Xerox 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

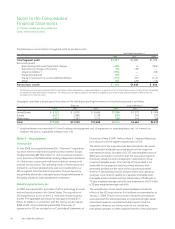

Secured Borrowings

We have an agreement in the U.S. (the “Loan Agreement”) under

which General Electric Capital Corporation, a subsidiary of GE,

provides secured funding for our customer leasing activities in the

U.S. The maximum potential level of borrowing under this

agreement is a function of the size of the portfolio of finance

receivables generated by us that meet GE’s funding requirements

and cannot exceed $5 billion.

Under this agreement, lease originations to be funded by GE are

transferred to a wholly-owned consolidated subsidiary. The funds

received under this agreement are recorded as secured borrowings

and together with the associated lease receivables are included in

our Consolidated Balance Sheet. We and GE intended for the

transfers of the lease contracts to be “true sales at law” and that

the wholly-owned consolidated subsidiary be bankruptcy remote

and have received opinions to that effect from outside legal

counsel. As a result, the transferred receivables are not available to

satisfy any of our other obligations. The final funding date for the

U.S. facility is December 2010. There have been no new borrowings

under the Loan Agreement since December 2005.

As of December 31, 2008 and 2007, net encumbered finance

receivables were $104 and $377, respectively, and secured debt

associated with those receivables was $56 and $275, respectively.

Accounts Receivable Sales Arrangements

We have a facility in Europe that enables us to sell, on an on-going

basis, certain accounts receivables without recourse to a third-

party. During 2008 and 2007, we sold approximately $717 and

$326, respectively, of accounts receivables under this facility. Fees

associated with these sales were $4 and $2, respectively. Of the

amounts sold, $178 and $170 remained uncollected by the third-

party as of December 31, 2008 and 2007, respectively. In the

fourth quarter of 2008, we also sold an additional $43 of accounts

receivable in Europe without recourse under a separate one-time

factoring arrangement.

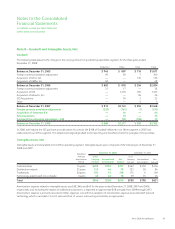

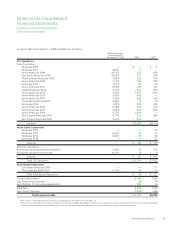

Note 5 – Inventories and Equipment on Operating

Leases, Net

Inventories at December 31, 2008 and 2007 were as follows:

2008 2007

Finished goods $1,044 $1,099

Work-in-process 80 70

Raw materials 108 136

Total Inventories $1,232 $1,305

The transfer of equipment from our inventories to equipment

subject to an operating lease is presented in our Consolidated

Statements of Cash Flows in the operating activities section as a

non-cash adjustment. Equipment on operating leases and similar

arrangements consists of our equipment rented to customers and

depreciated to estimated salvage value at the end of the lease term.

We recorded $115, $66 and $69 in inventory write-down charges for

the years ended December 31, 2008, 2007 and 2006, respectively.

Equipment on operating leases and the related accumulated

depreciation at December 31, 2008 and 2007 were as follows:

2008 2007

Equipment on operating leases $1,507 $1,435

Less: Accumulated depreciation (913) (848)

Equipment on operating leases, net $ 594 $ 587

Depreciable lives generally vary from three to four years consistent

with our planned and historical usage of the equipment subject to

operating leases. Depreciation and obsolescence expense for

equipment on operating leases was $298, $269 and $230 for the

years ended December 31, 2008, 2007 and 2006, respectively. Our

equipment operating lease terms vary, generally from 12 to 36

months. Scheduled minimum future rental revenues on operating

leases with original terms of one year or longer are:

2009 2010 2011 2012 2013 Thereafter

$380 $282 $183 $86 $38 $21

Total contingent rentals on operating leases, consisting principally

of usage charges in excess of minimum contracted amounts, for

the years ended December 31, 2008, 2007 and 2006 amounted to

$117, $117 and $112, respectively.

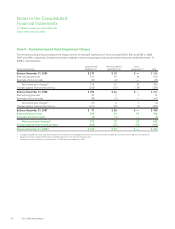

Note 6 – Land, Buildings and Equipment, Net

Land, buildings and equipment, net at December 31, 2008 and

2007 were as follows:

Estimated

Useful Lives

(Years) 2008 2007

Land $ 45 $ 48

Buildings and building equipment 25 to 50 1,156 1,208

Leasehold improvements Varies 372 371

Plant machinery 5 to 12 1,597 1,710

Office furniture and equipment 3 to 15 973 998

Other 4 to 20 100 86

Construction in progress — 95 88

Subtotal 4,338 4,509

Less: Accumulated depreciation (2,919) (2,922)

Land, buildings and equipment,

net $ 1,419 $ 1,587

62 Xerox 2008 Annual Report