Xerox 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2

Dear fellow shareholders:

It will come as no surprise to you that Xerox shareholders

have been negatively impacted by the economic crisis that

has ricocheted around the world in recent months. Through

three quarters of 2008, we were on the path to another year

of solid performance. That trajectory changed dramatically

in the fourth quarter.

One example will make the point. Our developing markets

organization was on track to deliver another year of double-

digit revenue growth. Through the first three quarters of

2008, revenue was up 17 percent. Starting in mid-November,

the bottom fell out with breathtaking speed, resulting in

a fourth-quarter revenue decline of 14 percent in our

developing markets.

Although we are hardly immune from the recessionary turmoil,

we are better positioned than most to navigate through it.

Our value proposition is supported by the strength of our

financial position and the resiliency of our recurring revenue

stream that is driven by installs of Xerox technology and

multi-year contracts for Xerox services. More than 70 percent

of our revenue and 80 percent of our cash flow is generated

from our annuity-based business model, making for a solid

and reliable asset, especially in tough economies. Last year,

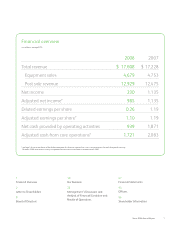

our annuity delivered $12.9 billion in revenue – up 4 percent

from 2007 – and helped us generate more than $1.7 billion

in adjusted cash from core operations* – or $1.36 per share in

adjusted free cash flow.*

“ The wonderful people I am privileged

to lead at Xerox are focused with

passion and grit on those things we

can control. This attitude and focus

helped us turn in credible performance

in a very difficult year.”

“ Although we are hardly immune

from the recessionary turmoil, we

are better positioned than most

to navigate through it.”

Some of the sudden shift was due to a rapid decline in the

Russian and Eastern European economies. But 11 points

of the 14-point decline was due to major – some would say

wild – shifts in currency in several developing markets.

* See Page 7 for the reconciliation of the difference between this financial measure that is not in

compliance with Generally Accepted Accounting Principles (GAAP) and the most directly

comparable financial measure calculated in accordance with GAAP.

Typically, we manage changes in currency through pricing,

but this currency decline was so swift and so significant that

pricing couldn’t catch up. I point this out not as an excuse, but

as an illustration of the roller-coaster nature of this economy.