Xerox 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

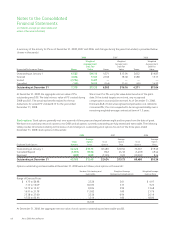

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

February 9, 2009, three class members filed a notice of appeal of

the Court’s January 15, 2009 order and final judgement and ruling

on motion for award of attorneys fees.

In Re Xerox Corp. ERISA Litigation: On July 1, 2002, a class

action complaint captioned Patti v. Xerox Corp. et al. was filed in

the United States District Court for the District of Connecticut

(Hartford) alleging violations of the ERISA. Four additional class

actions were subsequently filed, and the five actions were

consolidated as In Re Xerox Corporation ERISA Litigation. The

purported class includes all persons who invested or maintained

investments in the Xerox Stock Fund in the Xerox 401(k) Plans

(either salaried or union) during the proposed class period, May 12,

1997 through November 15, 2002, and allegedly exceeds 50,000

persons. The defendants include Xerox Corporation and the

following individuals or groups of individuals during the proposed

class period: the Plan Administrator, the Board of Directors, the

Fiduciary Investment Review Committee, the Joint Administrative

Board, the Finance Committee of the Board of Directors, and the

Treasurer. The complaint alleges that the defendants breached

their fiduciary duties under ERISA to protect the Plan’s assets and

act in the interest of Plan participants. Specifically, plaintiffs allege

that the defendants failed to provide accurate and complete

material information to participants concerning Xerox stock,

including accounting practices which allegedly artificially inflated

the value of the stock, and misled participants regarding the

soundness of the stock and the prudence of investing their

retirement assets in Xerox stock. The plaintiffs filed a Second

Consolidated Amended Complaint, alleging that some or all

defendants breached their ERISA fiduciary duties during 1997-

2002 by (1) maintaining the Xerox Stock Fund as an investment

option under the Plan; (2) failing to monitor the conduct of Plan

fiduciaries; and (3) misleading Plan participants about Xerox stock

as an investment option under the Plans. The complaint does not

specify the amount of damages sought, but demands that the

losses to the Plans be restored, which it describes as “millions of

dollars.” It also seeks other legal and equitable relief, as

appropriate, to remedy the alleged breaches of fiduciary duty, as

well as interest, costs and attorneys’ fees. On January 28, 2009. the

Court granted preliminary approval of an agreement to settle this

case, the terms of which are within the amount previously reserved

by the Company for this matter. The Company and the other

defendants do not admit any wrongdoing as a part of the

settlement, which is subject to final Court approval and other

conditions. A fairness hearing has been scheduled for April 13,

2009.

Digwamaje et al. v. IBM et al.: A purported class action was filed

in the United States District Court for the Southern District of New

York on September 27, 2002. Service of the complaint on the

Company was deemed effective as of December 6, 2002. The

purported class includes all persons who lived in South Africa at any

time from 1948 until the present and purportedly suffered

damages as a result of human rights violations and crimes against

humanity through the system of apartheid. The defendants

included the Company and a number of other corporate

defendants who were accused of providing material assistance to

the apartheid government in South Africa from 1948 to 1994, by

engaging in commerce in South Africa and with the South African

government and by employing forced labor, thereby violating both

international and common law. Specifically, plaintiffs claimed

violations of the Alien Tort Claims Act, the Torture Victims

Protection Act and RICO. They also asserted human rights

violations and crimes against humanity. Plaintiffs sought

compensatory damages in excess of $200 billion and punitive

damages in excess of $200 billion. On October 27, 2008, plaintiffs

filed an amended complaint that did not name the Company as a

defendant, so the Company is no longer a party to the action.

Arbitration between MPI Technologies, Inc. and MPI Tech S.A.

and Xerox Canada Ltd. and Xerox Corporation: In an

arbitration proceeding the hearing of which commenced in

January 2005, MPI Technologies, Inc. and MPI Tech S.A.

(collectively “MPI”) sought damages from the Company and Xerox

Canada Ltd. (“XCL”) for royalties owed under a license agreement

between MPI and XCL (the “Agreement”) and breach of fiduciary

duty, breach of confidence, equitable royalties and punitive

damages and disgorgement of profits and injunctive relief with

respect to a claim of copyright infringement. In September 2005,

the arbitration panel rendered its decision, holding in part that the

Agreement had been assigned to Xerox and that no punitive

damages should be granted, and awarded MPI approximately $89,

plus interest thereon. In December 2005, the arbitration panel

rendered its decision on the applicable rate of pre-judgment

interest resulting in an award of $13 for pre- and post-judgment

interest. In 2006, Xerox’s application for judicial review of the

award, seeking to have the award set aside in its entirety, was

denied by the Ontario Superior Court in Toronto and Xerox

released all monies and software it had placed in escrow. In

January 2007, Xerox and XCL served an arbitration claim against

MPI seeking a declaratory award concerning the preclusive effect

of the remedy awarded by the prior arbitration panel. In

March 2007, MPI delivered to Xerox a statement of defense and

counterclaim in response to Xerox’s arbitration claim. MPI claims

entitlement to an unspecified amount of damages for royalties. In

addition, MPI claims damages of $50 for alleged “misuse” of its

licensed software by Xerox after December 2006. MPI also claims

entitlement to unspecified amounts of pre and post-judgment

interest and its costs of the arbitration. A panel of three arbitrators

has been appointed to hear the dispute. The panel heard oral

arguments relating to preliminary dispositive motions on

84 Xerox 2008 Annual Report