Xerox 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

(in millions, except per share data and

unless otherwise indicated)

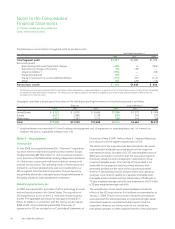

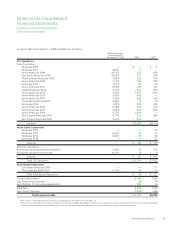

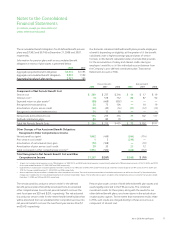

Reconciliation to Consolidated Statements of Cash Flows

Year Ended December 31,

2008 2007 2006

Charges to reserve $(186) $(222) $(284)

Asset impairments 53 1 30

Effects of foreign currency and other

non-cash items 2(14) (11)

Cash payments for restructurings $(131) $(235) $(265)

The following table summarizes the total amount of costs incurred

in connection with these restructuring programs by segment for

the three years ended December 31, 2008:

2008 2007 2006

Production $190 $(6) $147

Office 200 3 138

Other 39 (3) 100

Total net charges $429 $(6) $385

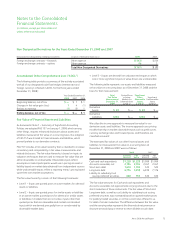

Over the past several years we have engaged in a series of

restructuring programs related to downsizing our employee base,

exiting certain activities, outsourcing certain internal functions and

engaging in other actions designed to reduce our cost structure

and improve productivity. These initiatives primarily include

severance actions and impact all major geographies and segments.

Management continues to evaluate our business and, therefore,

there may be additional provisions for new plan initiatives as well

as changes in estimates to amounts previously recorded, as

payments are made or actions are completed. Asset impairment

charges were also incurred in connection with these restructuring

actions for those assets made obsolete as a result of these

programs.

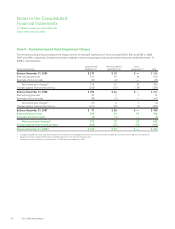

2008 Activity

During 2008, we recorded $357 of net restructuring charges

predominantly consisting of severance and costs related to the

elimination of approximately 4,900 positions primarily in both

North America and Europe. Focus areas for the actions include the

following:

• Improving efficiency and effectiveness of infrastructure

including: marketing, finance, human resources & training.

• Capturing efficiencies in technical services, managed services

and supply chain & manufacturing infrastructure.

• Optimizing product development and engineering resources.

In addition, related to these activities, we also recorded lease

cancellation and other costs of $19 and asset impairment charges

of $53. The lease termination and asset impairment charges

primarily related to: (i) the relocation of certain manufacturing

operations including the closing of our toner plant in Oklahoma

City and the consolidation of our manufacturing operations in

Ireland; and (ii) the exit from certain leased and owned facilities as

a result of the actions noted above.

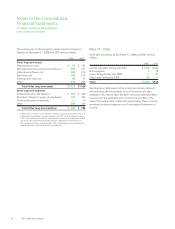

2007 Activity

Restructuring activity was minimal in 2007 and the related charges

primarily reflected changes in estimates in severance costs from

previously recorded actions.

2006 Activity

The 2006 charges primarily relate to the elimination of

approximately 3,400 positions primarily in North America and

Europe. The actions associated with these charges primarily include

the following: technical and professional services infrastructure and

global back-office optimization; continued R&D efficiencies and

productivity improvements; supply chain optimization to ensure,

for example, alignment to our global two-tier model

implementation; and selected off-shoring opportunities. The lease

termination and asset impairment charges primarily related to the

relocation of certain manufacturing operations as well as an exit

from certain leased and owned facilities. These charges were offset

by reversals of $35 primarily related to changes in estimates in

severance costs from previously recorded actions.

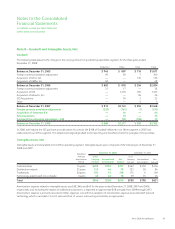

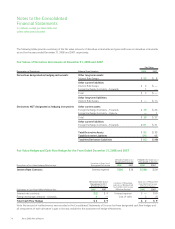

Note 10 – Supplementary Financial Information

The components of other current assets and other current liabilities

at December 31, 2008 and 2007 were as follows:

2008 2007

Other current assets

Deferred taxes $ 305 $ 200

Restricted cash 20 45

Prepaid expenses 119 120

Financial derivative instruments 39 27

Other 307 290

Total Other current assets $ 790 $ 682

Other current liabilities

Income taxes payable $ 47 $ 84

Other taxes payable 173 179

Interest payable 141 137

Restructuring reserves 325 81

Unearned income 203 242

Financial derivative instruments 134 30

Product warranties 25 25

Dividends payable 38 40

Other 683 694

Total Other current liabilities $1,769 $1,512

Xerox 2008 Annual Report 67