Xerox 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

indebtedness and rank equally with our other existing senior

unsecured indebtedness. Proceeds from the offering were used to

repay borrowings under the Credit Facility and for general

corporate purposes.

Guarantees

At December 31, 2008, we have issued guarantees of $139 to our

foreign subsidiaries. Of this amount, $67 is related to indebtedness

of our foreign subsidiaries and is included in our Consolidated

Balance Sheet as of December 31, 2008 with the remainder

primarily representing letters of credit. In addition, as of December

31, 2008, $55 of letters of credit have been issued in connection

with insurance guarantees.

Interest

Interest paid on our short-term debt, long-term debt and liabilities

to subsidiary trusts issuing preferred securities amounted to $527,

$552 and $512 for the years ended December 31, 2008, 2007 and

2006, respectively.

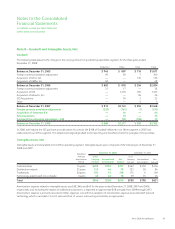

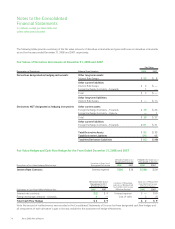

Interest expense and interest income for the three years ended

December 31, 2008 was as follows:

2008 2007 2006

Interest expense(1) $567 $579 $544

Interest income(2) $833 $877 $909

(1) Includes Equipment financing interest expense, as well as, non-financing interest expense

included in Other expenses, net in the Consolidated Statements of Income.

(2) Includes Finance income, as well as, other interest income that is included in Other

expenses, net in the Consolidated Statements of Income.

Equipment financing interest is determined based on an estimated

cost of funds, applied against the estimated level of debt required

to support our net finance receivables. The estimated cost of funds

is based on a blended rate for term and duration comparable to

available borrowing rates for a BBB rated company, which are

reviewed at the end of each period. The estimated level of debt is

based on an assumed 7 to 1 leverage ratio of debt/equity as

compared to our average finance receivable balance during the

applicable period.

Net cash proceeds on debt other than secured borrowings as

shown on the Consolidated Statements of Cash Flows for the three

years ended December 31, 2008 was as follows:

2008 2007 2006

Cash payments on notes payable,

net $ (238) $ (143) $ (19)

Net cash proceeds from issuance of

long-term debt 1,883 2,254 1,502

Cash payments on long-term debt (719) (297) (207)

Net cash proceeds on other debt $ 926 $1,814 $1,276

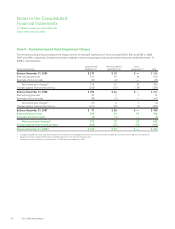

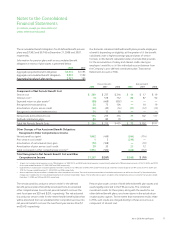

Note 12 – Liability to Subsidiary Trust Issuing

Preferred Securities

The Liability to Subsidiary Trust Issuing Preferred Securities included

in our Consolidated Balance Sheets of $648 and $632 as of

December 31, 2008 and 2007, respectively, reflects our obligations

to Xerox Capital Trust I (“Trust I”) as a result of their loans to us from

proceeds related to their issuance of preferred securities. This

subsidiary is not consolidated in our financial statements because

we are not the primary beneficiary of the trust.

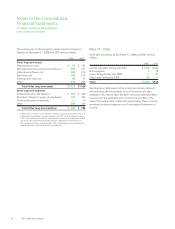

In 1997, Trust I issued 650 thousand of 8.0% preferred securities

(the “Preferred Securities”) to investors for $644 ($650 liquidation

value) and 20,103 shares of common securities to us for $20. With

the proceeds from these securities, Trust I purchased $670

principal amount of 8.0% Junior Subordinated Debentures due

2027 of the Company (“the Debentures”). The Debentures

represent all of the assets of Trust I. On a consolidated basis, we

received net proceeds of $637 which was net of fees and discounts

of $13. Interest expense, together with the amortization of debt

issuance costs and discounts, was $54 in 2008, 2007 and 2006. We

have guaranteed, on a subordinated basis, distributions and other

payments due on the Preferred Securities. The guarantee, our

obligations under the Debentures, the indenture pursuant to which

the Debentures were issued and our obligations under the

Amended and Restated Declaration of Trust governing the trust,

taken together, provide a full and unconditional guarantee of

amounts due on the Preferred Securities. The Preferred Securities

accrue and pay cash distributions semiannually at a rate of 8% per

year of the stated liquidation amount of one thousand dollars per

Preferred Security. The Preferred Securities are mandatorily

redeemable upon the maturity of the Debentures on February 1,

2027, or earlier to the extent of any redemption by us of any

Debentures. The redemption price in either such case will be one

thousand dollars per share plus accrued and unpaid distributions to

the date fixed for redemption.

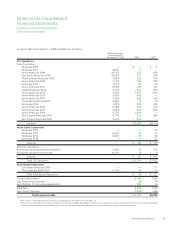

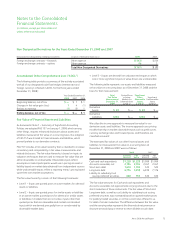

Note 13 – Financial Instruments

We are exposed to market risk from changes in foreign currency

exchange rates and interest rates, which could affect operating

results, financial position and cash flows. We manage our exposure

to these market risks through our regular operating and financing

activities and, when appropriate, through the use of derivative

financial instruments. These derivative financial instruments are

utilized to hedge economic exposures as well as to reduce earnings

and cash flow volatility resulting from shifts in market rates. We

enter into limited types of derivative contracts, including interest

rate swap agreements, foreign currency spot, forward and swap

contracts and net purchased foreign currency options to manage

interest rate and foreign currency exposures. Our primary foreign

Xerox 2008 Annual Report 71