Xerox 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

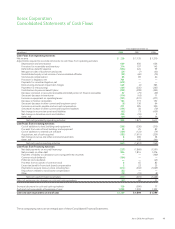

million, $1,871 million and $1,617 million for the years ended

December 31, 2008, 2007 and 2006, respectively. Cash flows

from operations in 2008 included $615 million in net payments

for our securities litigation.

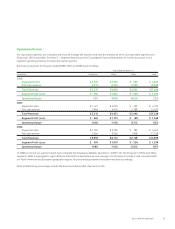

• Our debt maturities are in line with historical and projected cash

flows and are spread over the next ten years as follows (in

millions):

Year Amount

2009 $1,610

2010 962

2011 802

2012 1,169

2013 1,138

2014 69

2015 —

2016 950

2017 501

2018 and thereafter 1,000

Total $8,201

On January 15, 2009, we repaid in-full at maturity, our outstanding

U.S. Dollar and Euro-denominated 9.75% Senior Notes. The total

repayment of approximately $900 million was made using cash on

hand and the proceeds of a $400 million borrowing under our

Credit Facility.

Debt Activity

Credit facility: In February 2008, we exercised our right under our

$2.0 billion Credit Facility to request a one-year extension of the

maturity date. Lenders representing approximately $1.4 billion (or

approximately 70%) of the commitments under the Credit Facility

agreed to the extension and the portion represented by these

Lenders now has a maturity date of April 30, 2013, with the

remaining portion of the Credit Facility to mature on April 30, 2012.

In October 2008, we amended our Credit Facility to increase the

permitted leverage ratio (debt/consolidated EBITDA) to a fixed

ratio of 3.75x. The amendment also included a re-pricing of the

Credit Facility such that borrowings will bear interest at LIBOR plus

an all-in spread that will vary between 1.25% and 4.00% subject

to our credit rating and percent of Credit Facility utilization at the

time of borrowing. Based upon our current rating and utilization,

the all-in spread is 1.75%.

Capital markets offerings and other: In 2008, we raised net

proceeds of $1.4 billion through the issuance of Senior Notes and

$250 million from a private placement transaction.

Loan covenants and compliance: At December 31, 2008, we

were in full compliance with the covenants and other provisions of

the Credit Facility, our Senior Notes and the Loan Agreement. We

have the right to prepay any outstanding loans or to terminate the

Credit Facility without penalty. Failure to be in compliance with any

material provision or covenant of these agreements could have a

material adverse effect on our liquidity and operations and our

ability to continue to fund our customers’ purchase of Xerox

equipment.

Refer to Note 11 – Debt and Note 4 – Receivables, Net in the

Consolidated Financial Statements for additional information

regarding the above noted transactions and Loan Agreement,

respectively.

Share Repurchase Programs

The Board of Directors has authorized share repurchase programs

totaling $4.5 billion through December 31, 2008, which included

additional authorizations of $1.0 billion in both January and July of

2008. Since launching this program in October 2005, we have

repurchased 194.1 million shares, totaling approximately $2.9

billion. Refer to Note 17 – Shareholders’ Equity – “Treasury Stock”

in the Consolidated Financial Statements for further information

regarding our share repurchase programs.

Although we have $1.6 billion of remaining authorization, at the

current time, we have no immediate plans for further share

repurchases.

Dividends

The Board of Directors declared a 4.25 cent per share dividend on

common stock in each quarter of 2008.

Financial Instruments

Refer to Note 13 – Financial Instruments in the Consolidated

Financial Statements for additional information regarding our

derivative financial instruments.

42 Xerox 2008 Annual Report