Xerox 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

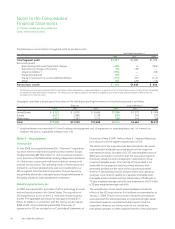

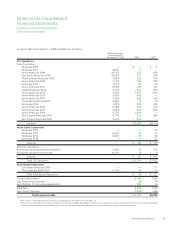

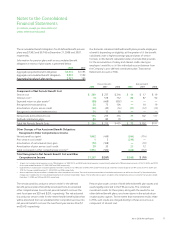

Scheduled payments due on long-term debt for the next five years

and thereafter are as follows:

2009 2010 2011 2012 2013 Thereafter Total

$1,549(1) $962 $802 $1,169 $1,138 $2,520 $8,140

(1) Quarterly total debt maturities for 2009 are $937, $12, $442 and $158 for the first,

second, third and fourth quarters, respectively.

The zero coupon notes of $433 due 2022 and $253 due 2023 are

included in the above maturity schedule based on the year of their

first potential put date of 2009 and 2010, respectively.

Credit Facility

The borrowing capacity under our $2 billion Credit Facility was $1.7

billion at December 31, 2008, reflecting $246 outstanding

borrowings and no outstanding letters of credit.

In February 2008, we exercised our right to request a one-year

extension of the maturity date of the Credit Facility. Lenders

representing approximately $1.4 billion (or approximately 70%)

agreed to the extension and the portion represented by these

Lenders now has a maturity date of April 30, 2013, with the

remaining portion of the Credit Facility to mature on April 30, 2012.

The Credit Facility is available, without sublimit, to certain of our

qualifying subsidiaries and includes provisions that would allow us

to increase the overall size of the Credit Facility up to an aggregate

amount of $2.5 billion. Our obligations under the Credit Facility are

unsecured and are not currently guaranteed by any of our

subsidiaries. In the event that any of our subsidiaries borrows

under the Credit Facility, its borrowings thereunder would be

guaranteed by us.

In October 2008, we amended our Credit Facility to increase the

permitted leverage ratio (debt/consolidated EBITDA) and modify

the pricing on borrowings. The following description of the key

terms and conditions of the Credit Facility reflect the changes from

the amendment.

Borrowings under the Credit Facility bear interest at LIBOR plus an

all-in spread that will vary between 1.25% and 4.00% subject to

our credit rating and our percentage utilization of the facility, in

each case, at the time of borrowing. Based upon our current credit

rating and utilization, the all-in spread was 1.75% as of

December 31, 2008.

The Credit Facility contains various conditions to borrowing, and

affirmative, negative and financial maintenance covenants.

Certain of the more significant covenants are summarized below:

(a) Maximum leverage ratio (debt divided by consolidated

EBITDA) calculated quarterly and at the date of each borrowing of

3.75.

(b) Minimum interest coverage ratio (a quarterly test that is

calculated as consolidated EBITDA divided by consolidated interest

expense) may not be less than 3.00:1.

(c) Limitations on (i) liens securing debt of Xerox and certain of our

subsidiaries, (ii) certain fundamental changes to corporate

structure, (iii) changes in nature of business and (iv) limitations on

debt incurred by certain subsidiaries.

The Credit Facility also contains various events of default, the

occurrence of which could result in a termination by the lenders

and the acceleration of all our obligations under the Credit Facility.

These events of default include, without limitation: (i) payment

defaults, (ii) breaches of covenants under the Credit Facility

(certain of which breaches do not have any grace period),

(iii) cross-defaults and acceleration to certain of our other

obligations and (iv) a change of control of Xerox.

Private Placement Transaction

In September 2008, we issued $250 of zero coupon notes in a

private placement transaction. The bonds mature in 2023 and the

final amount due at maturity is $709. The bonds are putable

annually at the option of the bond holder beginning in September

2010.

Senior Notes Offerings

In April 2008, we issued $400 of 5.65% senior notes due 2013 (the

“2013 Senior Notes”) at 99.996 percent of par and $1.0 billion of

6.35% senior notes due 2018 (the “2018 Senior Notes”) at 99.856

percent of par, resulting in net proceeds of approximately $1,390.

The 2013 Senior Notes accrue interest at the rate of 5.65% per

annum, payable semiannually, and as a result of the discount, have

a weighted average effective interest rate of 5.65%. The 2018

Senior Notes accrue interest at the rate of 6.35% per annum,

payable semiannually, and as a result of the discount, have a

weighted average effective interest rate of 6.37%. Debt issuance

costs of approximately $10 were deferred. The 2013 Senior Notes

and 2018 Senior Notes are subordinated to our secured

70 Xerox 2008 Annual Report