VSOE of

fair value is based on the price charged when the deliverable is sold

separately by us on a regular basis and not as part of the multiple-

element arrangement. Revenue allocated to software is normally

recognized upon delivery while revenue allocated to the software

maintenance element is recognized ratably over the term of the

arrangement.

Revenue Recognition for Leases: Our accounting for leases

involves specific determinations under FAS 13, which often involve

complex provisions and significant judgments. The two primary

criteria of FAS 13 which we use to classify transactions as sales-

type or operating leases are 1) a review of the lease term to

determine if it is equal to or greater than 75% of the economic life

of the equipment and 2) a review of the present value of the

minimum lease payments to determine if they are equal to or

greater than 90% of the fair market value of the equipment at the

inception of the lease. Our leases in our Latin America operations

have historically been recorded as operating leases given the

cancellability of the contract or because the recoverability of the

lease investment is deemed not to be predictable at lease

inception.

54 Xerox 2008 Annual Report