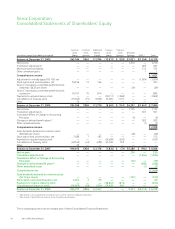

Xerox 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Our debt maturities are in line with historical and projected cash

On January 15, 2009, we repaid in-full at maturity, our outstanding

U.S. Dollar and Euro-denominated 9.75% Senior Notes. The total

$2.0 billion Credit Facility to request a one-year extension of the

approximately 70%) of the commitments under the Credit Facility

In October 2008, we amended our Credit Facility to increase the

permitted leverage ratio (debt/consolidated EBITDA) to a fixed

ratio of 3.75x. The amendment also included a re-pricing of the

Credit Facility such that borrowings will bear interest at LIBOR plus

an all-in spread that will vary between 1.25% and 4.00% subject

the all-in spread is 1.75%.

proceeds of $1.4 billion through the issuance of Senior Notes and

the Credit Facility, our Senior Notes and the Loan Agreement. We

Refer to Note 11 – Debt and Note 4 – Receivables, Net in the

The Board of Directors has authorized share repurchase programs

additional authorizations of $1.0 billion in both January and July of

2008. Since launching this program in October 2005, we have

billion. Refer to Note 17 – Shareholders’ Equity – “Treasury Stock”

The Board of Directors declared a 4.25 cent per share dividend on

common stock in each quarter of 2008.

Refer to Note 13 – Financial Instruments in the Consolidated

42 Xerox 2008 Annual Report

Credit Ratings

We are currently rated investment grade by all major rating agencies. As of January 31, 2009 the ratings were as follows:

Senior Unsecured Debt Outlook

Moody’s Baa2 Positive

Standard & Poors (“S&P”) BBB Stable

Fitch BBB Stable

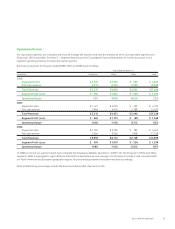

Contractual Cash Obligations and Other Commercial Commitments and Contingencies

At December 31, 2008, we had the following contractual cash obligations and other commercial commitments and contingencies:

(in millions) 2009 2010 2011 2012 2013 Thereafter

Long-term debt, including capital lease obligations(1) $ 1,610 $ 962 $ 802 $1,169 $ 1,138 $2,520

Minimum operating lease commitments(2) 223 188 151 100 84 123

Liability to subsidiary trust issuing preferred securities(3) —————648

Retiree Health Payments 105 99 99 98 97 445

Purchase Commitments

Flextronics(4) 700———— —

EDS Contracts(5) 239 137 77 77 77 16

Other(6) 17 12 11 — — —

Total contractual cash obligations $2,894 $1,398 $1,140 $1,444 $1,396 $3,752

(1) Refer to Note 11– Debt in our Consolidated Financial Statements for additional information and interest payments related to long-term debt (amounts above include principal portion only).

(2) Refer to Note 6 – Land, Buildings and Equipment, Net in our Consolidated Financial Statements for additional information related to minimum operating lease commitments.

(3) Refer to Note 12 – Liability to Subsidiary Trust Issuing Preferred Securities in our Consolidated Financial Statements for additional information and interest payments (amounts above include

principal portion only).

(4) Flextronics: We outsource certain manufacturing activities to Flextronics and are currently in the second year of the Master Supply Agreement. The term of this agreement is three years, with

two additional one year extension periods at our option. The amounts discussed in the table reflect our estimate of purchases over the next year and are not contractual commitments.

(5) EDS Contract: We have an information management contract with Electronic Data Systems Corp. (“EDS”) through June 30, 2009. Services to be provided under this contract include support for

global mainframe system processing, application maintenance, workplace and service desk, voice and data network management and server management. In 2008, the contracts for global

mainframe system processing and workplace and service desk were extended through December 2013 and March 2014, respectively. In January 2009, the contract for voice and data network

management services was revised and extended through March 2014. There are no minimum payments required under this contract. The amounts disclosed in the table reflect our estimate of

probable minimum payments for the periods shown. We can terminate the contract for convenience with six months notice, as defined in the contract, with no termination fee and with

payment to EDS for costs incurred as of the termination date. Should we terminate the contract for convenience, we have an option to purchase the assets placed in service under the EDS

contract.

(6) Other Purchase Commitments: We enter into other purchase commitments with vendors in the ordinary course of business. Our policy with respect to all purchase commitments is to record

losses, if any, when they are probable and reasonably estimable. We currently do not have, nor do we anticipate, material loss contracts.

Xerox 2008 Annual Report 43